XRP’s early-2026 rally faces resistance despite strong institutional support, as U.S.-listed spot XRP ETFs continue to attract net inflows into January.

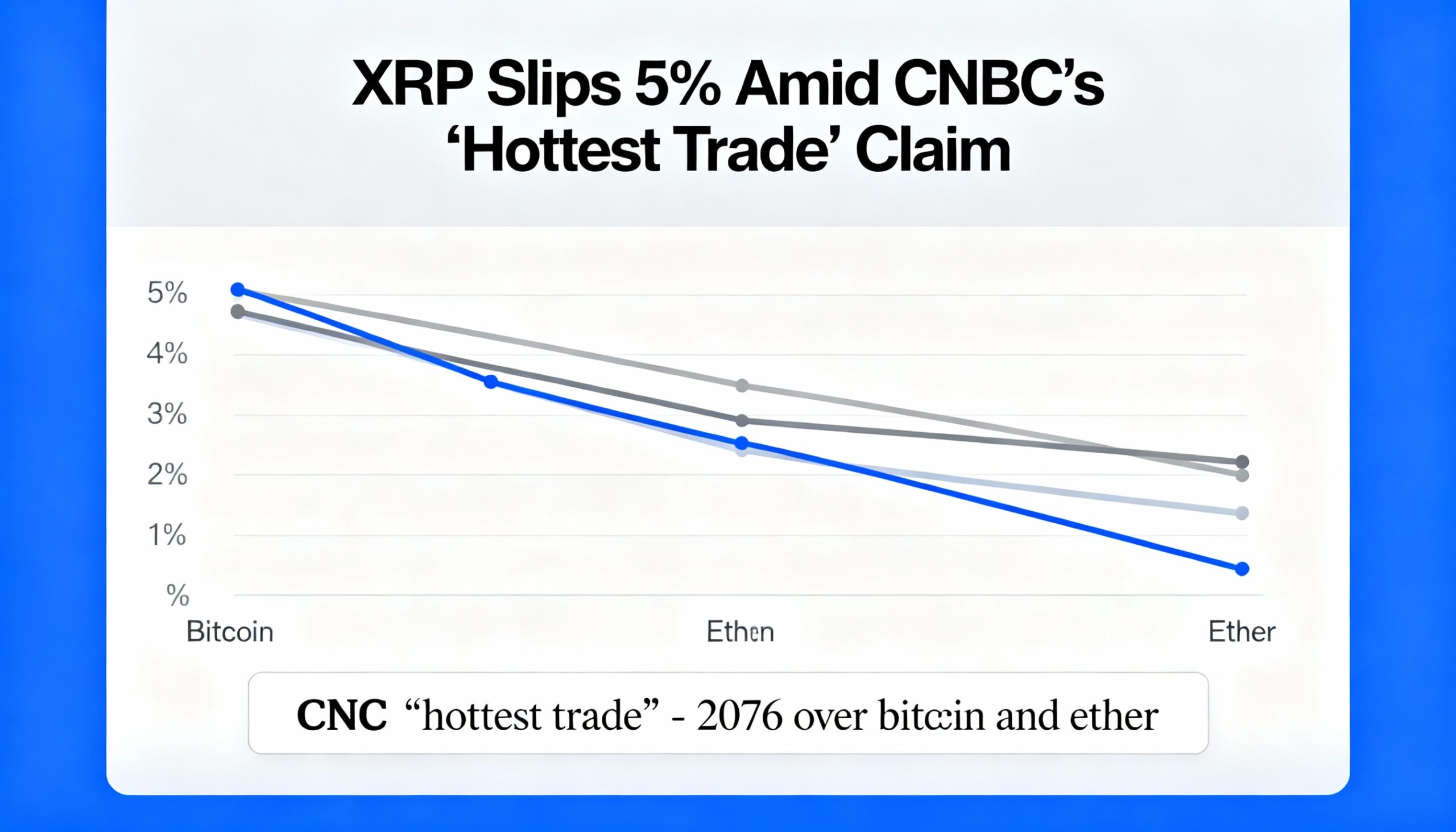

The token slipped to $2.18 after failing to break $2.28, cooling momentum that earned it CNBC’s “new crypto darling” label following outperformance versus bitcoin and ether in the first week of the year. The move highlights a familiar dynamic: even high-profile narratives must contend with supply at key technical levels.

Institutional demand remains a key driver. Spot XRP ETFs have extended a streak of net inflows, contrasting with the uneven flow patterns seen in bitcoin and ether ETFs. On-chain metrics have also improved, social sentiment is bullish, and exchange reserves have fallen — all suggesting tighter near-term supply.

Still, XRP faces momentum risks. Over the 24 hours through Jan. 8, the token fell 4.4%, dropping from $2.28 to $2.18 after repeated failures at resistance triggered heavier selling. Volume spiked to 133.8 million on Jan. 7, roughly 121% above the 24-hour average, as price broke through successive support levels.

The decline appears driven by active distribution rather than low liquidity. XRP formed a clear pattern of lower highs and lower lows toward $2.15, where dip buying finally emerged. A short-term rebound has begun near $2.173–$2.174, with price recovering to $2.18–$2.19 on improving volume — a constructive start, but still within a broader structure that has yet to reclaim overhead supply.

Key levels remain clear. $2.28 continues to act as a major resistance zone, while $2.15 is holding as near-term support. A sustained move above $2.20 and $2.28 would likely open the path to $2.30–$2.32, whereas a break below $2.15 could shift focus to $2.10, with $2.00 in view if broader risk appetite weakens.

Bottom line: XRP remains a year-to-date outperformer, but recent price action shows that leadership does not erase resistance — it only moves the market’s test of conviction.