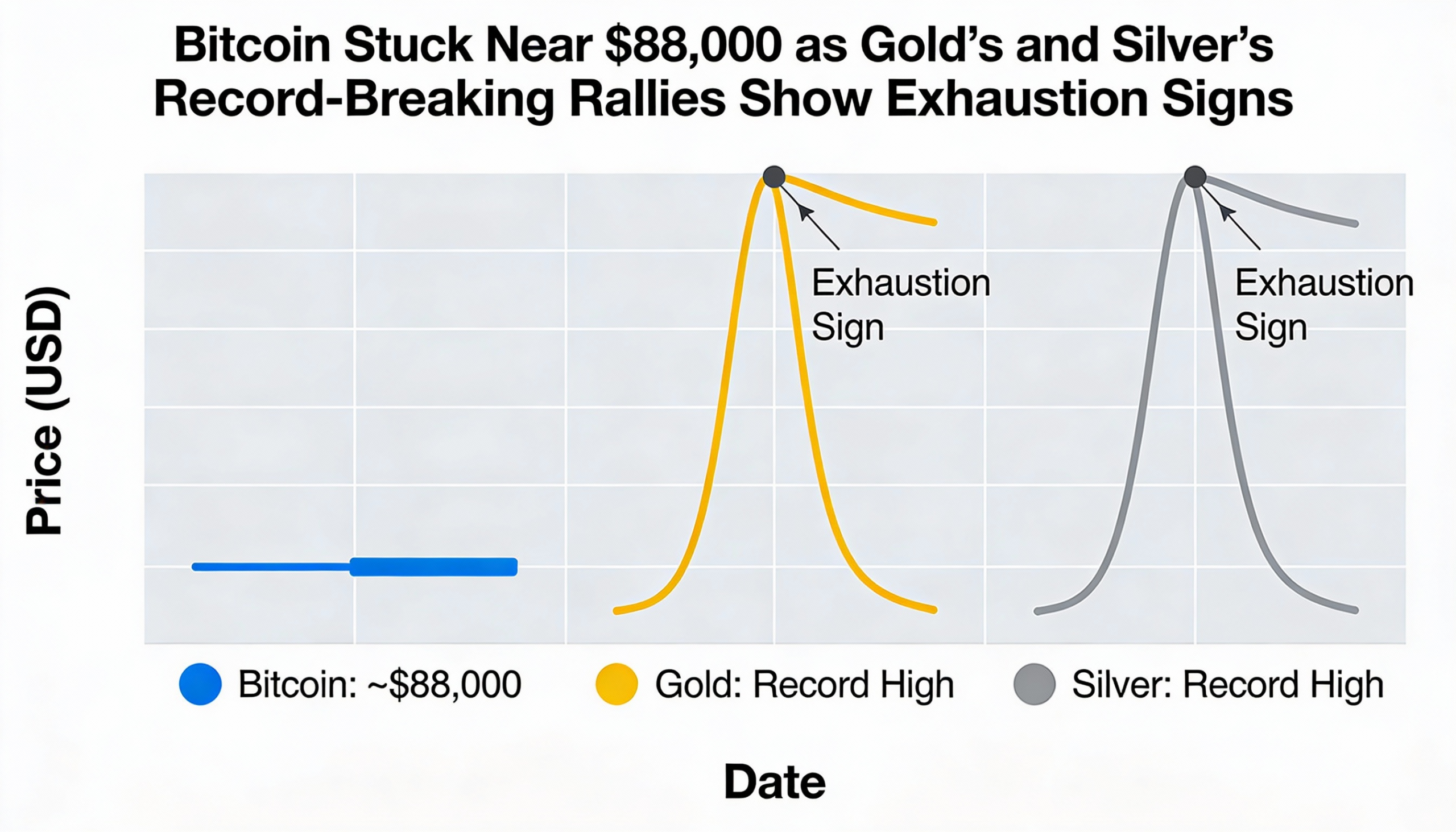

Bitcoin remained range-bound near $88,000 on Monday, showing little movement even as gold and silver surged to record highs before easing back.

The cryptocurrency recovered slightly from a wave of weekend selling but stayed below Friday’s peak of around $90,000. Rising concerns about a potential U.S. government shutdown on Jan. 31, and the possible impact on liquidity, were cited as a key factor behind Sunday’s pullback.

Precious metals, however, were largely unfazed. Gold broke through $5,000 and briefly touched $5,100 for the first time, while silver rallied to $118. By Monday, gold had pulled back to roughly $5,043, still up 1.3% on the day, and silver retreated to $108, maintaining a gain of around 7%. “Gold and silver casually adding an entire bitcoin market cap in a single day,” wrote crypto analyst Will Clemente, underscoring the contrast with bitcoin’s muted response.

Meanwhile, the U.S. dollar index (DXY) slipped to its weakest level since September after reports of coordinated intervention by the Federal Reserve and the Bank of Japan to support the yen. The dollar fell more than 1% to 154.07 per yen.

Bitcoin outlook remains cautious

Despite the weaker dollar, bitcoin has shown limited bullish follow-through, keeping near-term sentiment cautious. Analysts at Swissblock said recent price action reinforced a bearish bias, warning that a break below $84,500 could trigger a deeper correction toward $74,000. They noted, however, that if support holds and risk metrics ease, it could present an attractive entry point for buyers.

Bitfinex analysts expect BTC to remain range-bound between $85,000 and $94,500. They highlighted options market activity indicating traders are hedging short-term risks without pricing in a sharp rise in longer-term volatility. “Markets are pricing transitory risk rather than a sustained disruption to market structure,” they said.

ETF outflows and regulatory uncertainties

Selling pressure has been intensified by continued outflows from spot bitcoin ETFs, which totaled over $1.3 billion in the past week, reflecting weak risk appetite among investors.

Jim Ferraioli, Schwab’s director of crypto research and strategy, said a sustained move above current levels is unlikely without improvements in on-chain activity, ETF flows, derivatives positioning, or miner participation. He added that progress on the Clarity Act could act as a major catalyst, but the process may be delayed by a potential government shutdown. Until regulatory clarity emerges, Ferraioli expects bitcoin to trade in a tight range between the low $80,000s and mid-$90,000s, with institutional investors largely on the sidelines