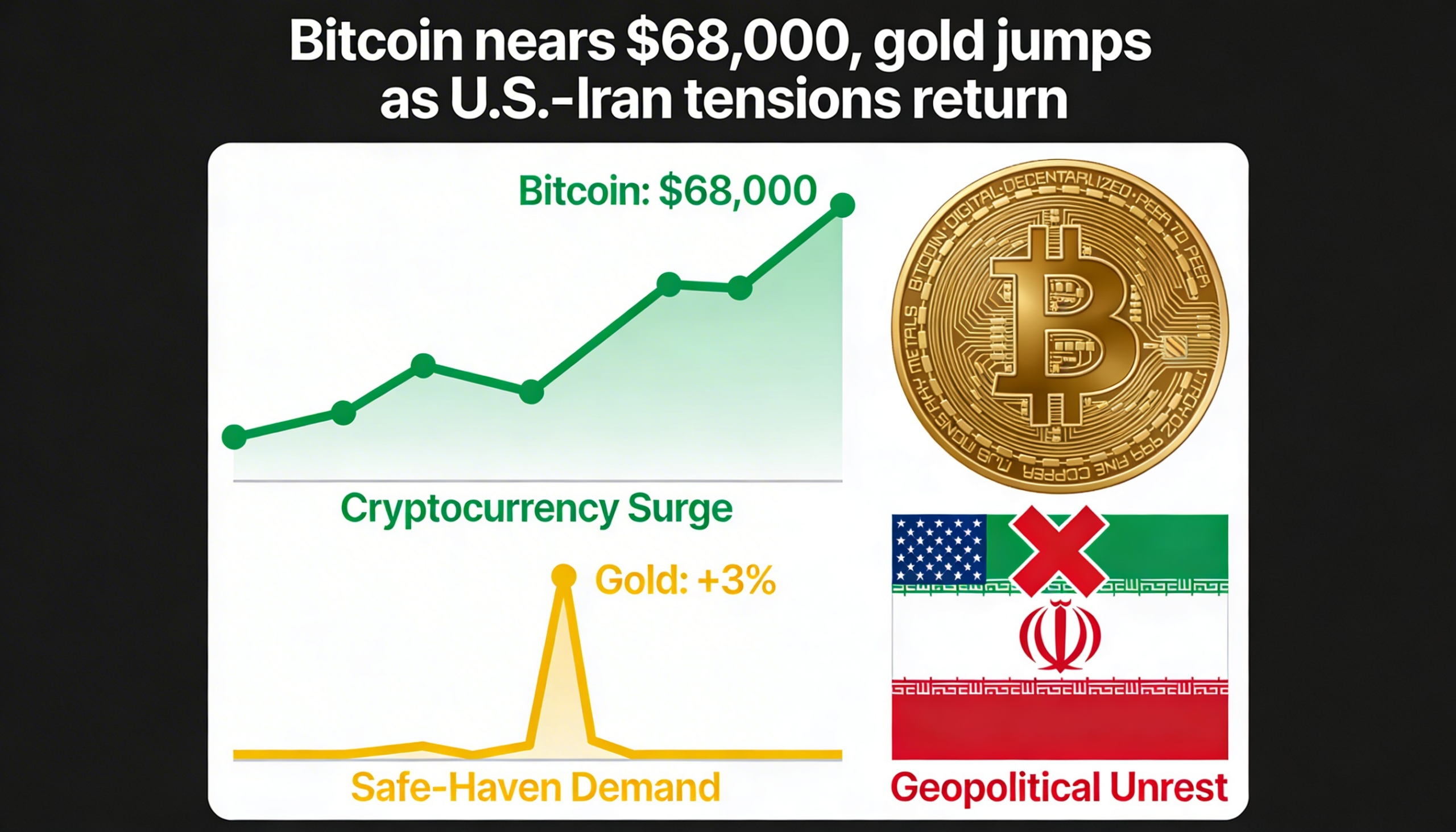

Bitcoin rebounded above $68,000 on Thursday, climbing from a local low near $65,600 even as U.S. spot ETF outflows swelled to $6.8 billion. Market participants say a decisive break above $72,000 would be required to confirm a broader bullish reversal.

The recovery gathered pace overnight. Since midnight UTC, bitcoin has advanced roughly 2%, while Solana (SOL) gained 2.7% and ether (ETH) added 1.2%.

Despite the bounce, the broader technical structure remains fragile. Bitcoin continues to register lower highs and lower lows, effectively surrendering most of the gains accumulated in the year through October 2025. For now, the asset remains range-bound, oscillating between established support and resistance. A sustained move above $72,000 is widely seen as the level that would shift momentum back toward the bulls.

Meanwhile, U.S.-listed spot bitcoin ETFs are experiencing their largest drawdown of the current cycle. Since October, investors have withdrawn around 100,300 BTC — equivalent to approximately $6.8 billion in additional supply entering an already cautious market.

Derivatives positioning stabilizes

Signs of stabilization are emerging in derivatives markets. Open interest has climbed to $15.8 billion, suggesting the worst of the recent deleveraging may have passed. Retail sentiment appears to be improving as funding rates turn flat to positive across major exchanges, reaching as high as 10% on platforms such as Bybit and Hyperliquid.

Institutional positioning remains measured, with the three-month annualized futures basis holding near 3%, reflecting steady but not aggressive conviction.

In options markets, activity shows a slight lean toward bullish exposure, with 24-hour volume split 51% in favor of calls. However, hedging demand remains elevated in the short term. The one-week 25-delta skew has widened to 17%, and the implied volatility term structure continues to display front-end backwardation.

That dynamic indicates traders are still paying a “panic premium” for near-term protection, even as longer-dated implied volatility stabilizes around 49%.

Liquidation data underscores ongoing volatility. Coinglass reports $179 million in liquidations over the past 24 hours, with 56% coming from long positions and 44% from shorts. Bitcoin accounted for $59 million, ether $46 million, and other tokens about $16 million in notional liquidations. Binance’s liquidation heatmap identifies $68,400 as a key upside level to monitor.

Altcoins outperform during consolidation

Away from bitcoin, altcoins showed relative strength. Lending protocol token MORPHO surged more than 12% overnight, while AI payments token KITE gained 11%, extending its 30-day rally to 153%.

DeFi tokens also participated in the move. Jupiter (JUP) rose over 3.6% after touching a seven-day low earlier in the session.

Among broader benchmarks, the CoinDesk Smart Contract Platform Select Index (SCPXC) led performance with a 2.25% gain over 24 hours, followed closely by the CoinDesk Memecoin Index (CDMEME), up 2.2%. The bitcoin-heavy CoinDesk 20 (CD20) advanced a more modest 1%, reflecting comparatively restrained moves among major cryptocurrencies.

Periods of sideways consolidation often encourage capital rotation into higher-beta tokens, as traders seek speculative upside while bitcoin, ether and XRP remain confined within defined ranges.