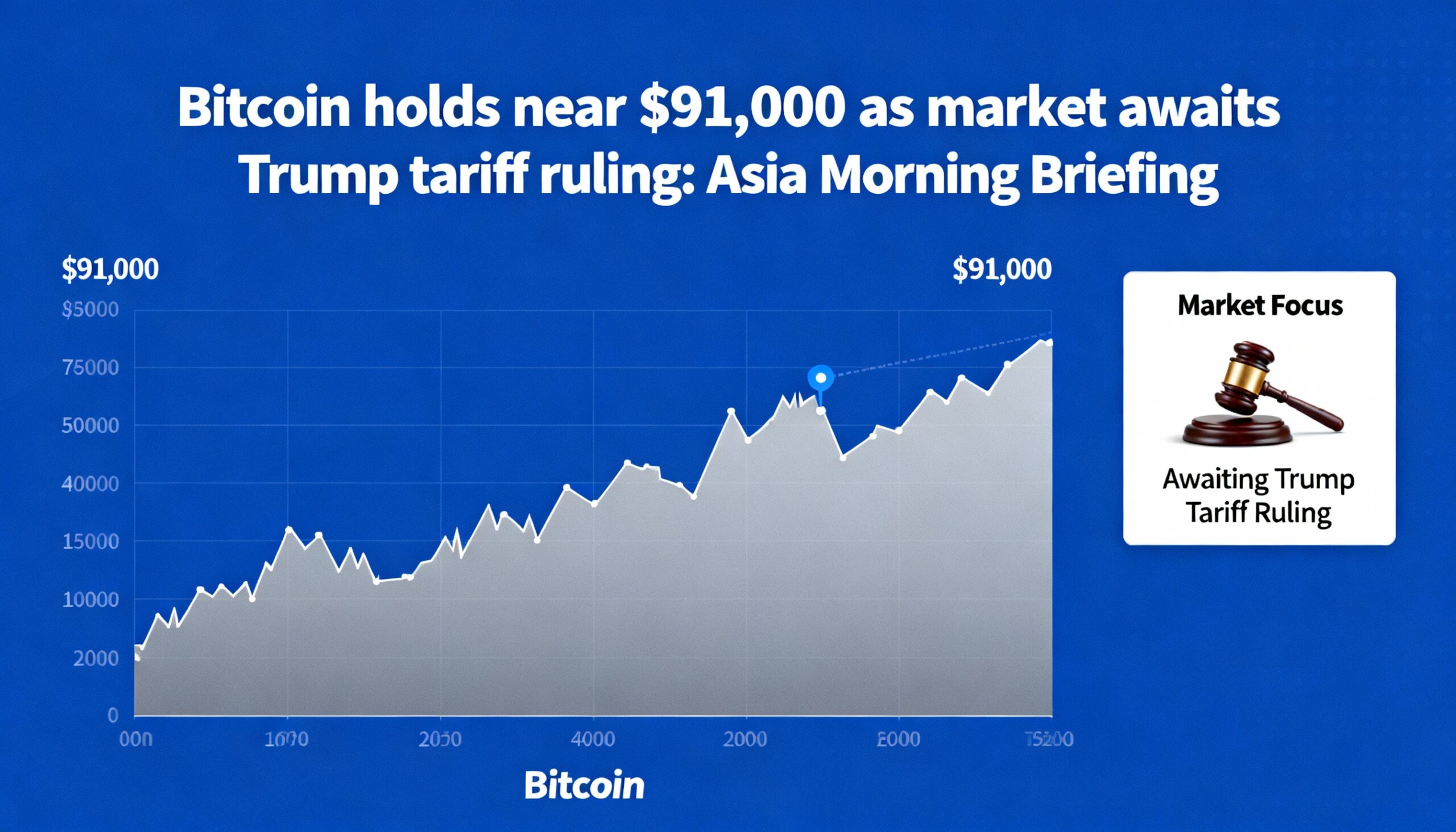

Bitcoin traded near $91,000 during Asian hours as investors awaited the U.S. Supreme Court’s January 10 ruling on President Donald Trump’s tariff authority.

Prediction markets suggest a low probability of a decisive outcome, with traders assigning just a 24% chance that the Court will fully uphold Trump’s use of emergency powers under the International Emergency Economic Powers Act to impose tariffs.

Past tariff episodes have tended to trigger short-lived crypto volatility rather than prolonged sell-offs. CoinDesk Indices labeled the first-quarter 2025 episode a “Tariff Tantrum,” marked by rapid drawdowns driven by liquidation cascades, reduced leverage, and momentum-based selling — while long-term participation remained stable. Trend-following strategies benefited most by cutting exposure early.

If the Court limits or avoids endorsing Trump’s authority, policy uncertainty could increase. Interactive Brokers economist Jose Torres said such a ruling would likely lead the administration to pursue alternative measures.

“If the court blocks the tariffs, the administration is going to look for workarounds,” Torres told CNBC. “President Trump is determined to advance this agenda, even amid potential controversy.”

A constrained ruling could push long-term U.S. Treasury yields higher and tighten global liquidity — conditions that have historically weighed on crypto, which reacts quickly to sudden shifts. The concern is less that tariffs vanish entirely and more that a limited ruling prolongs policy uncertainty through slower or more legally vulnerable trade tools.

Still, research from CoinDesk Indices suggests that once markets accept ambiguity as the base case, bitcoin has tended to stabilize faster than equities, with correlations weakening as uncertainty persists.

For now, Asian crypto traders — who could benefit most from a clear rollback of Trump’s tariff regime — are focused less on the ruling itself than on how long uncertainty might linger afterward.

Market Moves

- BTC: Bitcoin hovered near $91,000, edging slightly higher on the hour but modestly lower over the past 24 hours.

- ETH: Ether traded around $3,100, down more than 2% in the past day despite weekly gains.

- Gold: HSBC said gold could rise to $5,050 per ounce in early 2026 amid geopolitical risks and rising debt, while noting potential volatility and pullbacks if risks ease or the Fed tightens.

- Nikkei 225: Japan’s Nikkei 225 climbed 0.54% as investors awaited China’s December inflation data, expected at 0.8% year-on-year.