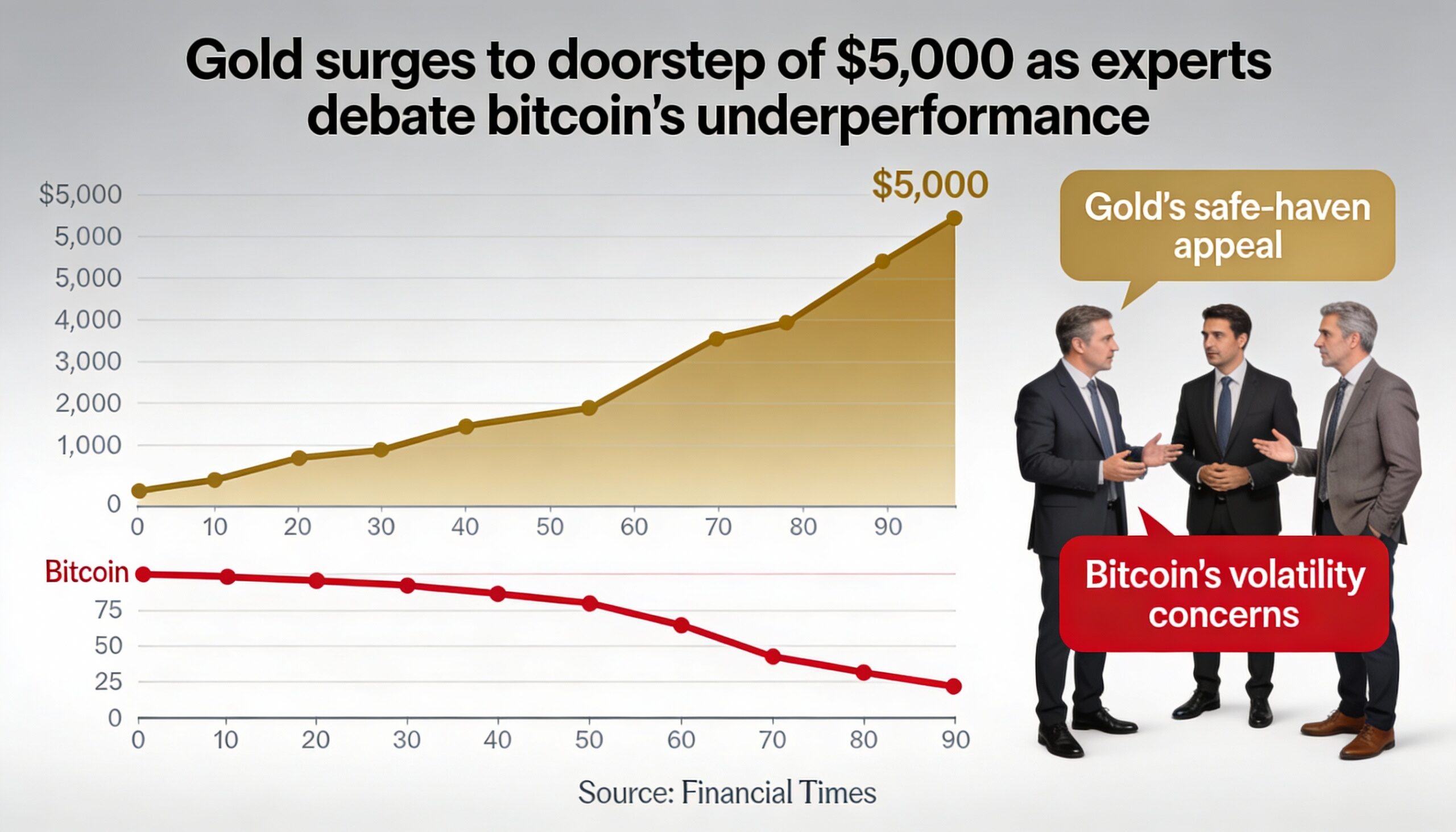

Gold and silver continue their upward march, while bitcoin remains largely stalled, prompting debate over whether the cryptocurrency’s adoption narrative is losing traction.

Gold climbed 1.7% Thursday to $4,930 per ounce, and silver rose 3.7% to $96. Bitcoin, by comparison, fell toward $89,000, about 30% below its early October all-time high.

Bianco Research founder Jim Bianco questioned whether bitcoin’s adoption-driven story still resonates. “The adoption announcements are not working anymore,” he wrote on X. “We need a new theme, and that’s not evident yet.”

Bloomberg ETF analyst Eric Balchunas urged a longer-term perspective, noting that bitcoin is consolidating after soaring from below $16,000 during the 2022 crypto winter to $126,000 in October. “It went up roughly 300% over the prior 20 months,” he said. “What do you want — 200% annual gains with no breaks?”

Balchunas also highlighted profit-taking by early investors, describing it as a “silent IPO.” He cited one long-term holder who sold more than $9 billion in bitcoin in July after holding the asset for over a decade.

Bianco pointed out that bitcoin has lagged other assets since President Trump’s November 2024 election win. Over the past 14 months, bitcoin is down 2.6%, while silver has gained 205%, gold 83%, the Nasdaq 24%, and the S&P 500 17.6%. “While we wait for that new theme, everything else is racing ahead as BTC stays stuck in the mud,” he said.

Balchunas noted that bitcoin had risen 122% year-over-year as recently as November 2024, outperforming gold. He argued the recent surge in precious metals represents catch-up rather than a fundamental shift in long-term market leadership.