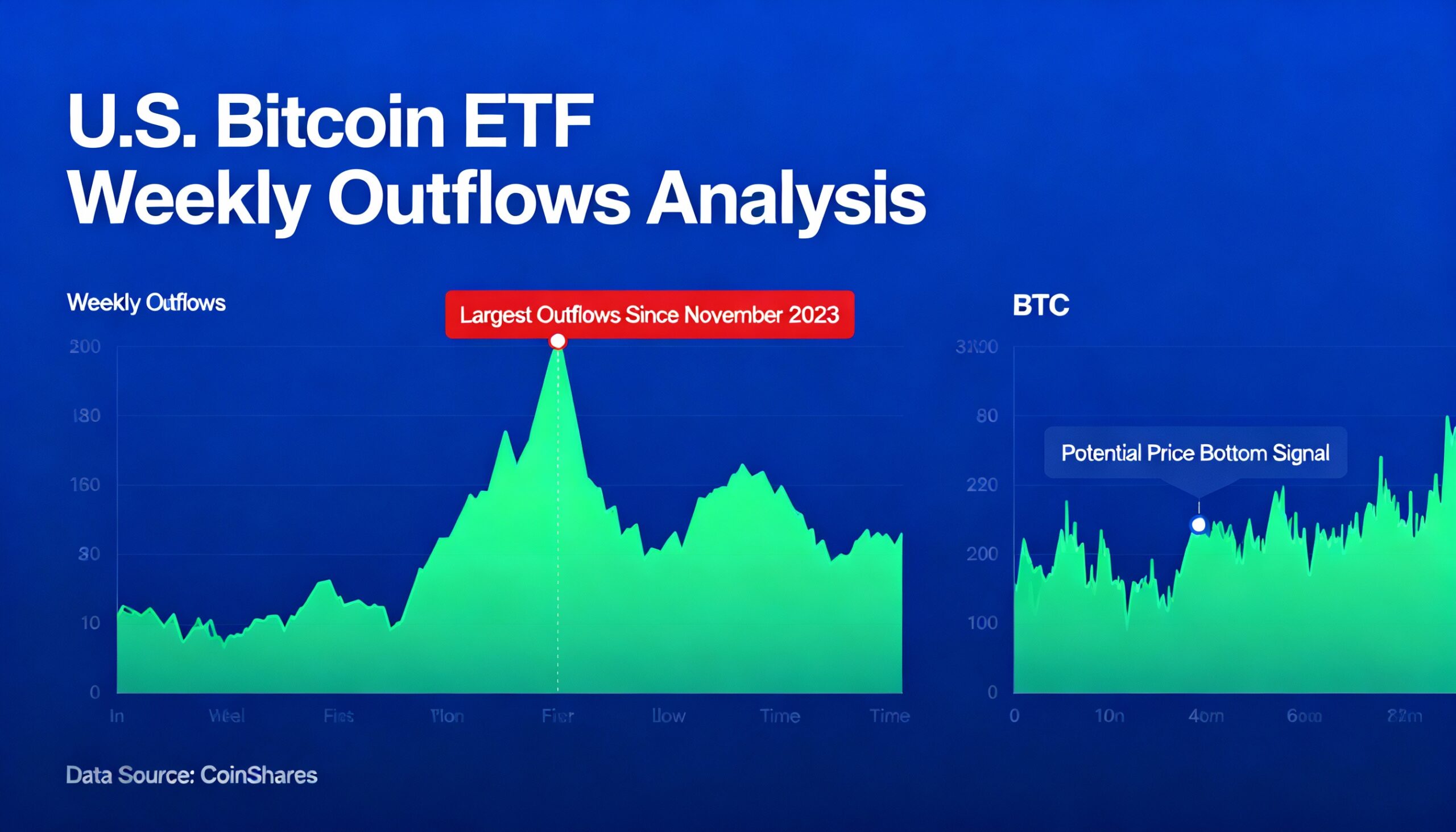

U.S. Bitcoin (BTC $88,748.27) ETFs experienced their largest weekly outflows since November, a move that often signals a short-term bottom in the cryptocurrency’s price.

