Peter Brandt Predicts Bitcoin Could Slide to $58K Amid Macro Risks

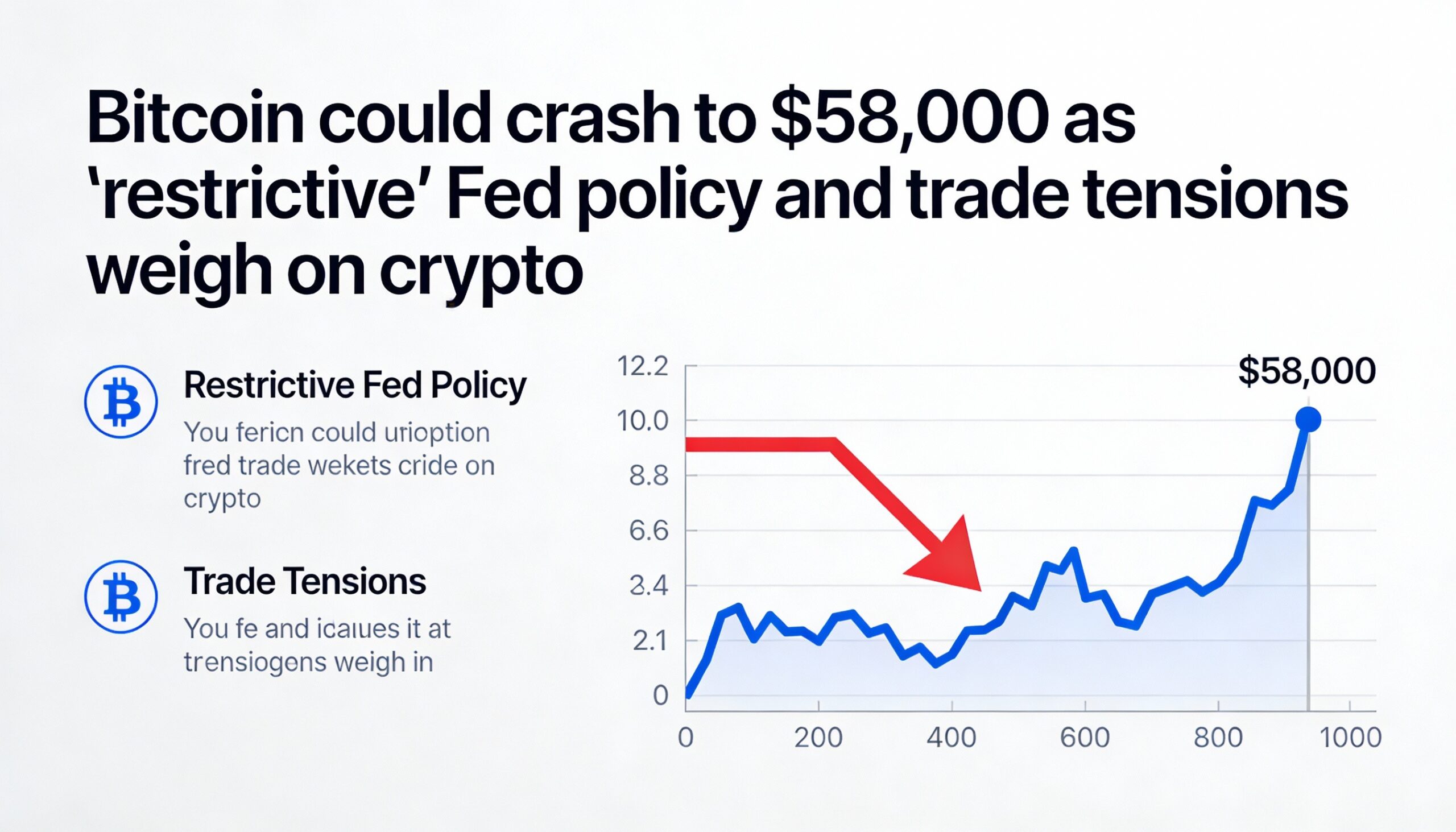

Veteran trader Peter Brandt, known for accurately forecasting the 2018 Bitcoin crash, has warned that Bitcoin (BTC $89,790) could fall to between $58,000 and $62,000 in the coming weeks. Analysts say current macroeconomic conditions make a bearish outlook increasingly plausible.

Experts point to U.S.-E.U. trade tensions and broader geopolitical uncertainty as key risk factors. Brandt, a futures trader since 1975 with over 850,000 followers on X, issued the warning late Monday.

Jason Fernandes, market analyst and AdLunam co-founder, noted that Brandt’s target is technically possible but emphasized macro drivers over chart patterns. “U.S. inflation below 2% hasn’t eased policy. Any escalation in tariffs or geopolitical tensions could reignite inflation and delay rate cuts. Greenland-related tensions may also reinforce a high-rate stance,” he said.

Mati Greenspan, founder of Quantum Economics, echoed the view: “There’s roughly a 50-50 chance Bitcoin could fall that far. Macro now outweighs technical setups.”

Data from decentralized exchanges and Deribit suggest a roughly 30% chance of Bitcoin falling below $80,000 by June.