XRP is showing signs of a potential major rally, with its price chart forming a bullish pattern and options market activity signaling further upside.

Although XRP is down by 10% this week, the pullback is taking shape as a “bull flag,” a technical analysis pattern typically indicating a pause before a continuation of the previous uptrend. This formation usually trends opposite the preceding sharp rise, recharging momentum for bulls and potentially setting the stage for further gains.

Charles Kirkpatrick, a market technician and president of Kirkpatrick & Company, explains in his book Technical Analysis, the Complete Resource for Finance Market Technicians that “a breakout should be expected in the direction of the preceding trend, provided it is steep and sharp.” He adds, “Flags preceded by a rise of 90% or more have almost zero failure rate and an average return of 69%.”

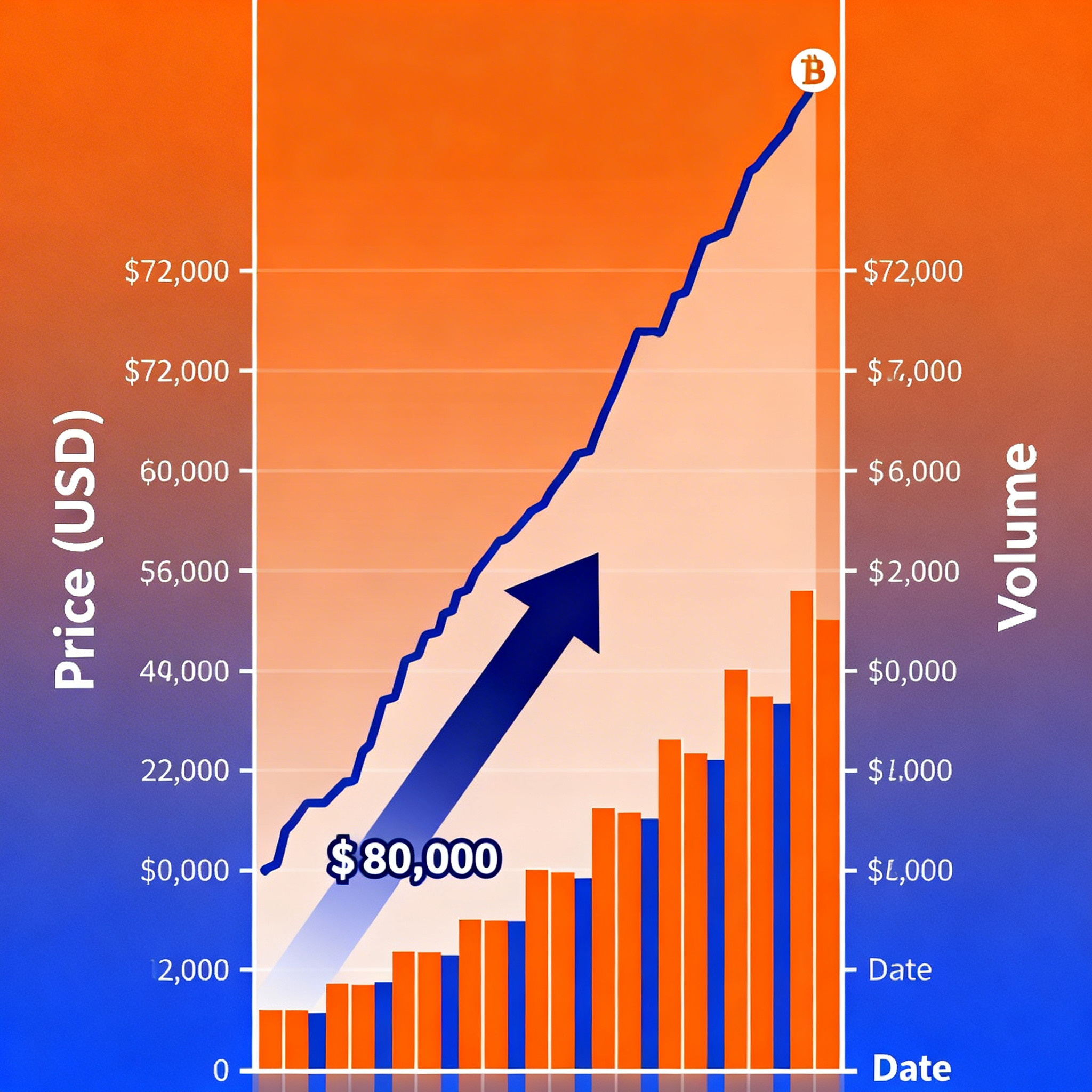

XRP’s recent price action follows a dramatic 500% surge to $2.9 by Dec. 3. If the bull flag pattern plays out, it could lead to a rally towards $5. This potential price target is calculated by adding the magnitude of the previous uptrend to the breakout point, which currently sits around $2.5. This technique, known as the measured height method, is commonly used in technical analysis.

Meanwhile, options market activity is heating up, particularly in the $5 strike call options on Deribit, signaling a growing bullish sentiment. The $5 call options have become the second-most traded XRP options in the past 24 hours, with a volume of 1.7 million contracts, according to Amberdata. (Each contract represents 1 XRP.)

Furthermore, the $5 call options are the most popular out-of-the-money strike, with a notional open interest of $1.25 million, based on Deribit’s data. This surge in activity suggests that traders are positioning themselves for a potential move above the $5 level.

However, it’s important to remember that technical analysis patterns are not infallible, and options market positioning can quickly change as prices evolve. Keeping an eye on broader market sentiment is key when navigating these fluctuations.