The renewed rally in oil prices is complicating the inflation outlook, potentially slowing the path to lower interest rates and adding fresh pressure on bitcoin.

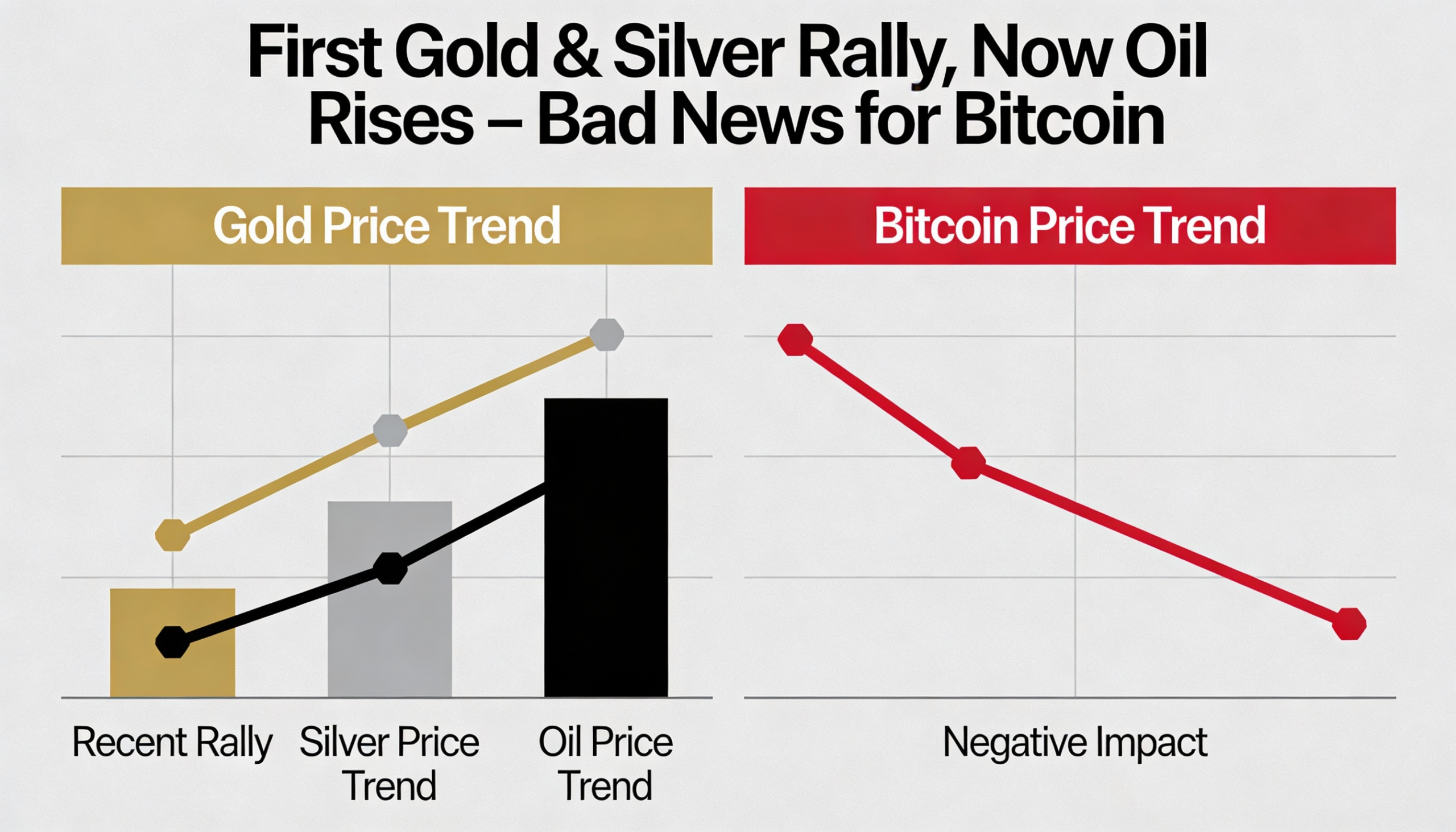

For bitcoin bulls, the macro environment has grown increasingly unfriendly. Gold and silver have already surged to record highs, pulling capital toward traditional inflation hedges and away from crypto. Now oil prices are climbing as well, reinforcing conditions that typically favor bitcoin bears.

West Texas Intermediate crude, the benchmark for North American energy markets, has risen roughly 12% this month to $64.30 a barrel, its highest level since September. Brent crude, the global benchmark, has followed a similar path, trading near $68.22.

The move threatens expectations for monetary easing, which many investors see as essential for reviving bitcoin’s momentum. After peaking above $126,000 in early October, bitcoin has since slipped below $90,000 amid tighter financial conditions.

Inflation back in focus

Oil prices are a critical input across the economy. Rising crude costs push gasoline and transportation prices higher, lifting costs for a wide range of goods and services, from food and apparel to electronics. Those increases are typically passed on to consumers, raising overall inflation.

Higher prices can also spill into labor markets, as workers seek wage increases to protect purchasing power. That dynamic can create a feedback loop, with higher wages leading businesses to raise prices further.

The Federal Reserve has repeatedly highlighted the importance of energy prices in inflation dynamics. Oil price pass-through to inflation is “both economically and statistically significant,” the central bank has said, noting that higher energy costs can also lift inflation expectations and pressure core prices.

Persistent inflation generally leads central banks to keep borrowing costs elevated. That environment weighed heavily on bitcoin in 2022, when aggressive Fed tightening contributed to a roughly 64% decline in the asset.

The latest rise in oil comes as the Federal Reserve faces renewed inflation concerns. On Wednesday, policymakers held interest rates steady in a range of 4.5% to 4.75%, noting that inflation remains “somewhat elevated,” partly due to tariffs imposed by President Donald Trump on imported goods.

ING said the Fed’s messaging signaled growing confidence that the policy-easing cycle is nearing its end.

That suggests limited urgency to cut rates — a stance that rising oil prices could further entrench.

What’s driving crude higher

Geopolitical risks and tightening supply conditions are underpinning the oil rally.

Markets are responding to escalating tensions involving Iran, a major oil producer, alongside falling U.S. inventories. In a recent Truth Social post, Trump warned that a large U.S. naval force was moving toward Iran and urged Tehran to agree to a nuclear deal or face a “far worse” U.S. response.

Iran responded by vowing a strong retaliation, underscoring the potential economic and humanitarian consequences of a broader conflict.

Meanwhile, data from the U.S. Energy Information Administration showed crude inventories declined by 2.3 million barrels in the week ended Jan. 24. Falling inventories typically signal demand is outpacing supply, forcing refiners to draw down stockpiles.

Together, geopolitical uncertainty and tighter supply are pushing oil prices higher — and creating another macro obstacle for bitcoin.