Asset manager Bitwise predicts the stablecoin market could reach $400 billion by 2025, driven by U.S. legislation, fintech adoption, and global payments.

The stablecoin market reached a significant milestone on Wednesday, crossing the $200 billion market value for the first time, signaling accelerating demand and growing adoption of these assets.

In just two weeks, the total market value of stablecoins surged by $10 billion, surpassing the previous record set during the 2022 bull cycle, according to data from CCData and DefiLlama. Stablecoins, which are cryptocurrencies pegged to the U.S. dollar to maintain a stable price, have become a key part of the digital asset ecosystem. They serve as the primary source of liquidity for crypto asset trading on exchanges and facilitate value transfer across blockchain networks.

Demand for stablecoins steadily increased throughout the year, as the crypto market began recovering from the bear market. Growth accelerated following Donald Trump’s election victory, leading to a $30 billion rise in supply as investors flooded into the cryptocurrency market.

Tether’s USDT, the leading stablecoin, saw its supply reach a record $139 billion, growing 12% in just a month, according to DefiLlama. The stablecoin was recently recognized as an accepted virtual asset by the Abu Dhabi Global Market (ADGM), with plans to expand services in the Middle East. Circle’s USDC, the second-largest stablecoin, also grew by 9%, reaching a market value of nearly $41 billion. Circle has also formed a partnership with Binance, the world’s largest crypto exchange by trading volume, to further promote USDC adoption globally.

But it’s not just the crypto market fueling this growth.

Stablecoins are increasingly being used for payments, remittances, and savings, particularly in developing countries with unstable currencies and fragile financial systems. One sign of growing adoption outside of the crypto market is the rise in stablecoin transactions on peer-to-peer payment platforms, as noted by Nik Milanovic, partner at Fintech Fund.

Tokenized stablecoins offering yields are also gaining popularity. Ethena’s USDe token, which generates yield by shorting bitcoin and ether perpetuals, has surged to over $5 billion, a 90% increase in a month, according to DefiLlama. Similarly, the decentralized finance (DeFi) protocol Usual’s stablecoin reached $700 million, doubling in size during the same period.

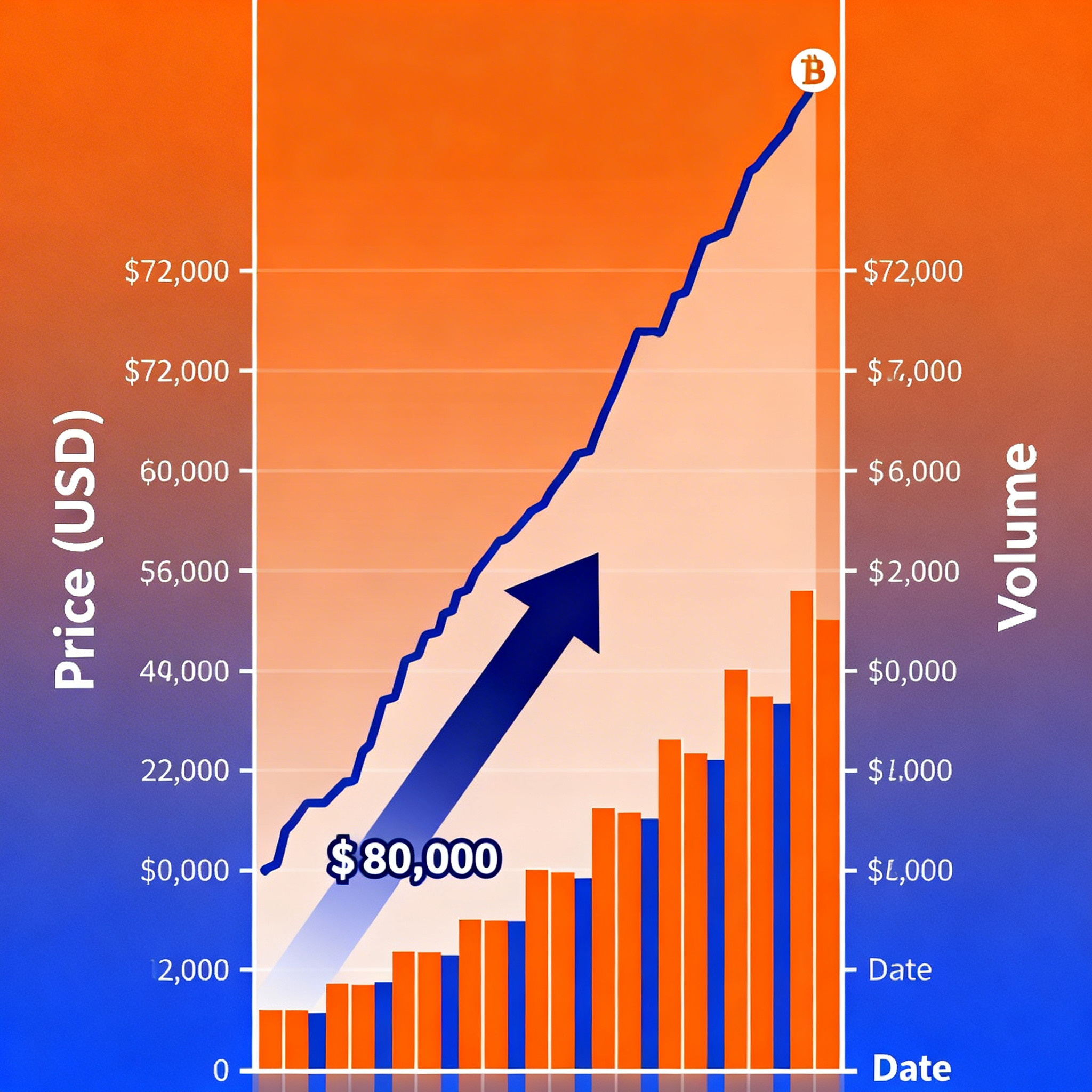

Market Cap Could Double by 2025

Bitwise forecasts continued growth, projecting the stablecoin market could reach $400 billion by 2025. The key catalyst for this growth could be the passage of U.S. stablecoin legislation, which would establish rules for businesses and institutions issuing and interacting with stablecoins.

“Clear answers to key questions—such as who regulates stablecoins and what the reserve requirements should be—will spark massive new interest among issuers, consumers, and businesses,” said Bitwise analysts. “This will likely lead to major traditional banks, like J.P. Morgan, entering the space.”

In addition to legislation, other factors contributing to the growth of stablecoins include the integration of stablecoins into popular fintech platforms, such as PayPal’s PYUSD stablecoin, and the increasing use of stablecoins in global payments and remittances.

Bitwise isn’t alone in its optimistic forecast. A recent report from Standard Chartered and Zodia Markets predicted that stablecoins could account for up to 10% of U.S. money supply and foreign exchange transactions, compared to just 1% currently.