Last week’s sharp downturn triggered the largest realized loss event in Bitcoin’s history, as the asset plunged from $70,000 to $60,000 on Feb. 5.

Data from Glassnode show that Entity-Adjusted Realized Loss climbed to $3.2 billion. The metric tracks the total U.S. dollar value of coins sold below their acquisition price, while excluding transfers between wallets controlled by the same entity to provide a clearer view of true selling pressure.

The scale of the losses eclipsed previous extremes, including the $2.7 billion recorded during the 2022 collapse of Terra (LUNA), one of the most severe crises in crypto market history.

According to Checkonchain, the sell-off met the criteria of a classic capitulation event. The drop unfolded rapidly, on heavy trading volume, and forced lower-conviction holders to exit positions at a loss. Daily net realized losses exceeded $1.5 billion at the peak of the decline.

In absolute dollar terms, it marks the largest amount of losses ever crystallized on the Bitcoin network. Historically, episodes of this magnitude have tended to occur in the later stages of bear markets and have sometimes coincided with the formation of price bottoms.

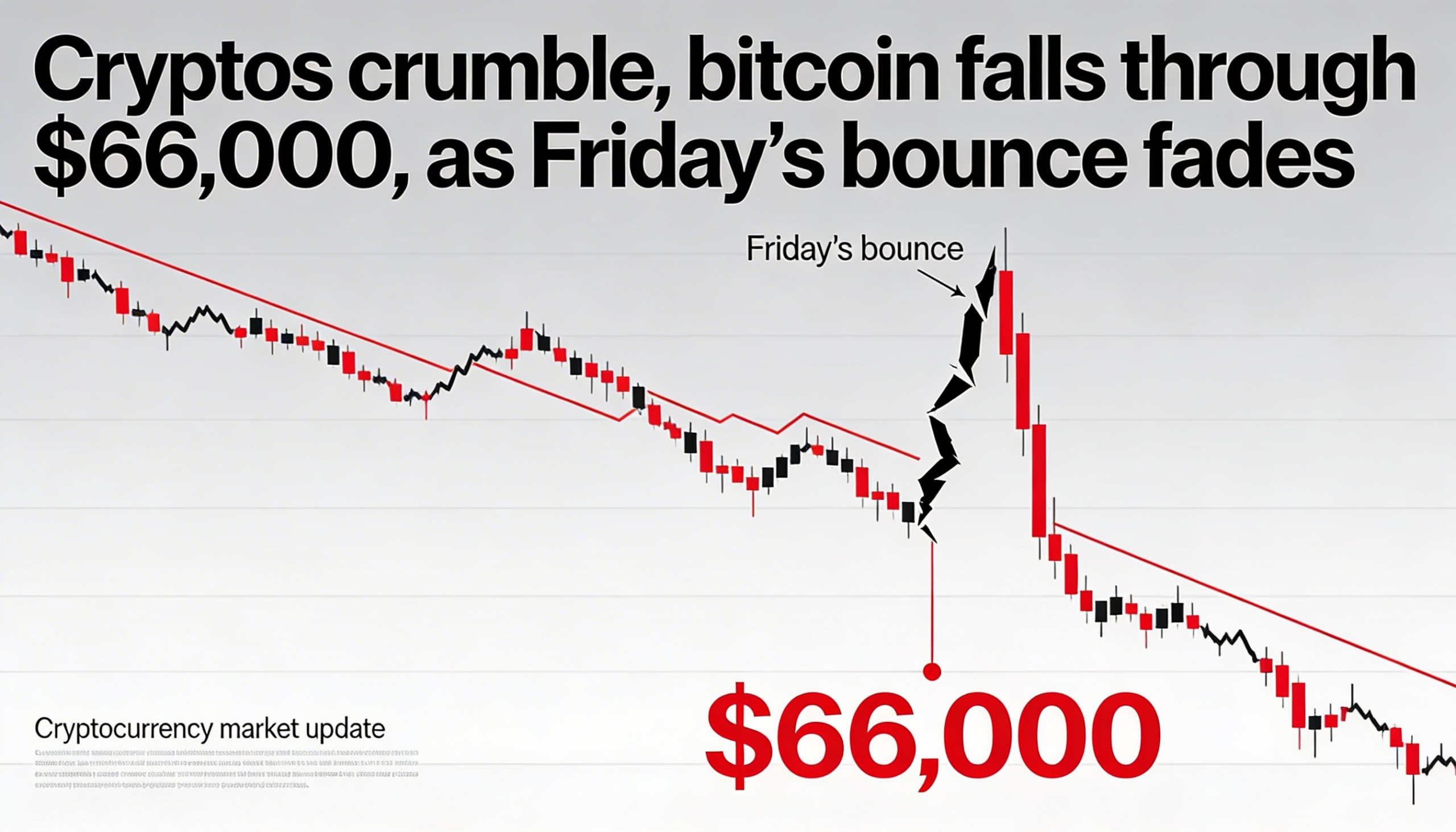

As of press time, Bitcoin was trading near $67,600, recovering a portion of last week’s slide