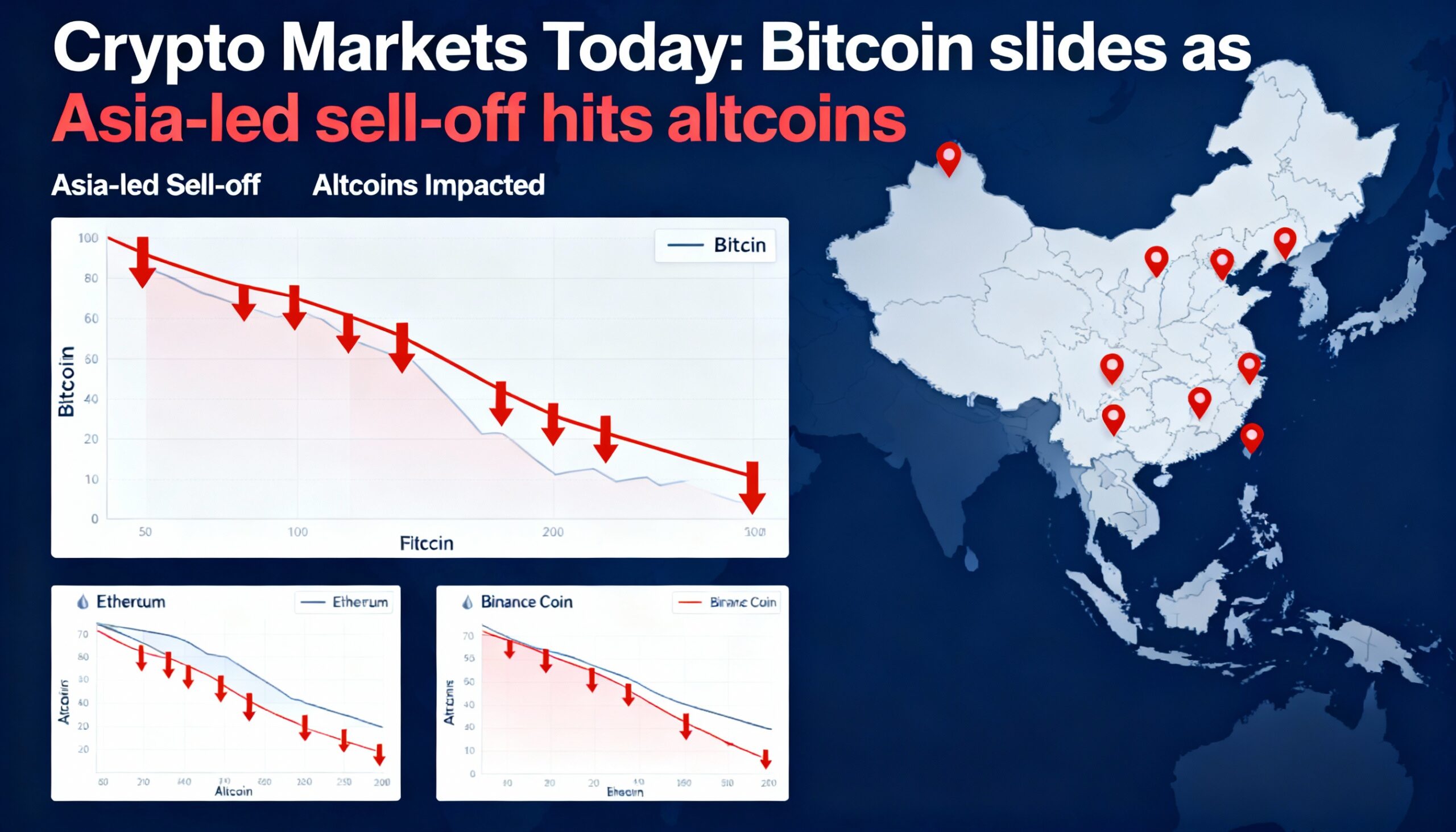

Bitcoin fell during Asian trading hours after failing to break above $94,500, weighing on the broader crypto market.

BTC $90,338.24 dropped to around $91,530 by 10:00 a.m. UTC, down from a local high near $93,750 at midnight. This marked Bitcoin’s third unsuccessful attempt in five weeks to surpass $94,500.

Altcoins underperformed, with PENGU and XRP falling 6.5% and 3.5% since midnight. Bitcoin is now trading within December’s range of roughly $85,000 to $94,500, continuing the decline that began in October.

Rising risk-off sentiment extended to U.S. equities, with Nasdaq 100 futures down 0.32% in pre-market trading. Crypto futures liquidations totaled $465 million over the past 24 hours, with longs accounting for more than half — a reversal from the previous two days when shorts dominated.

Cumulative open interest across global crypto futures remains above $143 billion, the highest in nearly two months, with moderately positive funding rates signaling sustained bullish positioning. Open interest in XRP, DOGE, SUI, and ZEC fell 5%-6%, likely reflecting profit-taking. CME Bitcoin futures OI rose from 100K BTC to 111K BTC since Dec. 30, still below last year’s 191K BTC.

Memecoins and privacy coins led losses, with ZEC ($423.54) down 4.5%, while CoinDesk’s Memecoin Index fell 1.5%, about twice the decline of the CoinDesk 5 index.

DeFi provided a bright spot, with total value locked up 0.17% despite falling prices. TRX ($0.2950) also bucked the trend, gaining 1.2% over 24 hours. CoinMarketCap’s “altcoin season” indicator sits at 25/100, signaling cautious optimism.