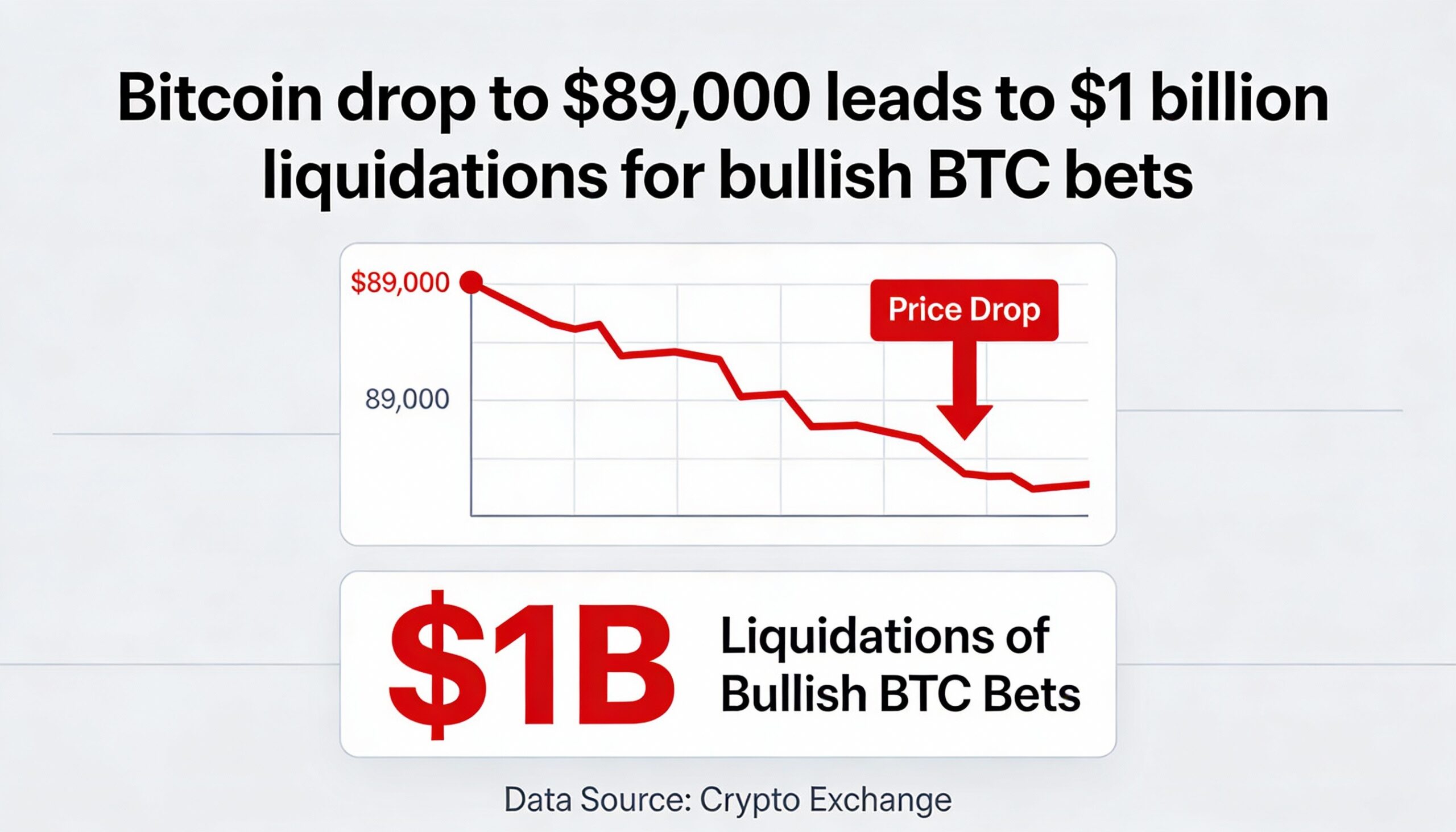

Bitcoin dropped below the $90,000 threshold on Tuesday as a sudden shift toward risk-off positioning sparked a wave of forced liquidations across crypto markets, wiping out more than $1 billion in leveraged bullish trades.

CoinGlass data showed that 183,066 traders were liquidated in the past 24 hours, with total liquidations reaching $1.09 billion. Long positions made up nearly 92% of the total, underscoring how stretched bullish positioning had become. The largest single liquidation was a $13.52 million BTCUSDT position on Bitget.

Liquidations occur when exchanges automatically close leveraged positions after losses exhaust a trader’s margin, often exacerbating price moves during periods of heightened volatility. Such liquidation cascades are commonly associated with market extremes, when sentiment becomes heavily skewed.

Bitcoin slid by as much as 3% during the selloff, falling to a low of $87,800 in late U.S. trading before recovering above $89,000 during Asian hours. The pullback marked a reversal from last week’s consolidation near recent highs.

The crypto downturn mirrored growing caution across global financial markets. Investor sentiment was rattled after President Donald Trump renewed threats to impose tariffs on European nations that rejected his Greenland-related proposal, reviving concerns over trade tensions and policy uncertainty.

Further pressure came from a selloff in Japanese government bonds, which pushed global yields higher and tightened financial conditions. These crosscurrents weighed on risk assets more broadly, particularly after a prolonged rally fueled by optimism around artificial intelligence lifted global equity markets to record highs.

With volatility compressed and positioning extended, crypto markets proved vulnerable once sentiment turned.