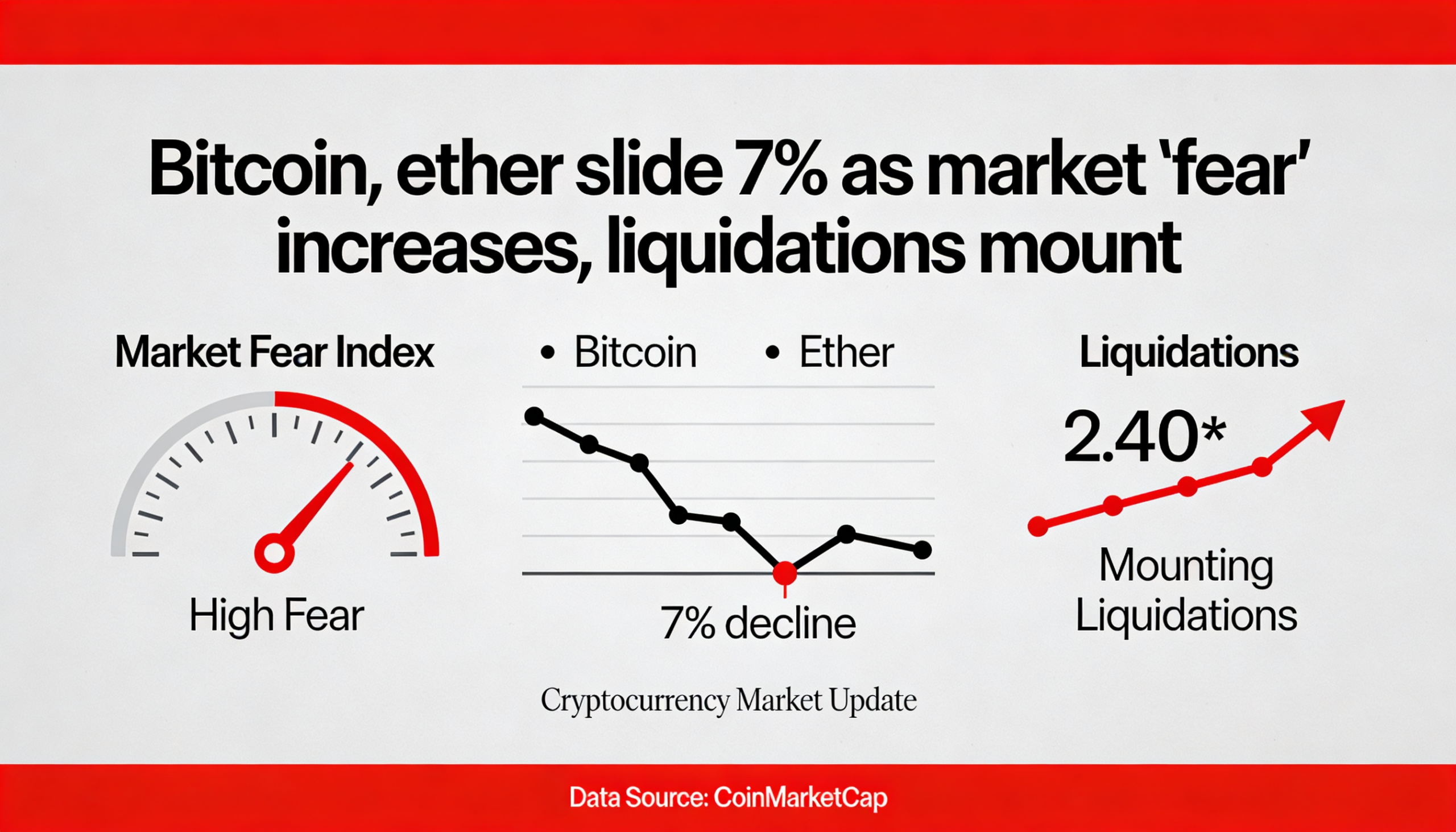

Crypto markets saw another sharp round of forced selling, with liquidations climbing above $1 billion in the past 24 hours and eliminating nearly $980 million in leveraged long positions.

Bitcoin fell below $68,000 during U.S. trading on Thursday, extending a week-long decline that has unfolded alongside broader weakness in global risk assets. The move followed an earlier drop under $70,000, a level traders have been closely watching as a near-term pivot for market structure.

Liquidity data suggests downside risks remain elevated. Coinglass heatmaps show that order-book depth drops off quickly below $70,000, with only limited liquidity pockets appearing further down. This dynamic increases the risk of a swift move into the upper $60,000s, as fewer liquidation-driven buy orders are available to slow declines once key levels are breached.

Liquidation heatmaps map price zones where leveraged traders are most exposed to forced exits. Dense clusters often act as short-term price attractors and volatility zones, helping traders identify crowded positioning rather than precise market bottoms.

Macro conditions have added to the pressure. A renewed sell-off in silver and continued deleveraging across macro trades have reinforced risk-off positioning, with cryptocurrencies increasingly trading as part of a broader, liquidity-driven asset complex.

Attention is now shifting toward lower technical reference points. The $60,000 region has emerged as a potential area of interest for some traders. As previously noted by CoinDesk, bitcoin’s 200-week moving average — which has historically marked cycle lows — is currently near $57,926.

Sentiment indicators also reflect a more defensive outlook. On Polymarket, contracts tied to bitcoin’s 2026 price outcomes now skew lower, with traders assigning the highest probability to prices at or below $65,000. Expectations for six-figure bitcoin prices have retreated sharply from January levels, while odds for a decline into the mid-$50,000s have increased.

Flow data reinforces the cautious tone. U.S.-listed spot bitcoin ETFs have recorded net outflows this week, and activity in perpetual futures has slowed as leverage continues to be reduced.

Despite the sell-off, some market participants still see the $68,000 to $70,000 range as an important technical zone, citing heavy historical trading volumes and long-term holder cost bases concentrated in that area. A sustained break below that range, however, could set the stage for a deeper consolidation phase, echoing post-rally pullbacks seen in previous cycles.