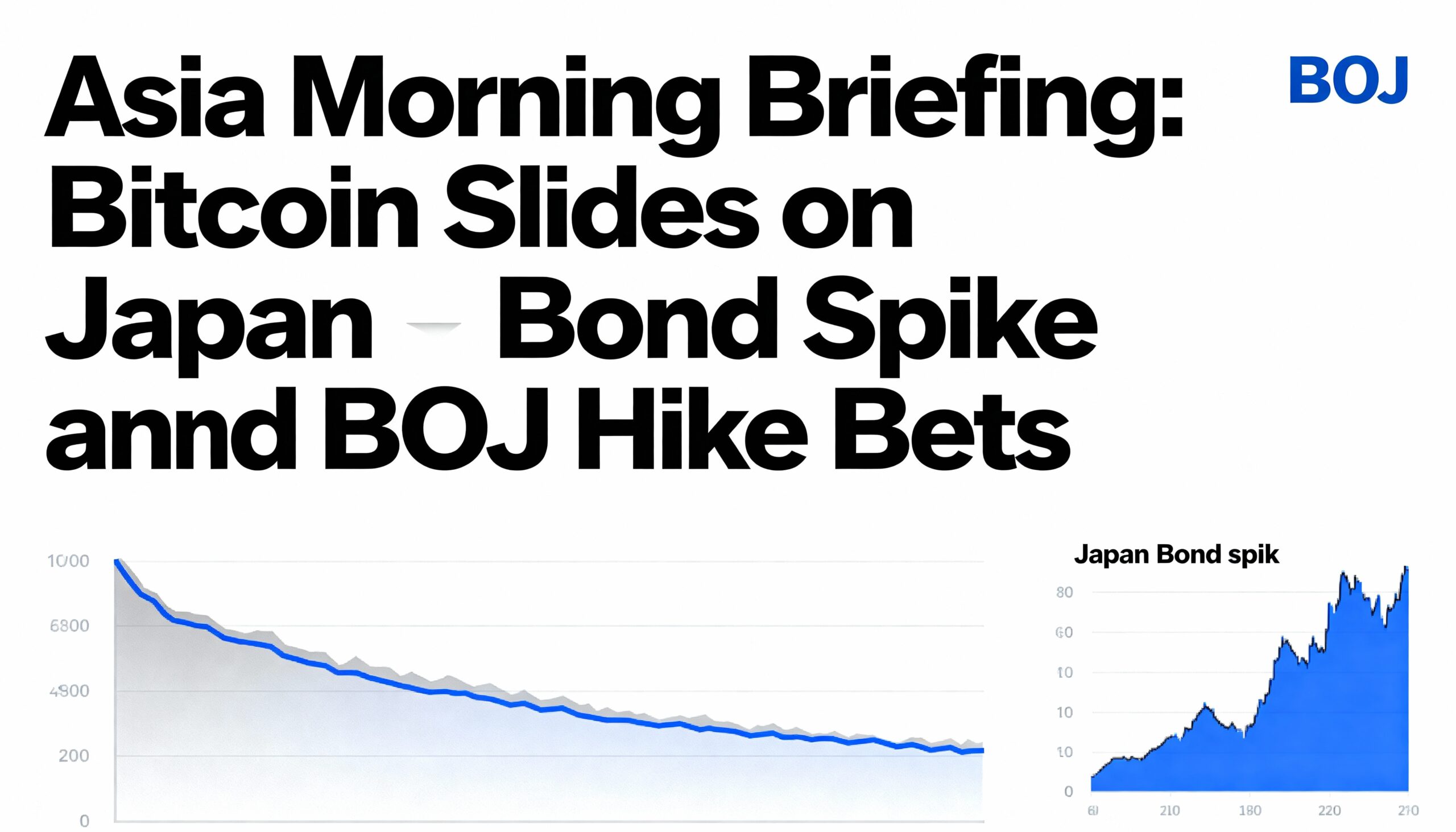

Bitcoin Drops Below $87,500 as Japanese Yields Surge to 17-Year Highs

Bitcoin fell below $87,500 during Hong Kong morning trading as Japan’s short-term government bond yields climbed to levels not seen since 2008, triggering a wave of risk-off sentiment across regional markets.

Japan’s 2-year government bond yield briefly reached 1.01%, driven by speculation that the Bank of Japan may end its long-standing near-zero interest rate policy. BOJ Governor Kazuo Ueda recently said the board will assess whether a rate hike is warranted at this month’s meeting.

The yen strengthened in Tokyo, prompting the unwinding of yen-funded carry trades that had supported risk assets throughout the year. Crypto markets, particularly sensitive to short-term liquidity in Asia, bore the brunt of the move. Bitcoin’s drop triggered more than $150 million in long liquidations, while Ether slid toward $2,850, with roughly $140 million in long positions liquidated.

Polymarket data indicates traders now assign roughly a 50% chance to a December BOJ rate hike, up seven percentage points from prior estimates, reflecting growing uncertainty over Japan’s policy path.

Market Highlights:

- Crypto: Rising Japanese yields and a stronger yen could continue to pressure leveraged positions, adding volatility to Bitcoin and Ether.

- Gold: Nearly 70% of institutional investors expect gold to keep climbing, with many forecasting prices above $5,000 by 2026, according to Goldman Sachs.

- Equities: Asia-Pacific markets slipped Monday. Japan’s Nikkei 225 dropped 1.3% as traders awaited China’s manufacturing data and priced in an 87% probability of a Fed rate cut.

Investors will be watching BOJ guidance and yen movements closely this week, as any additional tightening signals could trigger another wave of volatility across crypto and regional markets.