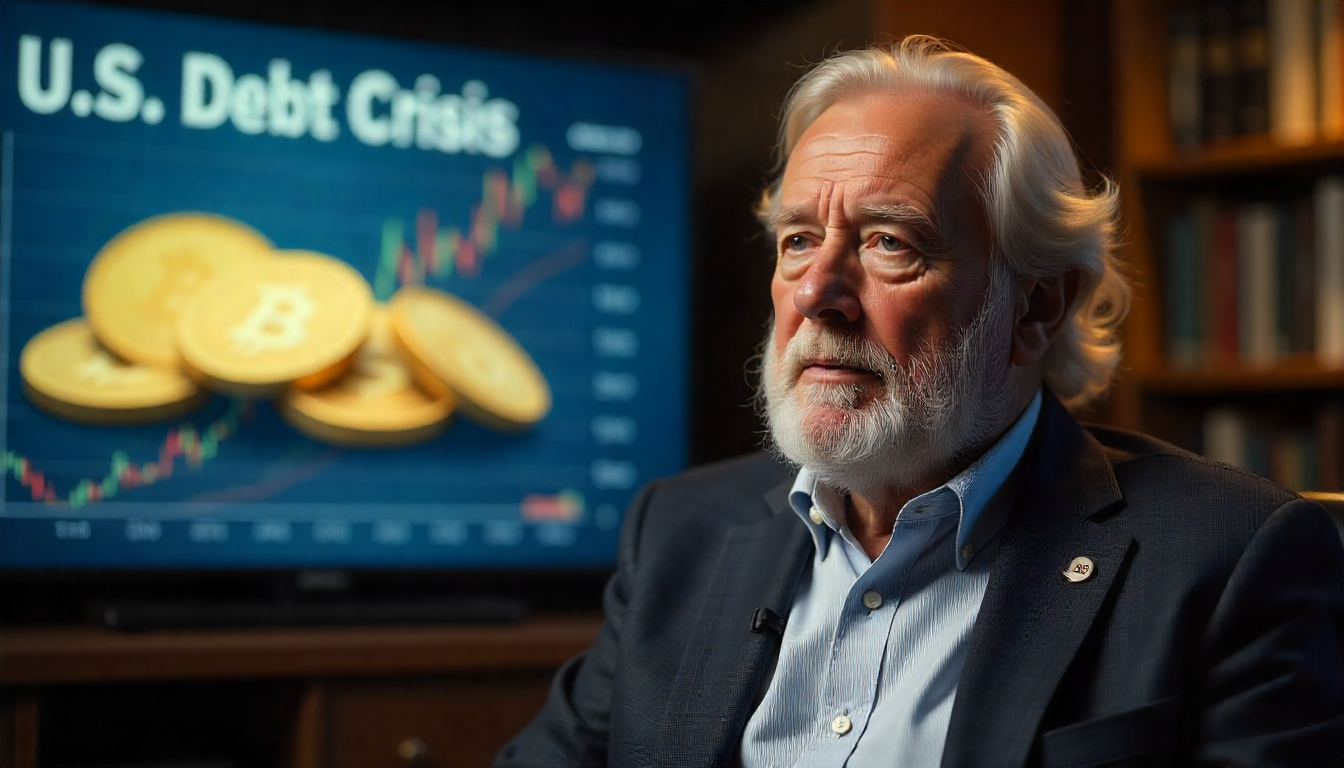

Ray Dalio Backs 15% Allocation to Bitcoin and Gold Amid Rising U.S. Debt Concerns

Bridgewater Associates founder Ray Dalio is urging investors to allocate up to 15% of their portfolios to Bitcoin or gold, citing intensifying fiscal pressures and the growing risk of currency debasement in the United States.

“If you want the best return-to-risk balance in your portfolio, a 15% allocation to gold or Bitcoin makes sense,” Dalio said on the Master Investor podcast on Sunday. This marks a significant shift from his 2022 guidance, when he recommended just 1–2% in Bitcoin, reflecting his escalating concern over what he now calls a “debt doom loop.”

Dalio pointed to alarming government borrowing figures—over $12 trillion in expected new Treasury issuance to manage the soaring $36.7 trillion national debt. A U.S. Treasury report on Monday confirmed a steep jump in borrowing needs, projecting $1 trillion in Q3—up $453 billion from earlier estimates—followed by $590 billion in Q4.

While Dalio maintains a preference for gold, he acknowledged both assets as strong hedges against inflation and fiat currency depreciation. However, he tempered enthusiasm for Bitcoin as a reserve currency, citing concerns about blockchain transparency and code-level vulnerabilities.

“Governments can monitor transactions,” Dalio warned, suggesting that this lack of privacy could hinder Bitcoin’s role as an alternative monetary system.

Dalio disclosed that he holds “some Bitcoin” himself, and emphasized that the mix between BTC and gold within the 15% allocation should be tailored to individual investor profiles.

Bitcoin was trading around $118,000 in Asia Tuesday morning, continuing to consolidate near its recent highs.