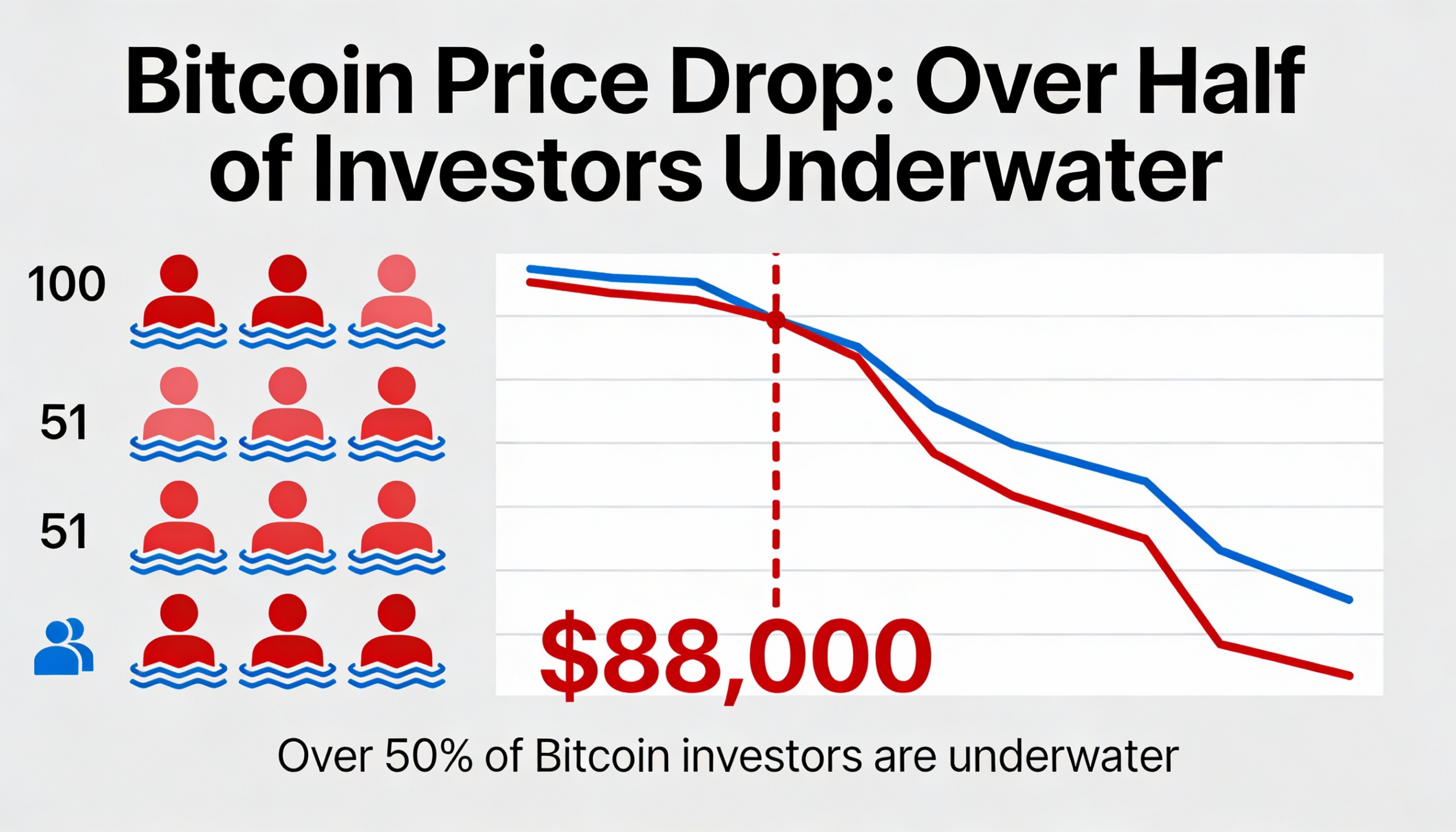

Most of bitcoin’s invested supply now sits above current prices, leaving the market exposed if key support levels fail.

According to Checkonchain, 63% of all bitcoin BTC $82,703.53 has a cost basis above $88,000, meaning the majority of capital entered at higher levels. Invested wealth tracks the value of coins when they last moved on-chain, while cost basis reflects the average purchase price.

The UTXO Realized Price Distribution (URPD) shows where this capital sits. Bitcoin has traded between $80,000 and $90,000 since November, with tens of billions of dollars concentrated between $85,000 and $90,000. A drop below $85,000 could trigger heavier selling, as long-term holders are already exiting at the fastest pace in six months.

Supply is thin between $70,000 and $80,000, meaning a breach of $80,000 — last tested in November — could accelerate a fall toward $70,000.

Bitcoin is on track to finish January largely flat, missing the typical relief rally after three months of declines. Historically, February has averaged gains of around 13%, but whether that trend holds may depend on how markets absorb the current overhang of underwater supply.