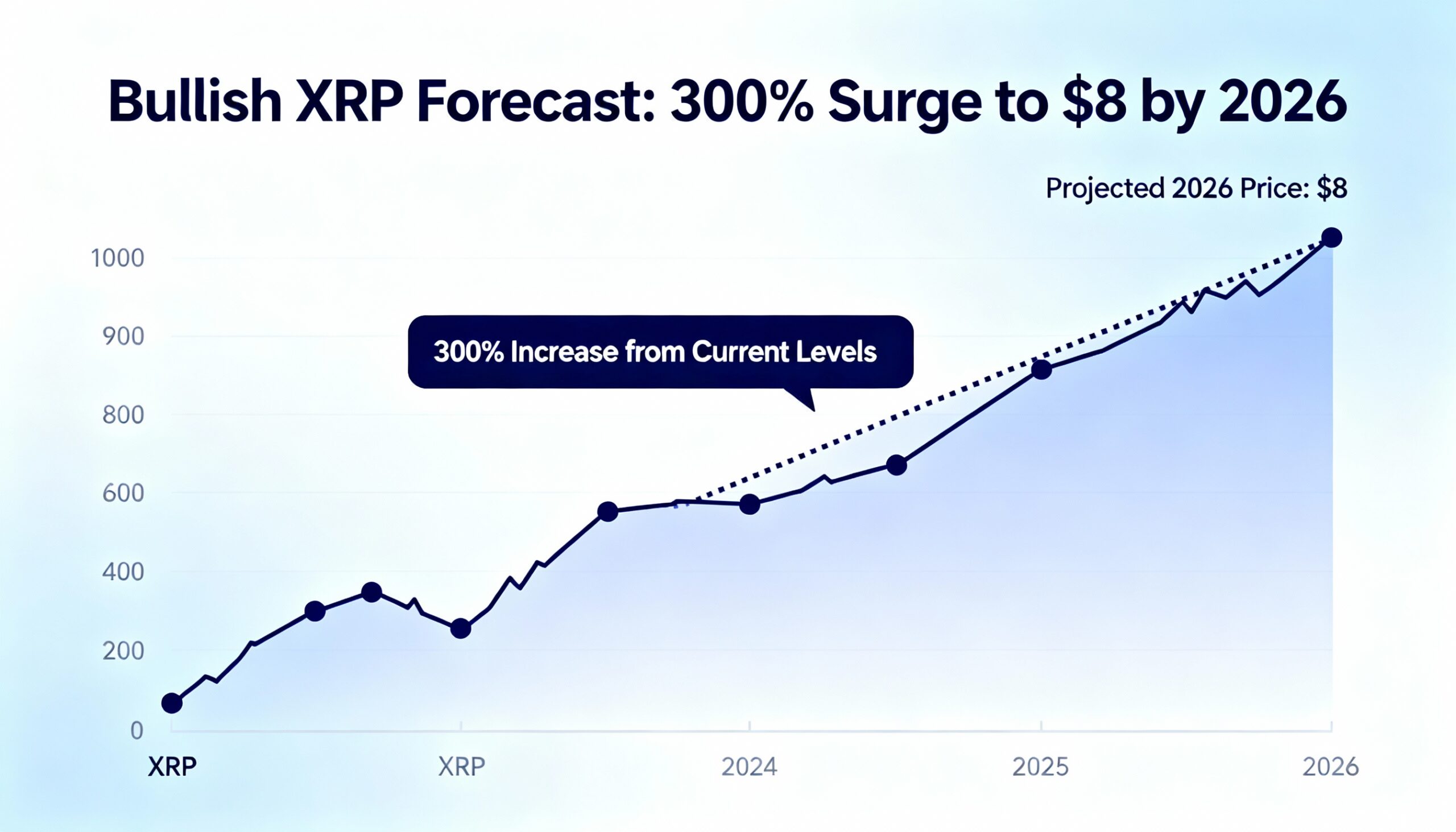

Standard Chartered has restated one of the most bullish institutional outlooks for XRP, forecasting the token could reach $8 by the end of 2026 as U.S. regulatory clarity improves and institutional participation expands. The view, first detailed in an April research note, implies roughly 330% upside from current prices.

Despite the optimistic long-term projection, near-term price action remains constrained. XRP slipped to $1.87 even as trading volume rose sharply, keeping the token confined to a tight range around the $1.85 support level. Rising activity without meaningful price movement suggests positioning rather than distress, a pattern that often precedes a larger directional move.

Geoff Kendrick, Standard Chartered’s global head of digital assets research, said clearer U.S. regulation has eased the legal uncertainty that weighed on XRP through much of the previous cycle. That shift has lowered barriers for institutional exposure and allowed Ripple and the XRP ecosystem to develop without persistent litigation risk.

Signs of institutional interest are increasingly visible in market structure. U.S.-listed spot XRP ETFs have attracted approximately $1.25 billion in net inflows since their November launch, reflecting a steadier allocation profile than the more volatile flows seen in bitcoin and ether ETFs. At the same time, XRP balances on exchanges have declined toward multi-year lows, a trend often interpreted as a reduction in readily available supply. While that alone does not ensure price appreciation, it can amplify moves if demand remains intact.

From a technical standpoint, XRP declined 0.79% on the session while volume ran about 20.8% above weekly averages, a divergence that typically points to rotation or distribution rather than clean accumulation. The most active trading window occurred around 14:00, when roughly 57.2 million tokens traded as price failed to push beyond resistance near $1.8792, reinforcing the view that sellers continue to fade strength.

The $1.85 area remains the critical near-term level. Although price tested and held the zone, the broader trend remains heavy, with moving averages bearishly aligned and sloping lower. This structure continues to cap upside attempts and keeps the short-term bias tilted toward selling into rallies.

Derivatives positioning adds complexity. Open interest rose to $3.43 billion even as spot netflows turned negative by roughly $10.7 million, suggesting leverage is building without confirmation from spot demand. This mix can compress price action in the near term but increases the risk of abrupt moves if positions are forced to unwind.

Looking ahead, January’s scheduled release of 1 billion XRP from escrow stands out as the next notable catalyst. Even if a substantial portion is re-escrowed, the event tends to heighten sensitivity around supply and liquidity — particularly with price sitting on a key technical shelf.

For now, XRP remains in a support-defense phase with significant overhead supply. A sustained hold above $1.85 followed by a reclaim of the $1.88–$1.89 zone would bring resistance near $1.92–$1.93 back into focus. A close above that area would improve the short-term outlook and open room toward $2.00 and the downtrend line near $2.08.

Conversely, a decisive break below $1.85 would likely shift attention to the next demand zone around $1.77, with deeper support near $1.60–$1.55. In the immediate term, rising volume alongside muted price movement suggests the market is positioning ahead of the January escrow event rather than committing to a clear directional trend — but the compression around $1.85 increases the likelihood that the next move will be sharp rather than gradual.