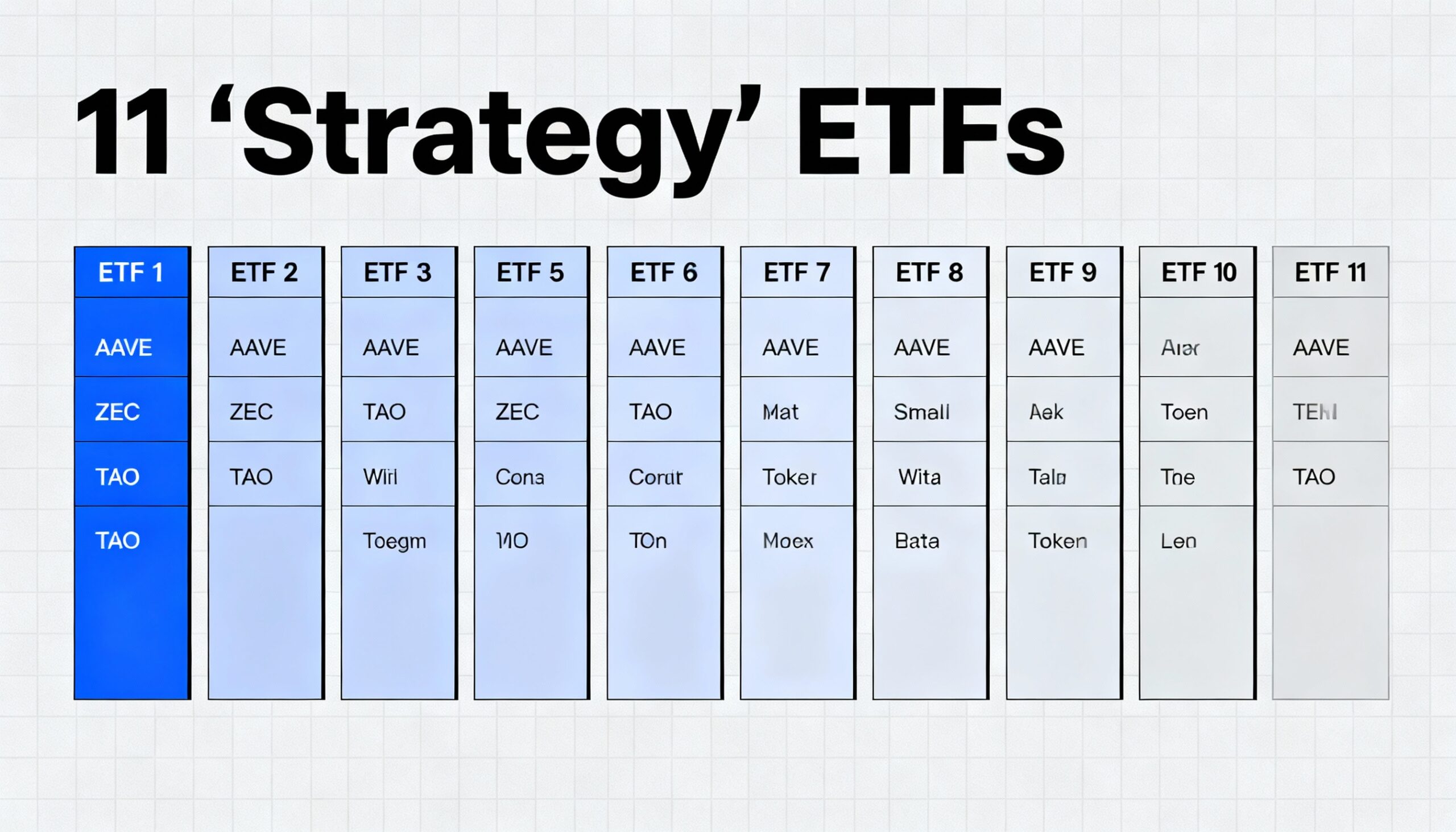

Crypto asset manager Bitwise has filed with the U.S. Securities and Exchange Commission to launch 11 crypto “strategy” exchange-traded funds (ETFs), extending its product lineup to cover tokens such as Aave (AAVE), Uniswap (UNI), Zcash (ZEC), Sui (SUI) and Bittensor’s TAO.

According to N-1A filings submitted Tuesday, the proposed funds would be permitted to invest up to 60% of their assets directly in the underlying digital token, with the remaining exposure coming from exchange-traded products and, potentially, derivatives including futures and swaps.

The Bitwise filings coincided with Grayscale’s application to convert its Bittensor trust into an exchange-traded product. Grayscale chairman Barry Silbert said in a post on X that the move underscores the rapid rise of decentralized artificial intelligence as an emerging investable theme in U.S. crypto markets.

Bittensor operates as an open, incentive-driven network designed to coordinate machine-learning development, rewarding contributors of models and computing resources with TAO. The protocol has drawn increased interest from investors seeking AI-focused crypto exposure beyond established smart-contract platforms.

The applications highlight how ETF issuers are moving beyond bitcoin and ether following the strong demand for spot ETFs tied to the two largest cryptocurrencies. Bitwise already offers spot products linked to bitcoin, ether, solana and XRP, and has filed additional applications tied to assets including Sui and Hyperliquid.