Bitcoin’s four-year cycle, historically tied to halving events, typically sees periods of rapid gains followed by major corrections over roughly four years from peak to peak.

Some analysts question whether the pattern will hold in 2026. U.S.-listed bitcoin ETFs have absorbed $57 billion in inflows, Strategy (MSTR) acts as a near-constant buyer, and early holders distributed bitcoin at unprecedented levels above $100,000. 2025 also ended as a down year, contrary to the parabolic peak expected under the cycle.

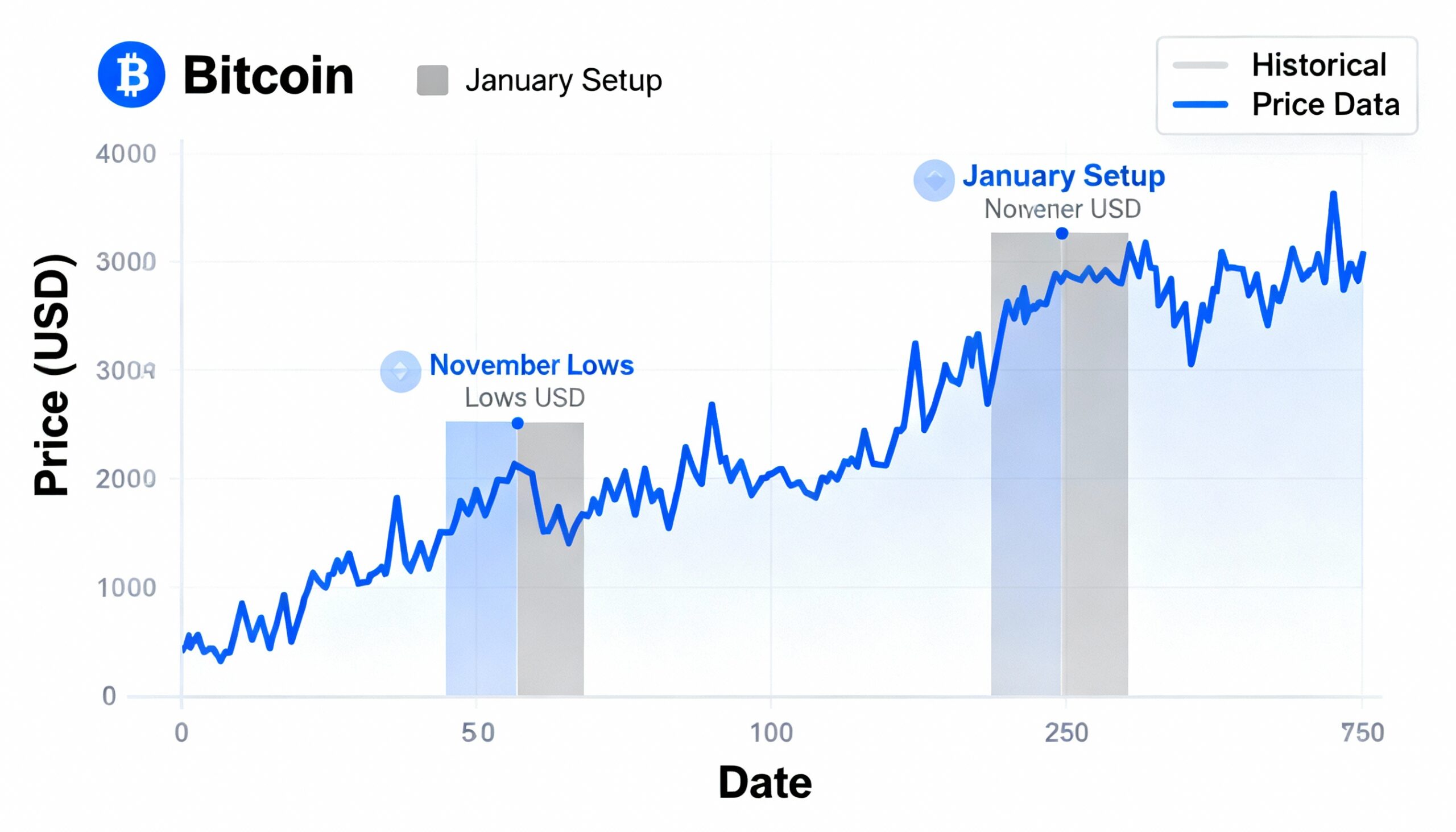

Yet the cycle shows resilience. Bitcoin peaked roughly 18 months after the April 2024 halving and reached $126,000 in October 2025, rebounding from the $15,500 low following the FTX collapse in November 2022. Notably, the local bottom on Nov. 21, 2025, at $80,524 mirrors the previous cycle low on Nov. 21, 2022, at $15,460.

January has historically been pivotal. January 2023 saw a local top near $25,000; January 2024 coincided with U.S. spot bitcoin ETF launches and a low under $40,000; January 2025 aligned with President Trump’s inauguration and a local high near $110,000.

All eyes now turn to January 2026. A U.S. crypto market structure bill is scheduled for a Jan. 15 markup hearing, potentially marking another meaningful inflection point in bitcoin’s cycle.