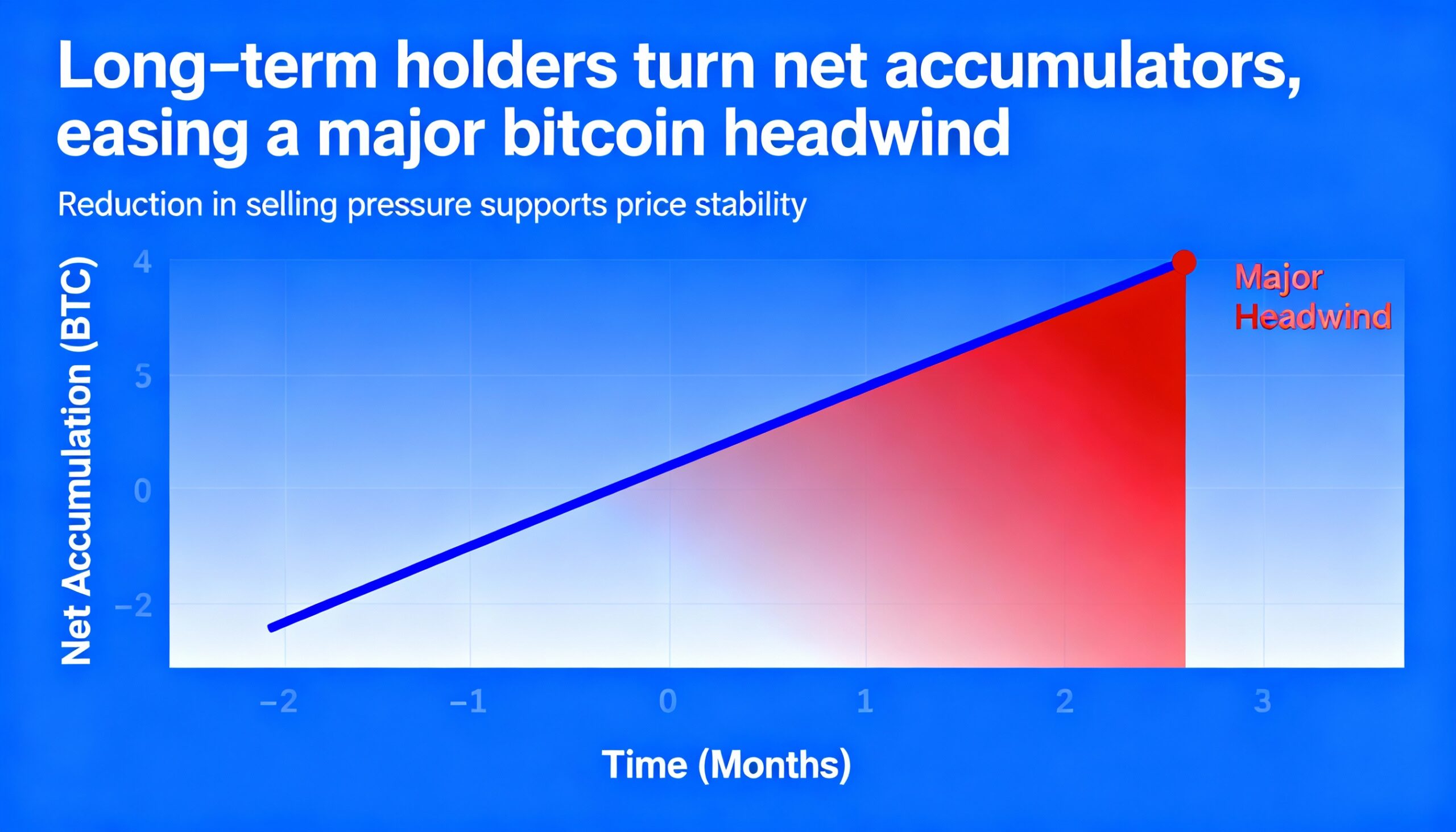

Long-term bitcoin holders (LTHs) have returned to net accumulation for the first time since July, signaling a shift after months of significant selling.

LTHs — wallets that have held bitcoin (BTC $87,768.09) for at least 155 days — added roughly 33,000 BTC on a 30-day net basis, according to onchain analytics firm checkonchain. Earlier in the year, selling from this cohort, along with miner capitulation, was one of the largest sources of downward pressure in the market.

The recent accumulation suggests that buyers from the past six months are now transitioning into long-term holders, outpacing distribution. During the 36% correction in October, LTHs sold over 1 million BTC, marking the largest sell-off from this group since 2019 — a year that ended near bitcoin’s bear market low of $3,200.

October’s sell-off was the third major LTH distribution phase of the current cycle. The first occurred in March 2024, when bitcoin hit $73,000 and over 700,000 BTC were sold, followed by a second in November 2024, when more than 750,000 BTC were distributed at a $100,000 peak.