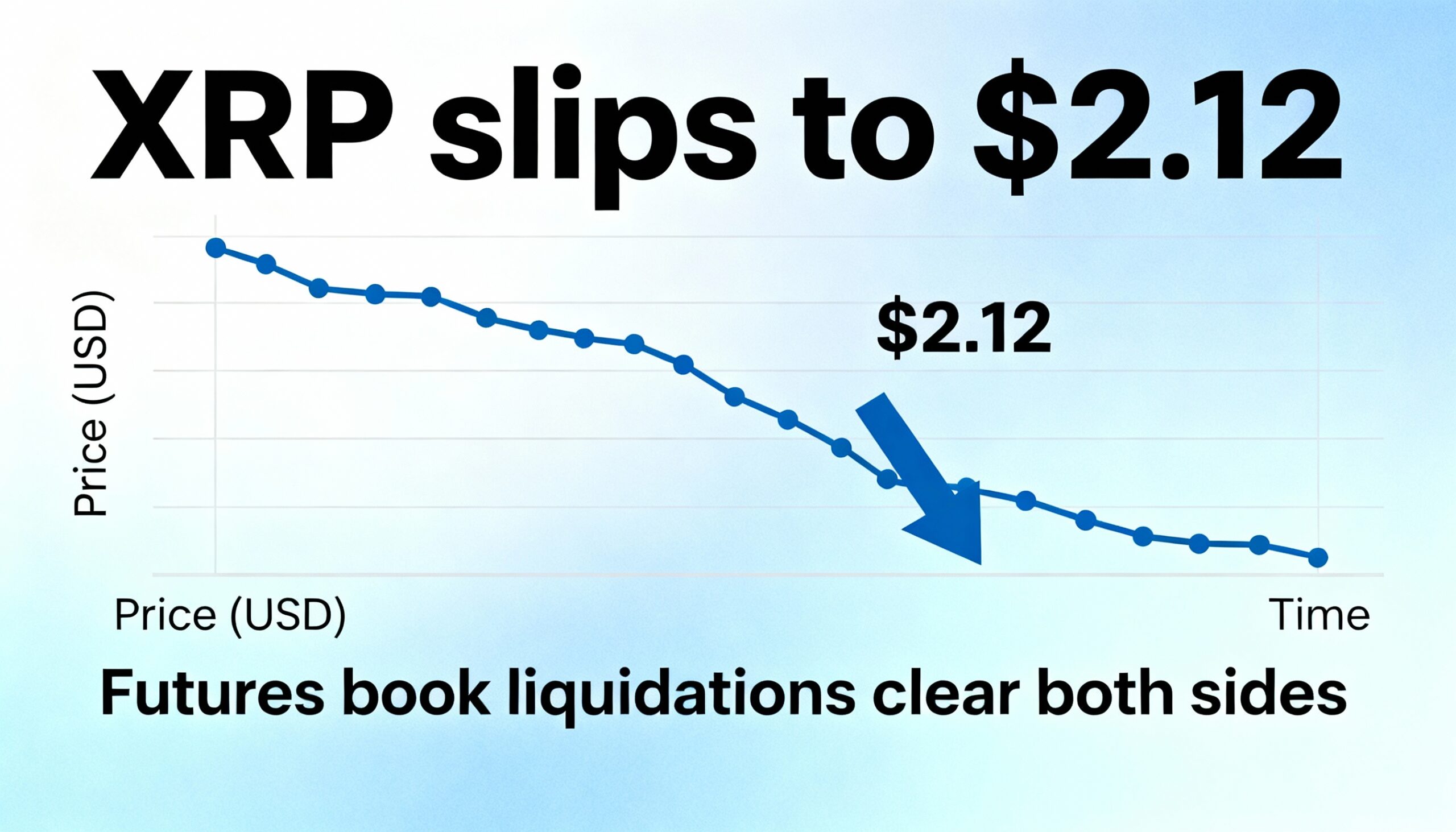

XRP Stuck in $2.07–$2.17 Range After Two-Sided Futures Liquidation

XRP traded at $2.12 following a rare two-sided liquidation on Binance Futures that cleared leverage from both longs and shorts, leaving price range-bound between $2.07 support and $2.17 resistance. Traders are waiting for a catalyst to break the consolidation.

Institutional Interest Persists

Even amid choppy price action, XRP continues to draw institutional attention. Evernorth, a Ripple- and SBI Holdings-backed digital asset treasury, announced a strategic collaboration with Doppler Finance to explore liquidity and treasury applications on the XRP Ledger (XRPL).

The partnership is exploratory, focusing on structured liquidity deployment, treasury management, and operational frameworks. While infrastructure developments remain constructive, near-term price action is driven primarily by derivatives-led leverage resets rather than fundamentals.

Technical Overview

Over the 24 hours ending Jan. 9 at 02:00 UTC, XRP fell 2.3%, from $2.17 to $2.12. The market absorbed a two-step liquidation reset: ~$4.4 million in short liquidations on Jan. 5 during a rally toward $2.40, followed by ~$5.5 million in long liquidations the next day, pulling price back to the current range.

Two-sided liquidation cascades reduce excess leverage but highlight uncertainty, punishing traders on both sides.

Trading Action

The $2.07–$2.08 demand zone held firm amid elevated volume, sparking a V-shaped rebound to $2.16, though rallies stalled near $2.17. Short-term charts show repeated flush-and-rebound cycles, underscoring technical, reactive, and mean-reverting price behavior.

Outlook

XRP remains range-bound between $2.07 and $2.17, with near-term moves likely dictated by leverage adjustments rather than fundamentals.