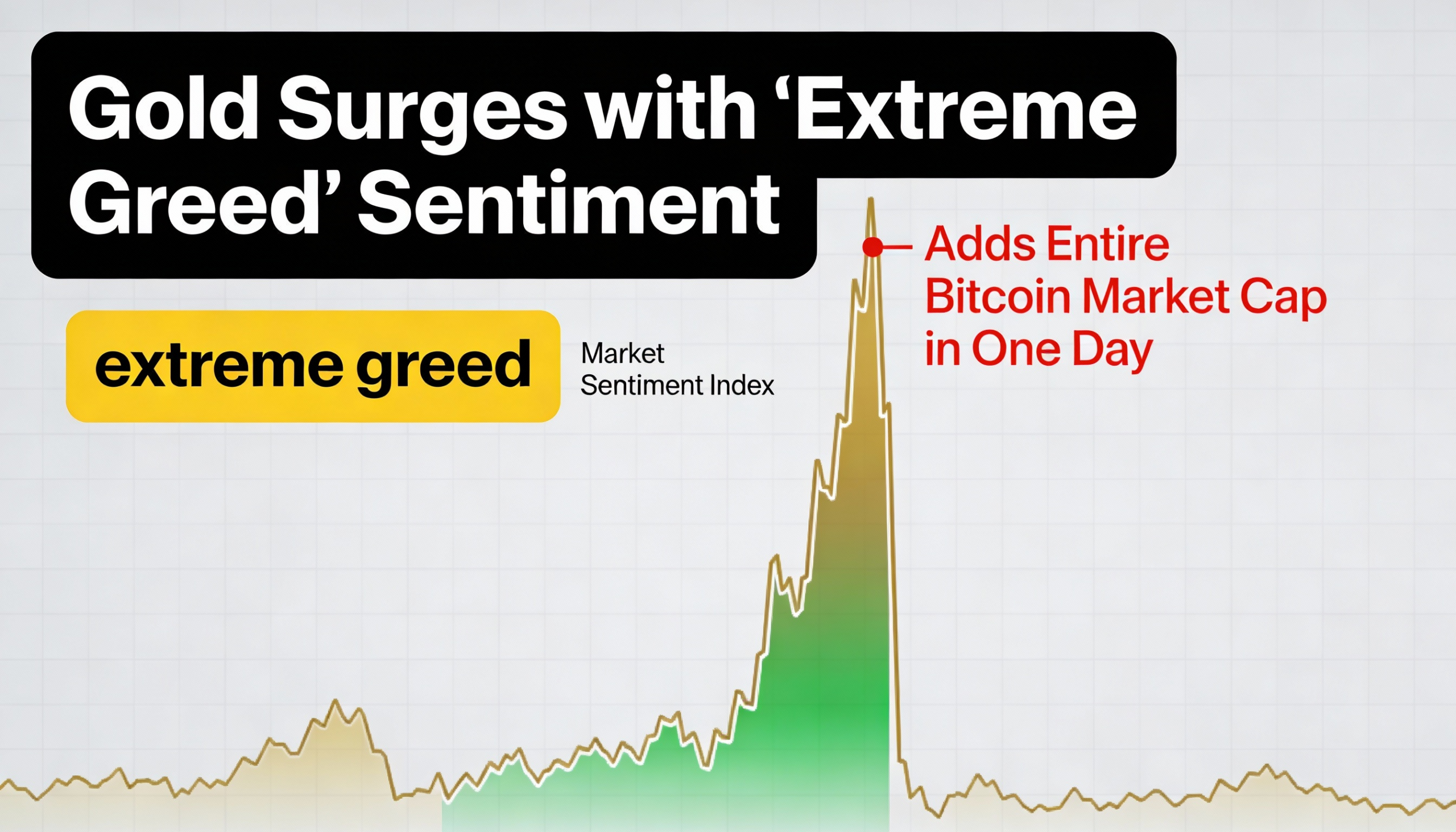

Gold Tops $5,500 as “Extreme Greed” Surfaces, Bitcoin Stays Below $90K

Gold’s rally is intensifying, moving from a steady climb to what looks like a crowded trade. The metal broke $5,500 an ounce Wednesday, adding roughly $1.6 trillion in notional value in a single day—about equal to bitcoin’s total market capitalization. While this “market cap” is based on above-ground supply rather than a float-adjusted measure, it highlights the mood: investors are prioritizing traditional hedges first.

Sentiment readings show a clear split. JM Bullion’s Gold Fear & Greed Index, tracking premiums, volatility, social media tone, retail activity, and Google Trends interest, now signals “extreme greed,” while crypto’s fear-and-greed gauges have stayed in the opposite zone for much of the month.

Silver is also surging, with sharp weekly gains and intraday swings reflecting positioning squeezes rather than slow accumulation.

Bitcoin, by contrast, remains stuck in the high-$80,000s, well below October’s peak. Trading like a high-beta risk asset, it relies on clean liquidity and clear catalysts. The divergence shows that “store of value” depends as much on who is buying as on the narrative, with investors currently favoring bars and coins over digital tokens.