XRP plunged more than 16% in the past 24 hours to around $1.29, making it the weakest performer among major tokens as bitcoin fell 7% on Thursday.

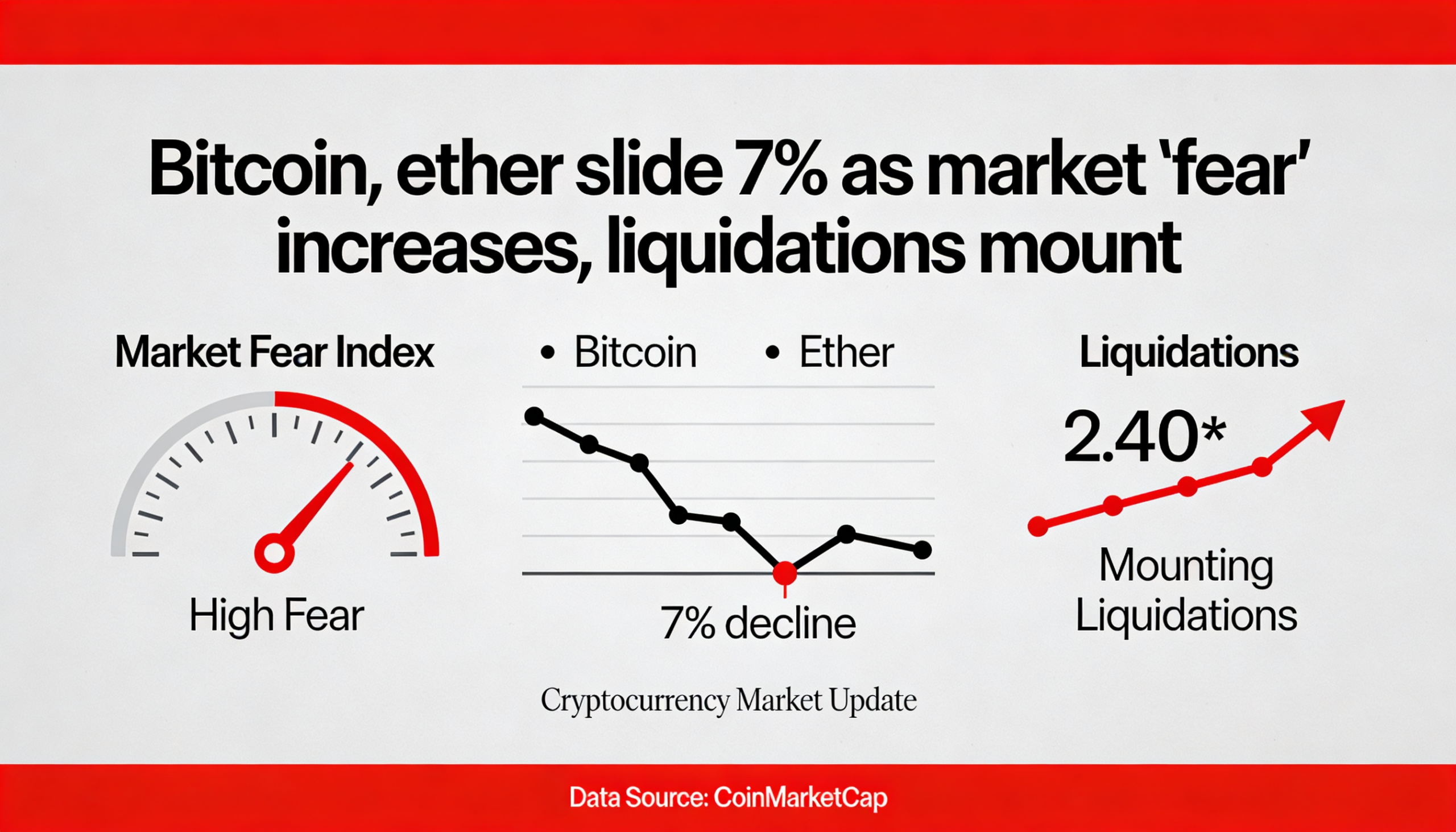

The sell-off was intensified by forced liquidations in derivatives markets. Coinglass data shows roughly $46 million in XRP positions were liquidated over the past day, with $43 million of that from leveraged long bets. This indicates that the move was driven not only by spot holders exiting but also by traders losing margin positions as key support levels gave way.

Throughout the session, XRP bled gradually before a sharp late-day drop, a pattern often seen when buyers retreat until a final wave of stop orders accelerates selling.

The token’s decline comes despite positive fundamentals. Flare and Hex Trust recently launched institutional access for FXRP minting and FLR staking, allowing institutions to use XRP in DeFi without selling it. Yet the announcement failed to boost sentiment, suggesting traders either doubt near-term demand or expect significant flows to take longer to materialize.

Ripple also expanded its institutional infrastructure, adding Hyperliquid to Ripple Prime for on-chain perpetual liquidity and securing e-money licenses in Luxembourg. While such steps usually enhance a token’s appeal in bull markets, they were insufficient to counter current technical and leveraged pressures.

From a technical perspective, the break below $1.44 has flipped a former support zone into overhead resistance. Below the current level, the next obvious psychological target is $1.00, as there is little trading history in between.

In the near term, XRP is behaving more like a leverage-driven unwind than a fundamentals-led rally — and neither trend appears finished.