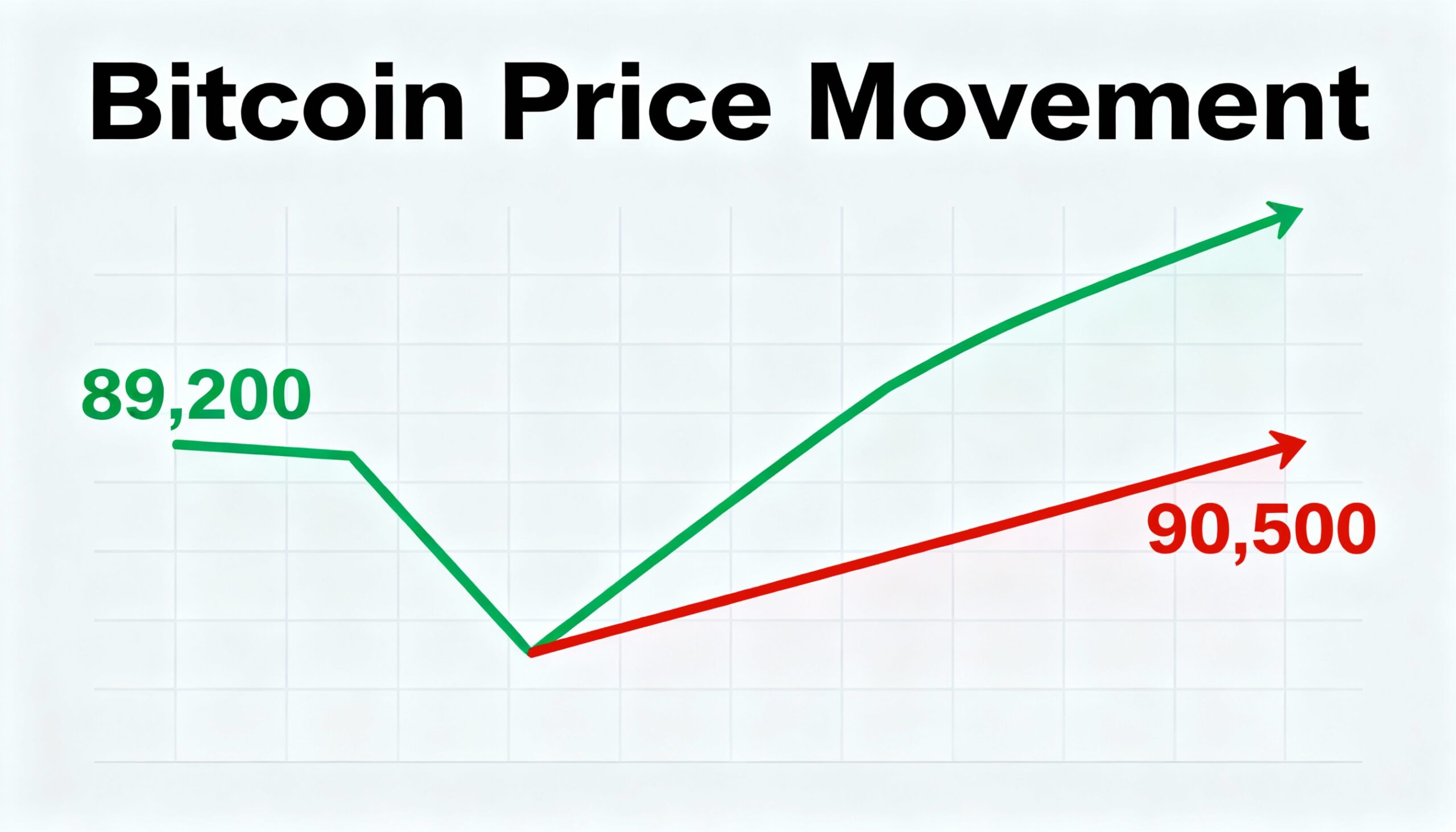

Bitcoin Pulls Back to $90,500 After Rally Fails to Hold $95,000

Bitcoin (BTC) bounced back to $90,500 Thursday morning after dipping to around $89,300 earlier in the session, marking its third straight day of pullback. The retreat follows a brief early-year rally that lifted BTC just under $95,000 on Monday but failed to maintain momentum, according to crypto trading firm Wintermute.

“After initial re-risking from the yearly open, the market failed to break the key $95,000 level, resulting in two-way trade as ETF outflows dominated the last two sessions,” said Jake Ostrovskis, head of OTC at Wintermute. Analysts also cited lighter trading volumes and profit-taking as contributing factors.

Fading expectations for a near-term Federal Reserve rate cut may also be weighing on the market. CME FedWatch shows the probability of easing at the Fed’s January 28 meeting has dropped to 11.6%, down from 15.5% a week ago and 23.5% a month ago.

Support and Technical Levels

Bitcoin tested the 50-day moving average, a key trend indicator, which provided support near $89,200 during today’s rebound.

Leverage and Liquidation Risk Remain Elevated

Open interest in BTC futures and options has climbed to nearly 700,000 BTC, a three-week high and roughly 75,000 BTC above the start of the year, signaling increased trader exposure. Positive perpetual futures funding rates of around 0.09% indicate long positions are paying shorts to hold exposure. Crowded long positions increase the risk of forced liquidations, which could amplify selling pressure if prices fail to move higher.