Metaplanet (3350), a digital asset treasury company, rose 4% in Tokyo on Wednesday after MSCI said it would not exclude firms holding cryptocurrency from its global indexes.

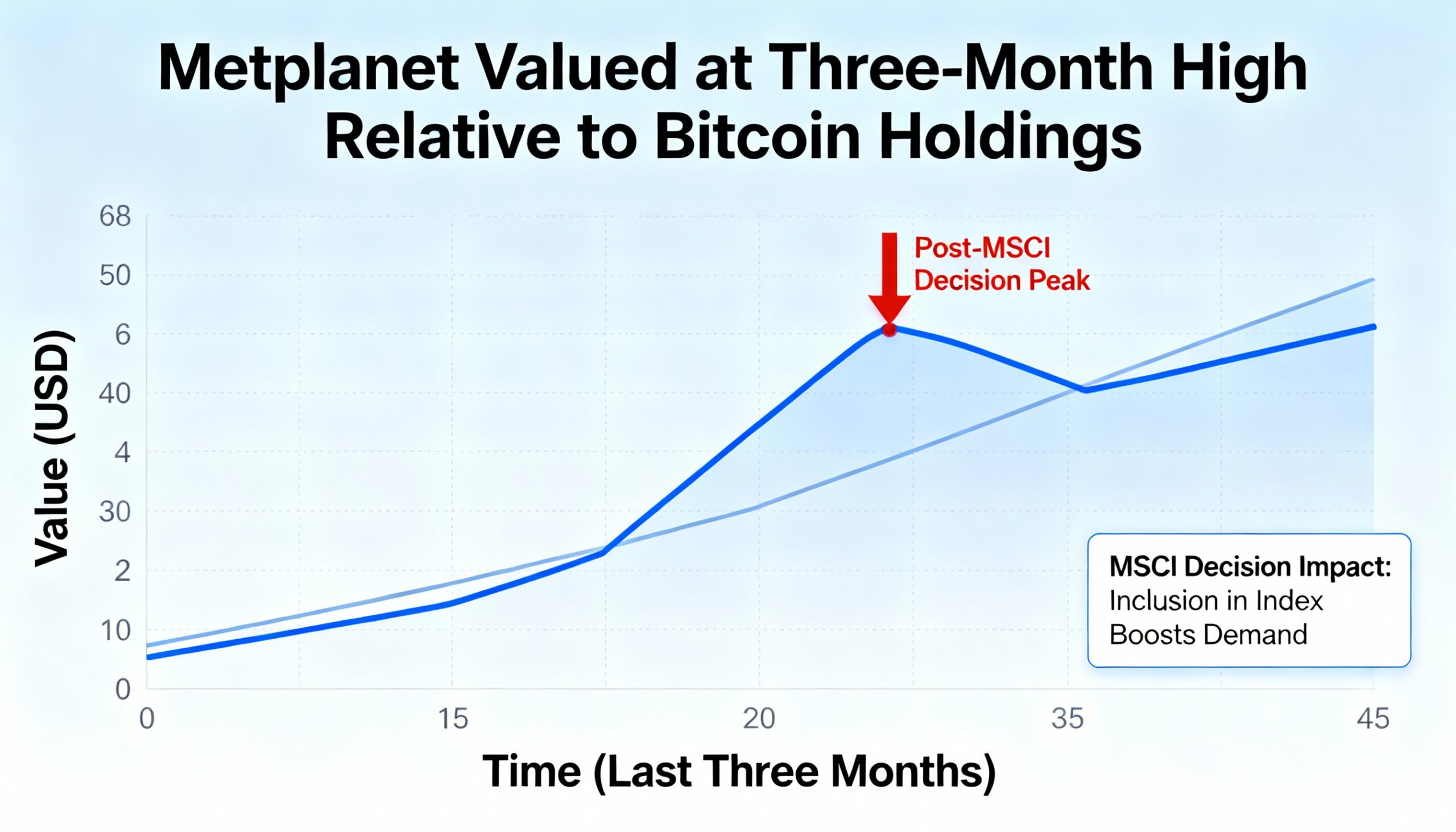

The rise takes Metaplanet about 20% higher year-to-date, valuing the company above its bitcoin holdings. Its net asset value multiple (mNAV) now stands at roughly 1.25 — the highest level since before October’s crypto sell-off, according to the company’s dashboard.

MSCI’s decision ended months of uncertainty over index eligibility and lifted U.S.-listed peers after hours on Tuesday. MicroStrategy (MSTR), the largest corporate bitcoin holder, gained roughly 5% in pre-market trading, while other crypto treasury firms saw smaller gains.

Metaplanet shares closed at 531 yen ($3.40), recovering from a low near 340 yen on Nov. 18. With 35,102 BTC on its balance sheet, the company is the fourth-largest publicly traded bitcoin treasury globally.

While the MSCI announcement removes a near-term overhang for crypto treasury stocks already in major indexes, the provider also signaled a broader consultation on non-operating and investment-focused companies is forthcoming. Analysts said this suggests regulatory and index-related risks for bitcoin treasury firms have been deferred rather than fully resolved.