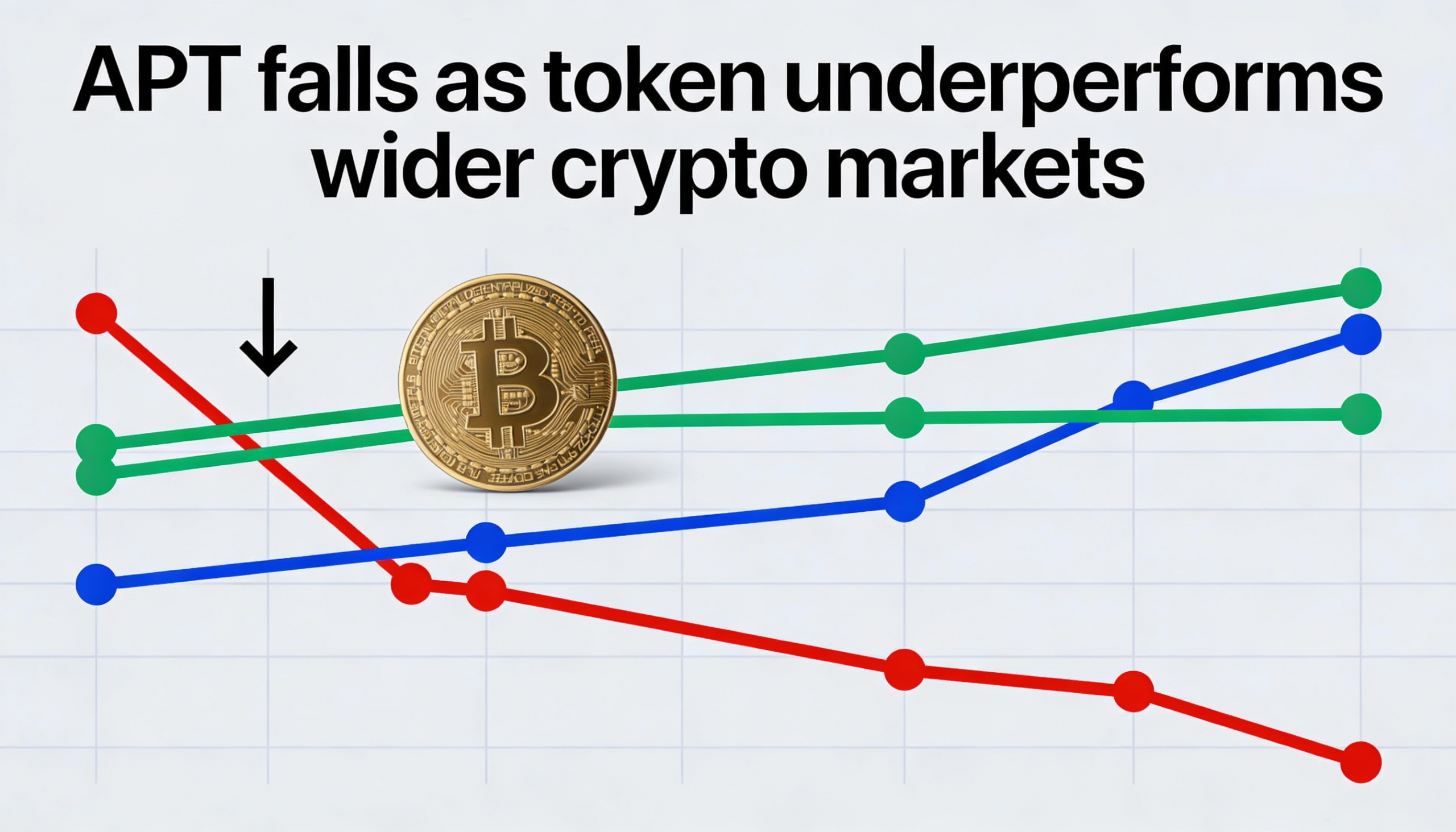

APT underperformed the broader crypto market as trading remained subdued, with recent ecosystem updates failing to generate significant buying pressure.

The token dropped 2.4% to $1.69 on below-average volume, lagging the CoinDesk 20 index (CD20), which was up 0.5% at the time of publication.

CoinDesk Research’s technical analysis model indicates the relative weakness reflects selective investor caution toward APT. Over the past 24 hours, the token slid from $1.73 to $1.69, forming a range-bound pattern with a total trading range of roughly $0.09.

The session’s most notable activity occurred earlier when volume surged to 12.2 million tokens — more than double the 24-hour moving average — confirming strong resistance near $1.75, according to the model.

Following the initial decline, APT consolidated within a narrow channel as momentum slowed and volumes normalized. Overall trading remained muted, with 24-hour volume 31% above the seven-day average but below levels typically needed to sustain a breakout.

Technical Highlights:

- Key support sits at $1.68–$1.69, while resistance is confirmed at $1.75 following the high-volume rejection.

- Peak volume of 12.17 million tokens (214% above the moving average) underscores the resistance failure, though improving activity above $1.695 hints at a potential recovery.

- The token remains range-bound within a $0.09 channel, with 60-minute charts showing a tentative bullish recovery pattern.

- Near-term upside targets are $1.70–$1.705, with the broader $1.75 level representing the next major test.

- Technical indicators remain broadly bearish across multiple timeframes.