Strategy Shares Jump After MSCI Keeps Digital Asset Treasury Firms in Indexes

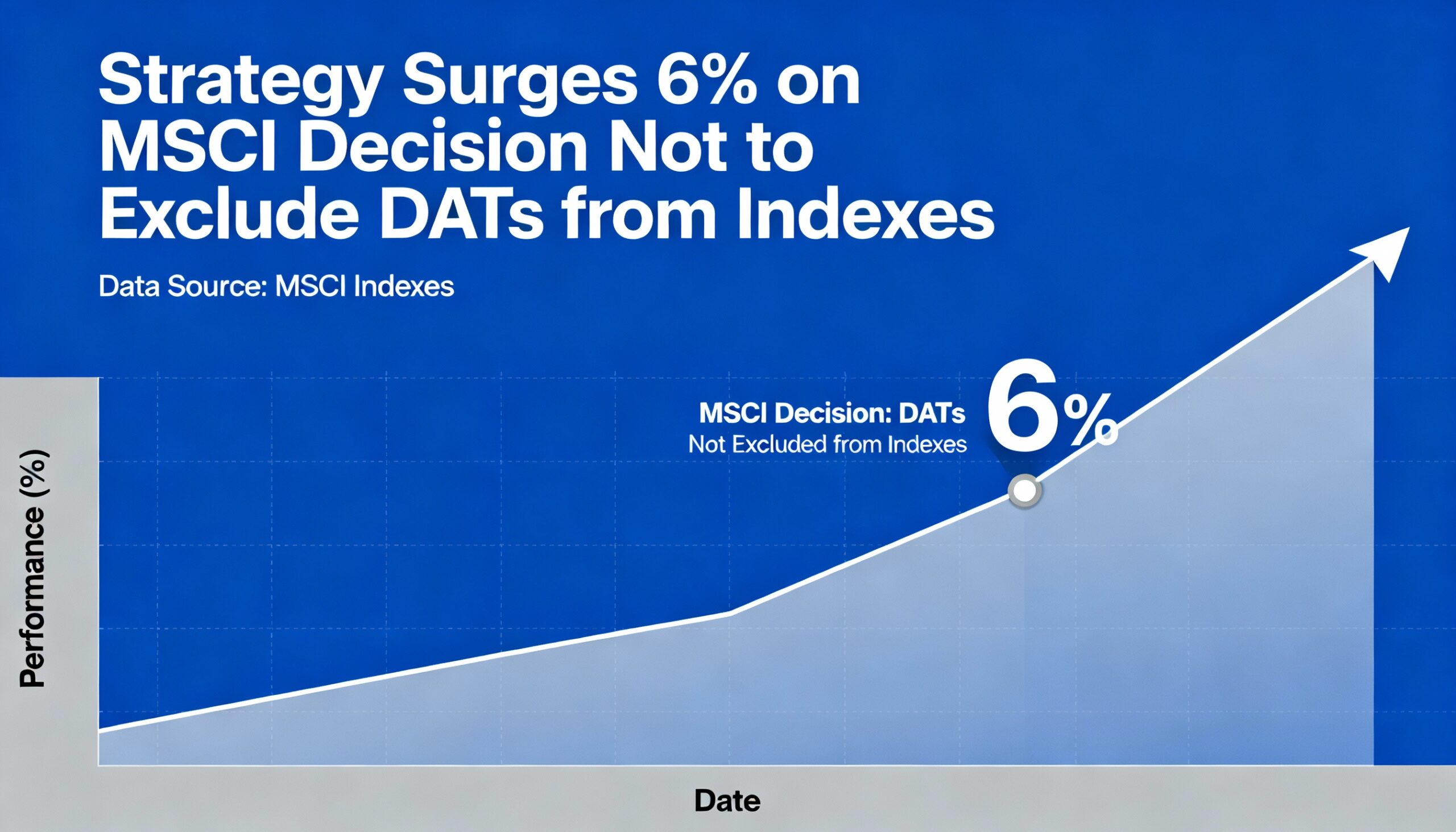

Shares of Strategy (MSTR) rose 6% in after-hours trading Tuesday after MSCI said it will not exclude digital asset treasury companies (DATs) from its indexes, easing a key overhang on the stock.

The Michael Saylor-led firm had been under pressure amid weak bitcoin prices and concerns that MSCI might remove companies whose balance sheets are heavily weighted toward digital assets.

In a statement, MSCI said it needs more analysis before distinguishing between investment companies and operating firms that hold non-operating assets, such as digital assets, as part of their core business. The index provider added that assessing eligibility across these entities may require additional criteria, including financial-statement-based or other indicators.

“For the time being, the current index treatment of DATCOs identified in the preliminary list published by MSCI… will remain unchanged,” the firm said, referring to companies whose digital asset holdings represent at least 50% of total assets.

The decision was closely watched across the sector, as exclusion from major indexes could have cut off billions of dollars in passive inflows not only for Strategy but also for firms seeking to emulate its digital asset treasury model.

With the risk of removal now lifted, capital could begin flowing back into the space, improving sentiment. Other DATs, including Bitmine Immersion (BMNR), Sharplink (SBET), and Twenty One Capital (XXI), also posted modest after-hours gains.

Bitcoin, which had traded lower earlier in the session, rose about 1% following the announcement, changing hands near $93,500.