Crypto markets once again failed to hold onto early gains, with a brief surge quickly erased by renewed selling.

The Supreme Court of the United States voted 6–3 on Friday to invalidate President Donald Trump’s tariff regime, ruling that the administration had exceeded the authority granted under the statute.

In its decision, the court said no prior president had invoked the law to impose tariffs of such magnitude and scope. The absence of historical precedent, combined with the sweeping powers claimed by the executive branch, indicated the measures extended beyond the president’s legitimate authority.

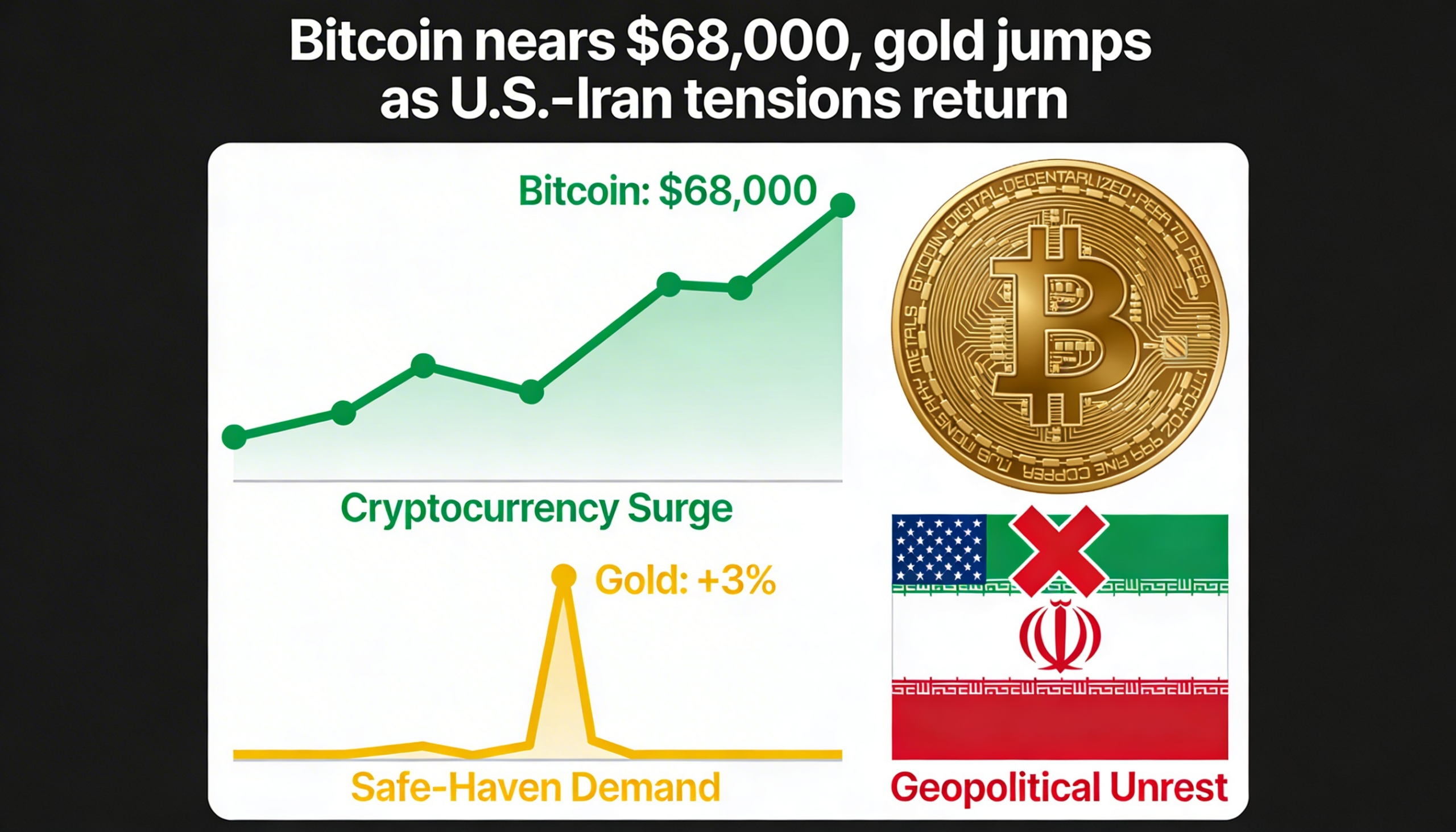

Bitcoin’s fleeting rally

Bitcoin initially jumped about 2% on the headline, briefly trading above $68,000. The move proved short-lived, however, as prices quickly retreated below $67,000 within minutes — reinforcing the fragile tone that has characterized recent crypto trading.

The contrast with equities was notable. The Nasdaq Composite advanced 0.6% to a session high, suggesting a more durable risk-on response in traditional markets.

Mixed economic signals

Earlier Friday, data from the United States Department of Commerce showed the U.S. economy expanded at a modest 1.4% annualized pace in the fourth quarter of 2025. For the full year, growth came in at 2.2%, marking the slowest annual expansion since 2020.

At the same time, core personal consumption expenditures (PCE) inflation rose 3% year-over-year, exceeding expectations of 2.9% and accelerating from 2.8% previously — highlighting persistent price pressures.

Art Hogan, chief market strategist at B. Riley Wealth, described the data as sending a conflicting message. Stronger-than-expected inflation alongside softer growth, he said, supports the Federal Reserve’s current cautious stance on interest rates.

For digital assets, the combination of policy uncertainty and stagflationary signals continues to create a challenging environment — one in which rallies struggle to gain traction and upside moves are quickly met with resistance.