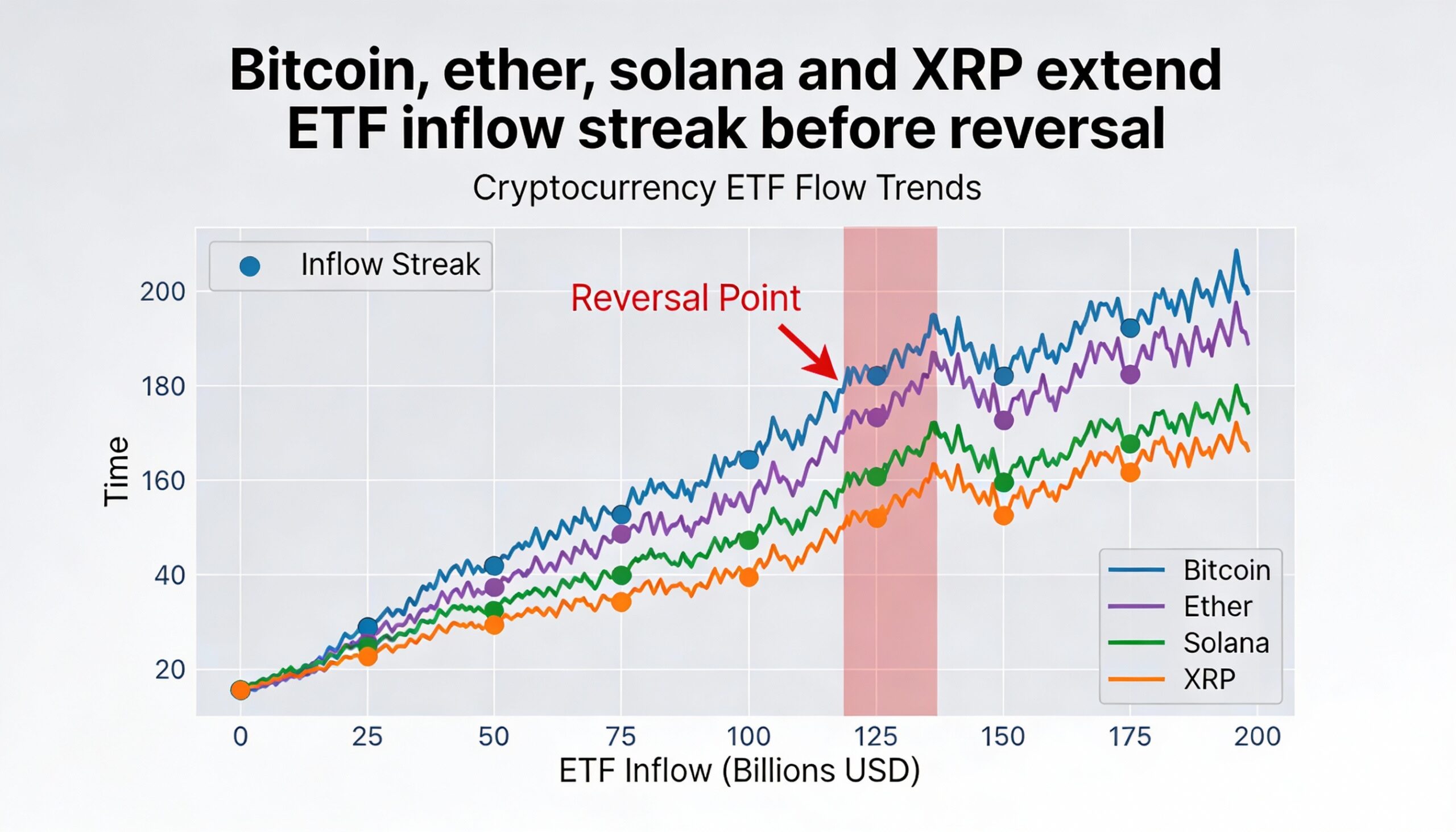

Digital asset investment products recorded strong inflows last week, led by bitcoin, which drew $1.55 billion. Ethereum added $496 million, while Solana attracted $45.5 million.

Overall, net inflows across crypto investment products totaled $2.17 billion—the largest weekly figure since October 2025—as investors poured capital into bitcoin and other major tokens before sentiment softened toward the end of the week.

According to CoinShares’ Monday report, the inflows highlight broad demand for crypto beyond bitcoin, even amid ongoing policy discussions surrounding stablecoins and yield-focused products.

However, Friday saw a reversal, with $378 million flowing out amid renewed geopolitical tensions and tariff concerns, including issues tied to Greenland. CoinShares’ head of research, James Butterfill, also pointed to policy uncertainty after reports suggested Kevin Hassett, a potential U.S. Federal Reserve chair candidate, would likely remain in his current role.

Regionally, the U.S. dominated inflows with $2.05 billion. Other notable contributions came from Germany ($63.9 million), Switzerland ($41.6 million), Canada ($12.3 million), and the Netherlands ($6 million).

Among altcoins, XRP led with $69.5 million in inflows, followed by Sui, Lido, and Hedera. Blockchain equities also saw $72.6 million in net inflows, reflecting ongoing investor appetite for crypto exposure via public-market proxies despite headline risks.