As 2025 comes to an end, few events rattled the crypto market like the Oct. 10 “flash crash,” when bitcoin (BTC $87,784.51) plunged nearly $12,000 — nearly 10% — in minutes. The sudden drop triggered over $19 billion in liquidations, circulated a trader “cascade warning,” and erased roughly $500 billion from total crypto market capitalization.

The crash kicked off a prolonged decline, leaving bitcoin more than 30% below its $126,223 peak reached just six days earlier. This drop is expected to produce bitcoin’s first full-year loss since the 2022 crypto winter.

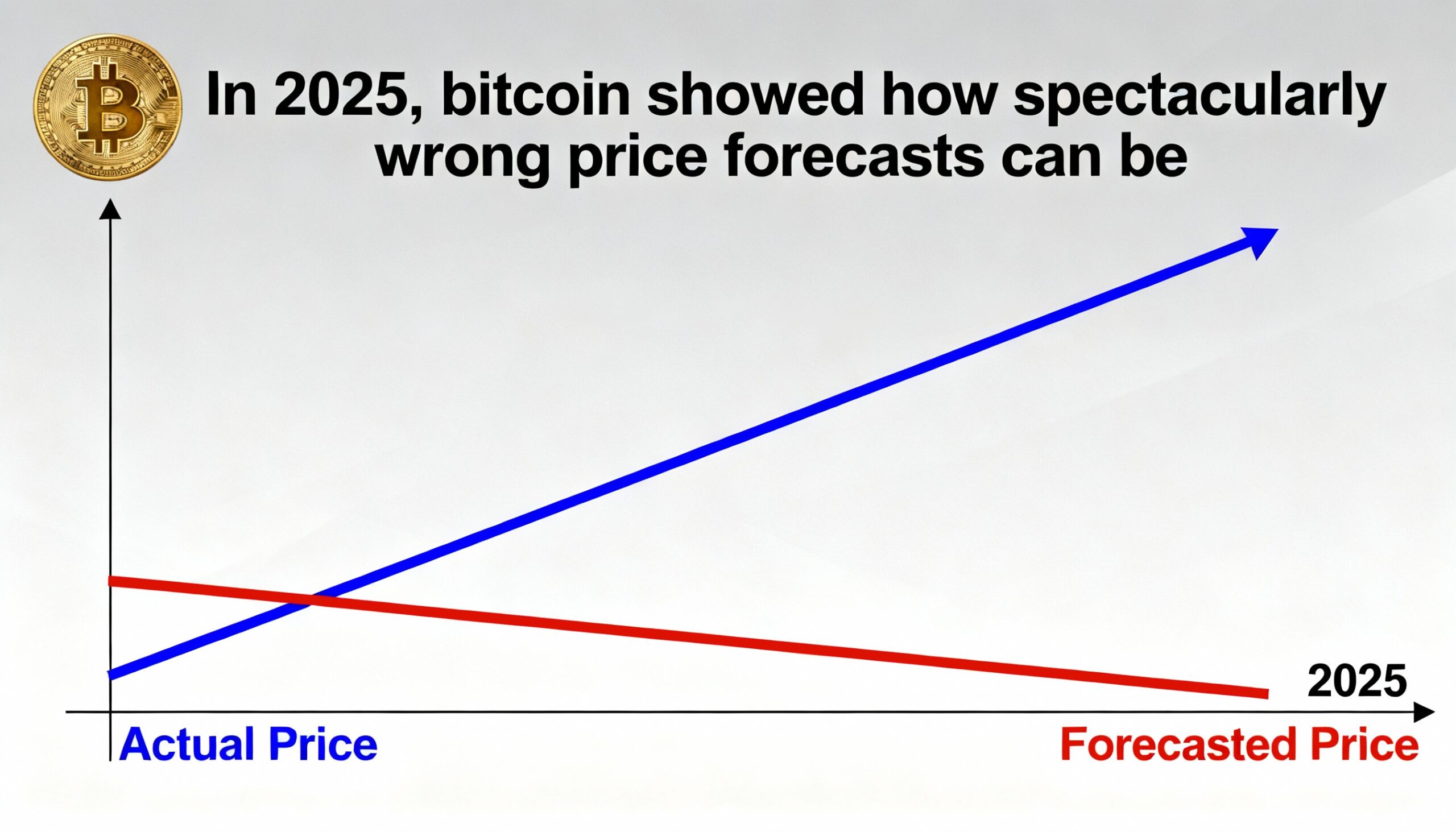

The year began with optimism and a flood of price predictions, from conservative estimates to highly ambitious targets. Long-term projections included Fidelity’s Jurrien Timmer predicting $1 million by 2038 and BlackRock CEO Larry Fink’s $700,000 target tied to institutional adoption.

Even 2025-specific forecasts were bold. Jan3 CEO Samson Mow predicted a “violent” surge to $1 million, while Blockstream CEO Adam Back cited ETF inflows, institutional buying, and limited supply for a $500,000–$1 million target. Venture capitalist Chamath Palihapitiya also forecast $500,000 by October.

Conservative forecasts still overshot reality. JPMorgan analysts projected $165,000 pre-crash, and Michael Saylor of Strategy (MSTR) expected $150,000 post-crash, adding $1 billion in BTC in December to reach 671,268 total holdings.

Few adjusted downward. Galaxy Digital CEO Mike Novogratz revised his $500,000 forecast to $120,000–$125,000, while Standard Chartered cut its target to $100,000.

The takeaway from 2025: bitcoin humbles everyone. It defies charts, models, and the boldest forecasts — proving that while predictions are easy to make, being right is rare.