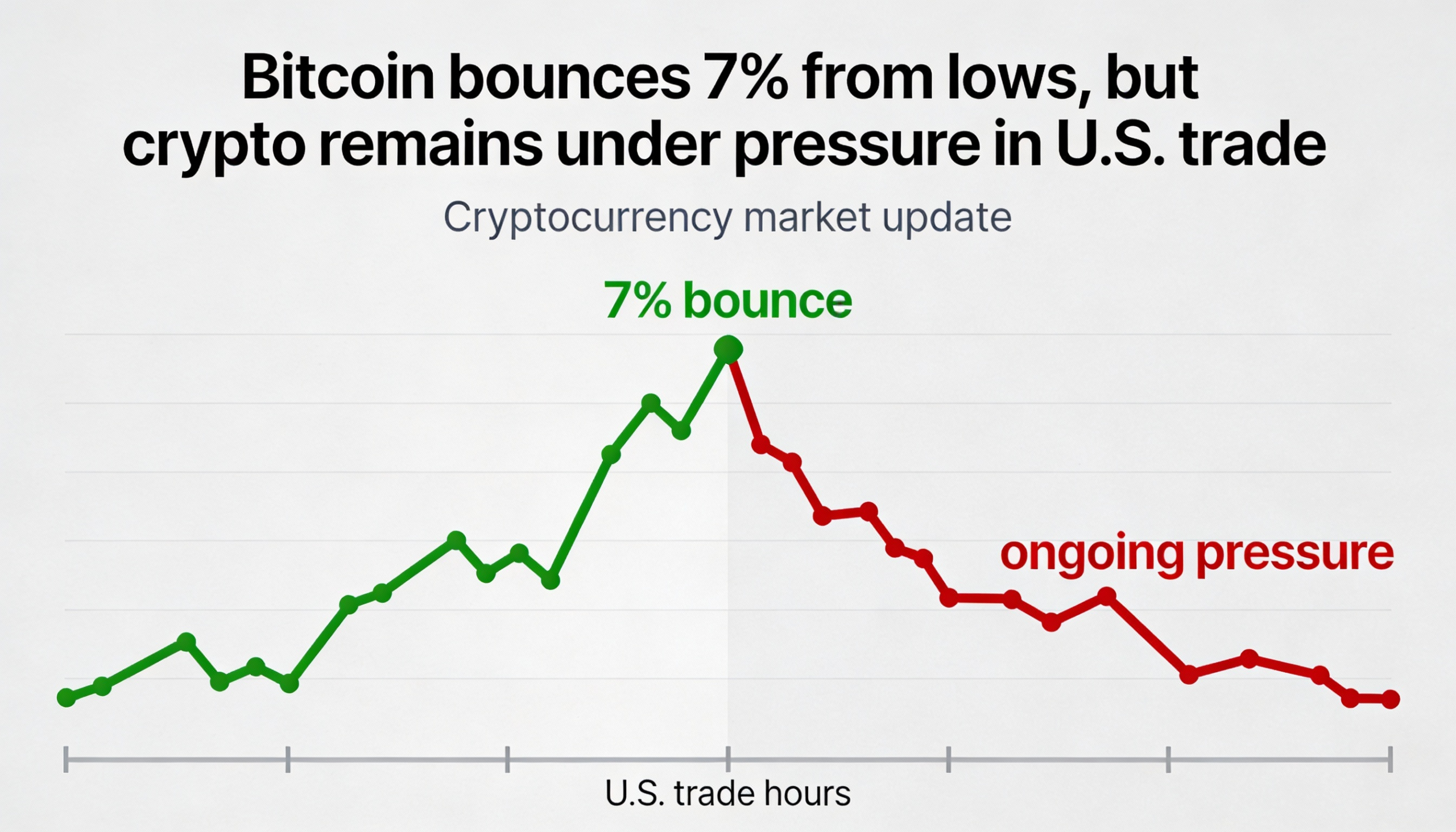

According to SoSoValue, a total of $1.22 billion left ETFs over the four days ending Thursday, including $479.7 million on Tuesday and $708.7 million on Wednesday. Bitcoin fell roughly 5% during the same period and has remained largely unchanged since the start of the year.

Historically, heavy ETF outflows have coincided with local price lows. In November, a similar four-day withdrawal preceded a rebound from about $80,000 to over $90,000. Comparable patterns emerged in March 2025, ahead of tariff-related market turmoil, when Bitcoin dipped to $76,000, and in August 2024, when it bottomed near $49,000 amid the unwind of the yen carry trade.

Glassnode data shows the average cost basis for ETF investors sits at $84,099, a level that has historically provided support during past pullbacks.

The combination of elevated outflows and historical support levels suggests Bitcoin may be nearing a potential short-term bottom.