Fed rates expected to hold, but Powell’s words could move bitcoin and the dollar

The Federal Reserve is set to announce its latest interest rate decision this week, with markets overwhelmingly expecting no change. Attention is squarely on Chair Jerome Powell’s post-meeting press conference, where his guidance on monetary policy and comments on politically sensitive topics could influence both traditional and crypto markets.

Powell’s remarks on the economic outlook, the future path of rates, and high-profile issues such as President Donald Trump’s housing affordability measures and renewed scrutiny of Fed independence will be closely watched.

Rates likely to remain steady

After three consecutive quarter-point cuts, the Fed is widely expected to pause. CME FedWatch futures indicate a 96% probability that rates will remain at 3.5%–3.75%.

This reflects Powell’s December guidance that the FOMC does not plan further cuts into 2026. Minneapolis Fed President Neel Kashkari, a voting member this year, reinforced that view, calling additional easing “way too soon.”

Absent a surprise cut—which could weaken the dollar and boost bitcoin and equities—the rate decision itself is expected to have minimal immediate market impact.

Hawkish or dovish pause?

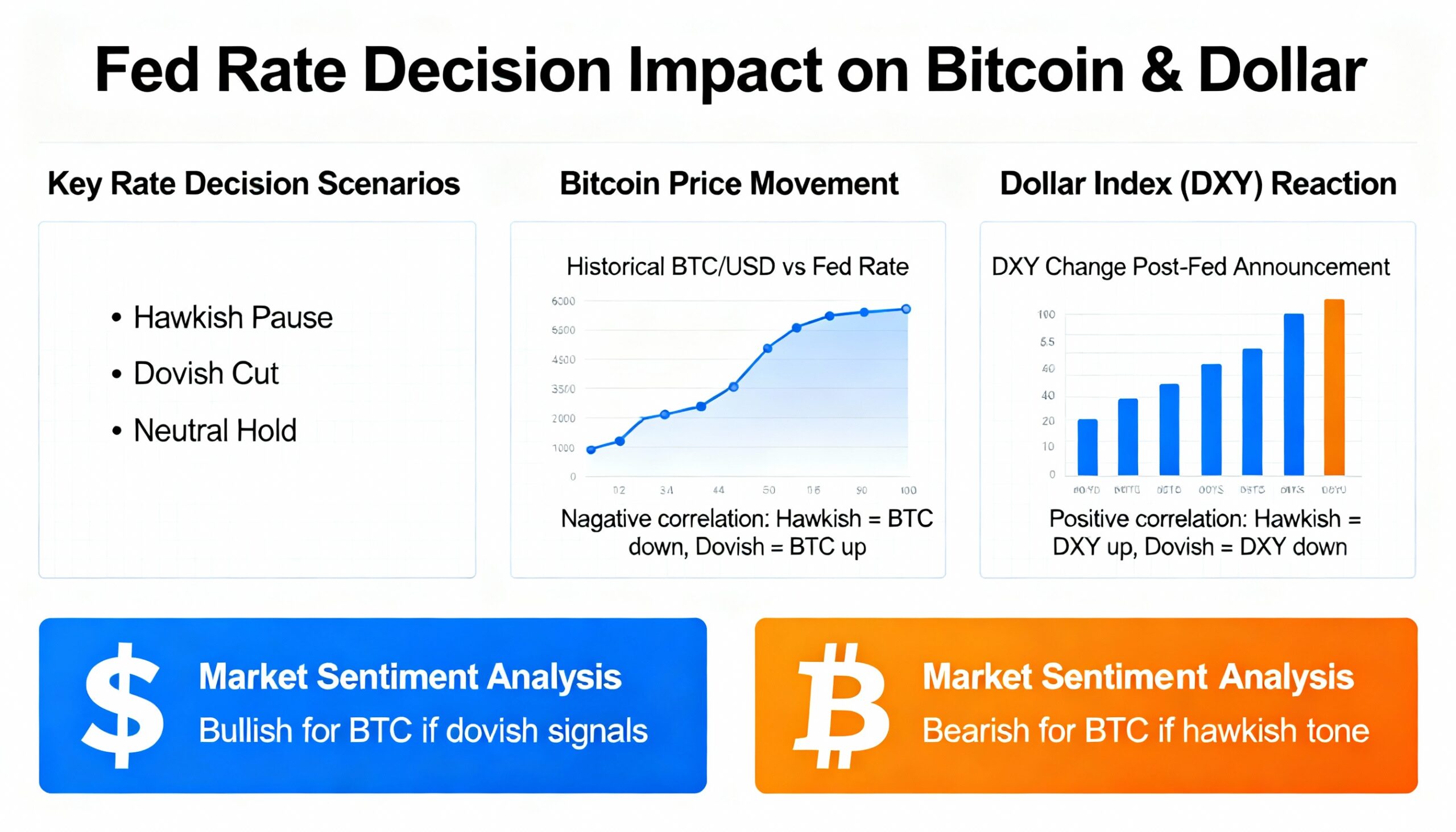

Markets will focus on whether Powell frames the pause as hawkish or dovish.

- Hawkish pause: Powell emphasizes persistent inflation risks, pushing back expectations for rate cuts and pressuring risk assets.

- Dovish pause: Powell signals that the pause is temporary and cuts could resume, potentially supporting equities and bitcoin.

Morgan Stanley expects a dovish tilt, with the Fed retaining language that it is “considering the range and timing for further adjustments,” keeping future easing on the table while acknowledging the economy’s strength.

Dissenting voices will also matter. Trump-appointed Fed Governor Stephen Miran is expected to dissent in favor of a 50-basis-point cut. Additional dissenters could bolster the case for future easing, lifting risk assets.

Most banks expect one or two rate cuts later this year, while JPMorgan projects no cuts in 2025 followed by a hike next year.

Dollar implications and political factors

Powell is likely to face questions about the rationale for holding rates steady and the potential inflationary impact of Trump’s affordability measures.

ING analysts note that Powell may struggle to argue that financial conditions are restrictive, which could support the dollar and pressure bitcoin. They suggest that a sustained dollar decline is more likely to come from weak economic data than Fed commentary.

Trump’s housing initiatives—including $200 billion in mortgage-backed securities purchases and limits on institutional buyers of single-family homes—could push demand forward, raising housing inflation. Allianz Investment Management warns that MBS purchases may inflate prices, while restrictions on institutional buyers likely have minimal effect due to their small market share.

Trump’s tariffs are largely priced in, though their inflationary effects are expected to emerge gradually.

Other risks in focus

Powell may also be questioned about a Justice Department investigation targeting him personally, which he has called politically motivated, and recent bond market volatility linked to Japan’s fiscal challenges. He is expected to sidestep detailed comment and downplay global market concerns.

With rates expected to remain unchanged, markets will be parsing Powell’s tone and guidance for clues about whether the Fed will favor the dollar or risk assets like bitcoin in the months ahead.