Bitcoin’s 60-Day Coinbase Premium Streak Snaps, Hinting at Fading U.S. Demand

A key gauge of U.S. institutional demand for bitcoin (BTC) has turned negative for the first time in two months, raising concerns about potential market cooling.

The “Coinbase premium” — which tracks the price difference between BTC/USD on Coinbase and BTC/USDT on Binance — flipped below zero early Tuesday, according to TradingView data. It’s the first time since late May that the index has shown a discount rather than a premium.

This metric is closely watched as a proxy for U.S. investor appetite, particularly from institutions that prefer the Nasdaq-listed Coinbase platform over offshore exchanges like Binance. A positive premium typically signals strong U.S. buying pressure, while a negative reading suggests demand is softening.

The reversal comes after a record 60-day stretch in which Coinbase prices consistently traded above their Binance counterparts, coinciding with bitcoin’s surge to all-time highs and robust ETF inflows.

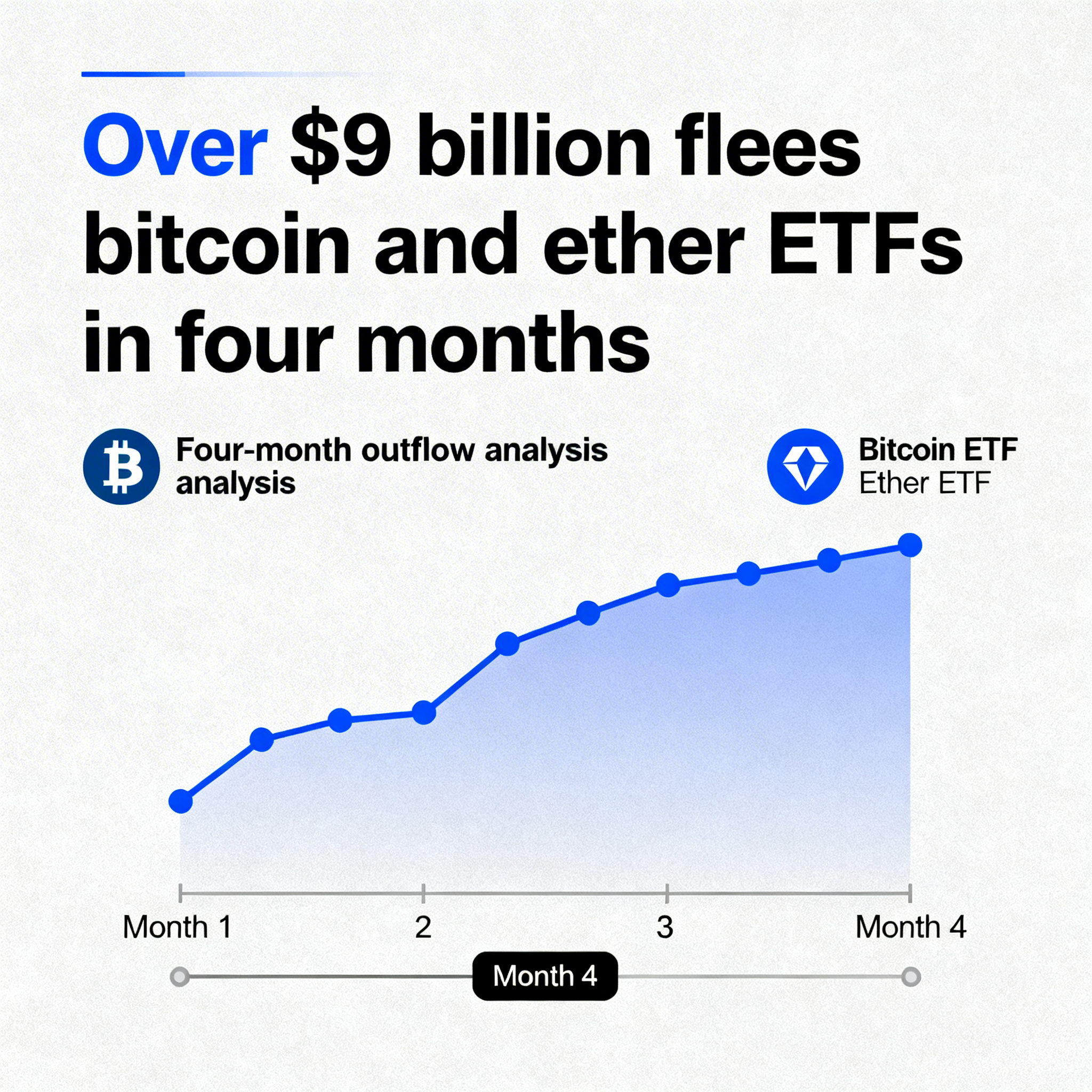

Now, with the premium fading, market analysts say the drop could mark the beginning of a deeper pullback or at least a period of prolonged consolidation. The shift also aligns with declining ETF volumes and rising caution around U.S. macro conditions.

While the broader crypto market remains resilient, the loss of the Coinbase premium removes a key pillar of recent bullish momentum — and underscores the importance of monitoring institutional flows in the weeks ahead.