Bitcoin Hovers Below $115K as ETF Outflows Grow and Altcoin Momentum Fizzles

Bitcoin is struggling to regain its footing above $115,000, as macro uncertainty, declining ETF inflows, and fading risk appetite continue to weigh on crypto markets. Traders are shifting out of altcoins and into high-liquidity majors—or exiting the market altogether—as sentiment remains cautious.

BTC was last seen trading near $114,200 in Tuesday’s Asia session, holding steady after a sharp weekend decline that erased nearly $6,000 from local highs. The pullback triggered over $1 billion in liquidations, mostly from leveraged long positions, and left markets on edge heading into the week.

Ethereum Shows Relative Strength

Ether (ETH) has held up more firmly than bitcoin, rebounding to $3,650 after dipping below $3,550. The asset continues to attract institutional interest, driven by staking yields, tokenization developments, and broader treasury adoption.

“Ethereum has quickly recovered most of its recent losses,” said Nick Ruck, director at LVRG Research. “Institutional capital is still flowing into ETH through treasury strategies and IPO anticipation—we’re constructive on its medium-term outlook.”

Altcoins Lose Steam as Traders Rebalance

Altcoin momentum has faded sharply. Solana (SOL) is down nearly 20% from recent highs, and XRP is struggling to hold above $2.98. The bullish “altseason” narrative has cooled as traders rotate capital into BTC and ETH or step back in response to tightening liquidity and growing macro risk.

Institutional Flows Slow

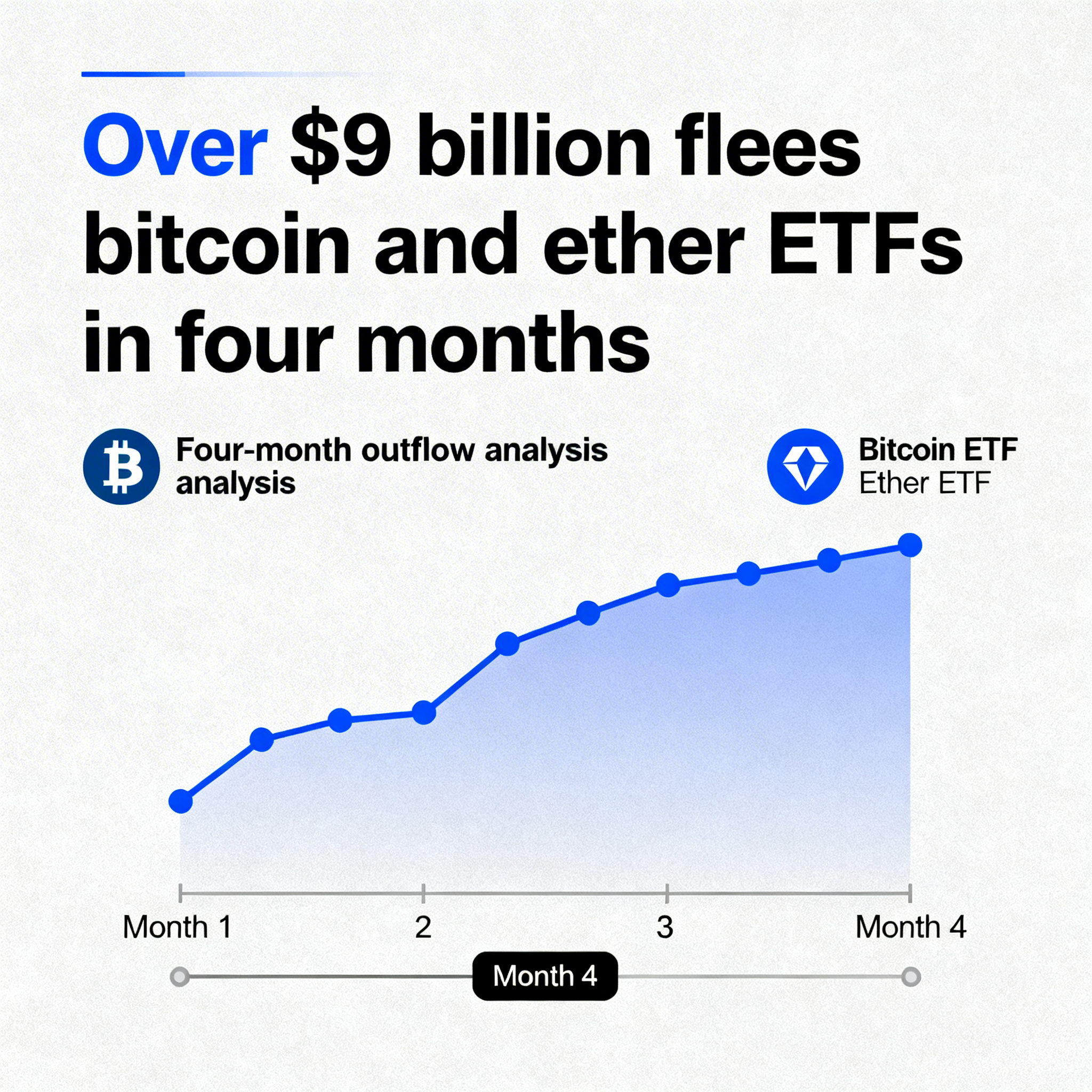

Spot ETF flows have weakened notably, adding to downside pressure. Friday marked one of the heaviest days of outflows for both bitcoin and ether ETFs—eroding confidence that institutional products would buffer volatility in uncertain markets.

With demand from ETFs fading, crypto markets are lacking a clear upside catalyst, and speculative flows into riskier altcoins have dried up.

Derivatives Markets Suggest Cautious Optimism

Despite near-term weakness, some professional traders are positioning for a bounce. In a note to clients, QCP Capital described the recent drop as “a correction, not a capitulation,” highlighting increased open interest in August BTC call spreads targeting $124,000.

Put skew remains elevated, indicating a degree of hedging, but has not reached levels associated with panic. QCP believes a breakout above $115K, accompanied by a recovery in ETF flows and lower implied volatility, could quickly restore bullish momentum.

Outlook

For now, traders are closely watching ETF flows, macro data, and volatility levels to gauge direction. Without a strong catalyst, markets are likely to remain in consolidation. However, any improvement in institutional participation or easing macro pressures could shift sentiment rapidly.

Until then, bitcoin remains rangebound, altcoins are underperforming, and the market stays in a wait-and-see mode.