U.S. Bitcoin and Ether ETFs Lose Nearly $1 Billion as Crypto Slides

U.S.-listed spot bitcoin and ether ETFs experienced one of their largest combined outflow days of 2026 on Thursday, as falling crypto prices, rising volatility, and macroeconomic uncertainty prompted investors to reduce exposure.

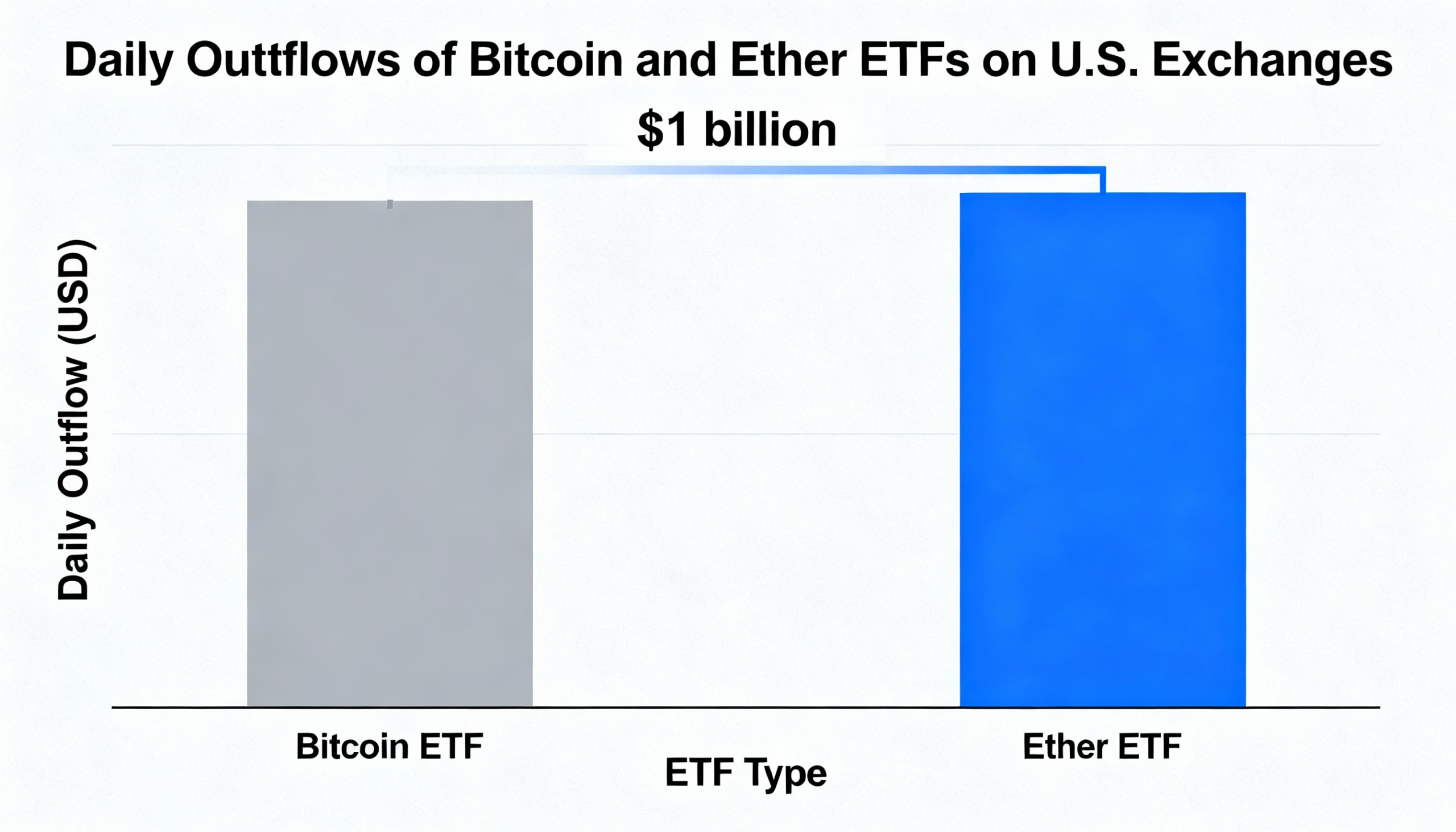

Data from SoSoValue shows bitcoin ETFs saw $817.9 million withdrawn on Jan. 29—their largest single-day outflow since Nov. 20. Ether ETFs also faced significant redemptions, totaling $155.6 million.

The selloff coincided with sharp declines in crypto markets. Bitcoin dipped below $85,000 before sliding toward $81,000 during U.S. trading hours, stabilizing near $83,000 in Asian markets Friday morning. Ether fell more than 7% on the day.

Among bitcoin ETFs, BlackRock’s IBIT led redemptions with $317.8 million withdrawn, followed by Fidelity’s FBTC at $168 million and Grayscale’s GBTC at $119.4 million. Smaller funds—including Bitwise, Ark 21Shares, and VanEck—also posted notable outflows.

Ether ETFs mirrored the trend. BlackRock’s ETHA lost $54.9 million, Fidelity’s FETH saw $59.2 million exit, and Grayscale’s ether products continued shedding assets. Total ether ETF holdings dropped to $16.75 billion from over $18 billion earlier this month.

The broad-based selling suggests institutional investors were trimming overall crypto exposure rather than rotating between bitcoin and ether—a shift from early January, when inflows into ether funds often offset weakness in bitcoin.

Analysts attribute the decline to rising volatility across risk assets, uncertainty around U.S. economic policy, and speculation about Federal Reserve leadership, with Kevin Warsh seen as bearish for bitcoin.

ETF flows appear to be tracking price movements rather than leading them. Analysts expect demand for bitcoin and ether ETFs to remain fragile until volatility eases.

“Bitcoin crashed to $81k due to a risk-off wave: hawkish Fed holding rates, $1B+ in BTC ETF outflows, geopolitical tensions, and a brief gold/silver dip,” said Andri Fauzan Adziima, Research Lead at Bitrue.

“This triggered massive leveraged liquidations after breaking key support (~$85k 100-week SMA), creating a self-reinforcing sell-off in thin liquidity. It’s a leverage shakeout amid macro pressure, not the start of a bear market, with rebound potential if supports hold,” Adziima added.