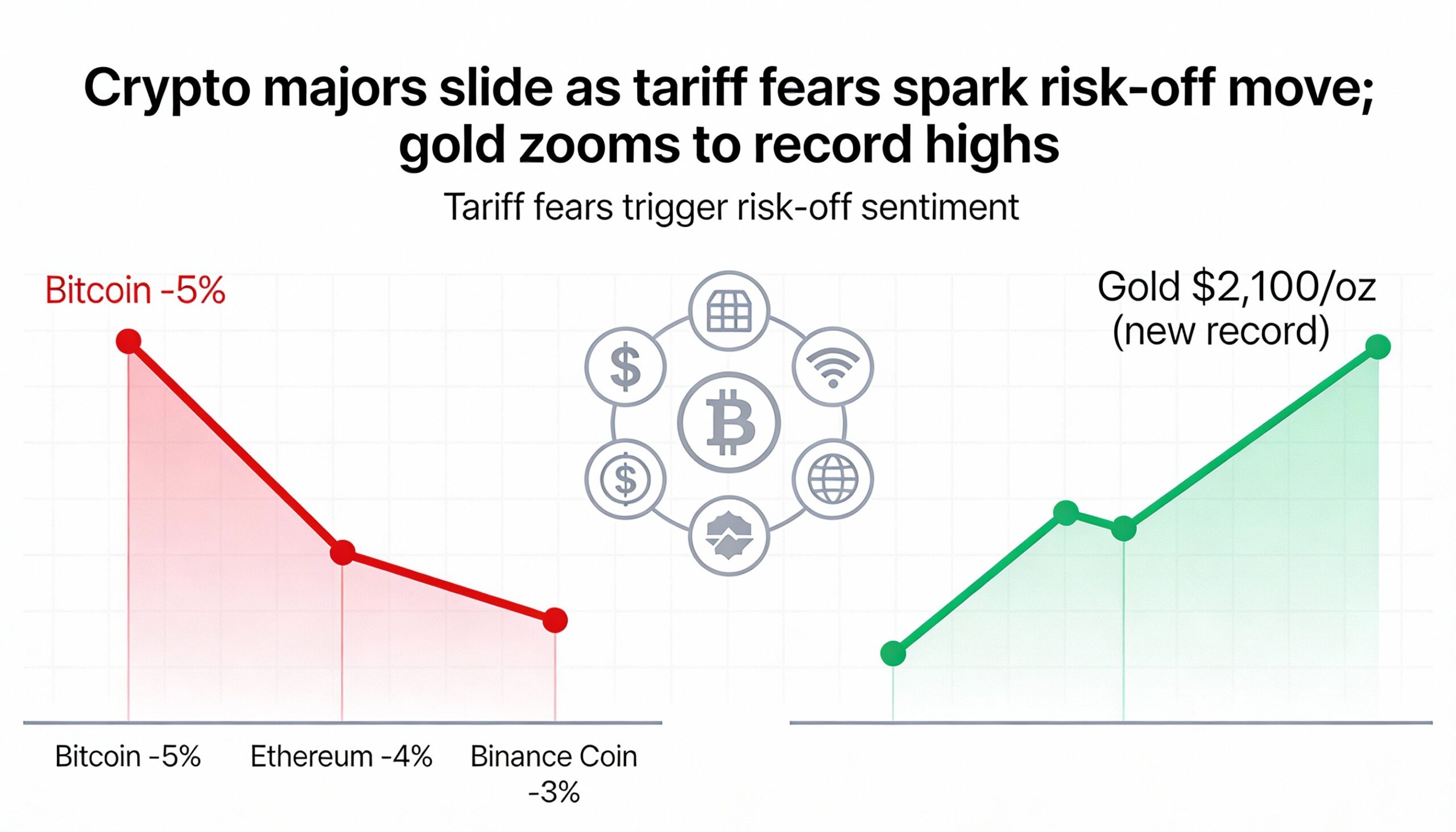

Crypto markets came under broad pressure on Monday, with major tokens sliding as renewed concerns over U.S. tariffs triggered a global risk-off move.

Solana dropped more than 6% over the past 24 hours, while XRP fell about 4% and dogecoin slid over 7%, according to CoinGecko data. Ether declined roughly 3% to trade near $3,200. Bitcoin held up better than peers but still slipped below $93,000, down around 2.5% on the day.

The selloff followed weekend comments from U.S. President Donald Trump, who said the U.S. would impose a 10% tariff on goods from eight European countries starting Feb. 1, with duties set to rise to 25% in June unless a broader agreement is reached. The remarks weighed on investor sentiment and pushed markets toward defensive positioning.

Digital assets tracked losses in traditional markets. U.S. equity-index futures fell sharply in early trading, with Nasdaq 100 futures down more than 1%, while European futures also retreated as trade tensions resurfaced. Asian markets were mixed, though most indices posted modest declines.

Safe-haven assets rallied in response. Gold and silver surged to record highs, European government bond futures advanced, and the U.S. dollar weakened against several major currencies as investors sought protection ahead of the U.S. session.

Liquidations rose alongside the downturn. Around $600 million in bullish crypto positions were liquidated over the past 24 hours, according to CoinGlass, with long positions accounting for the bulk of the losses. Bitcoin open interest declined as traders reduced leverage.

The pullback comes after a strong start to the year for digital assets. Bitcoin surged to just below $98,000 last week, buoyed by strong inflows into U.S.-listed spot ETFs, with altcoins rallying alongside. Monday’s decline suggests investors are reassessing risk as macroeconomic uncertainty returns.

Altcoins once again bore the brunt of the selling, a common pattern during risk-off phases as traders rotate away from higher-beta tokens toward more liquid assets. Attention is now on whether bitcoin can hold support near the $90,000 level, which could determine whether the broader pullback stabilizes or deepens.

For now, cryptocurrencies remain tightly linked to global risk sentiment, leaving prices vulnerable to further developments in trade policy, geopolitics and monetary policy.