Bitcoin Falls Below $90K Amid Global Risk-Off Selling

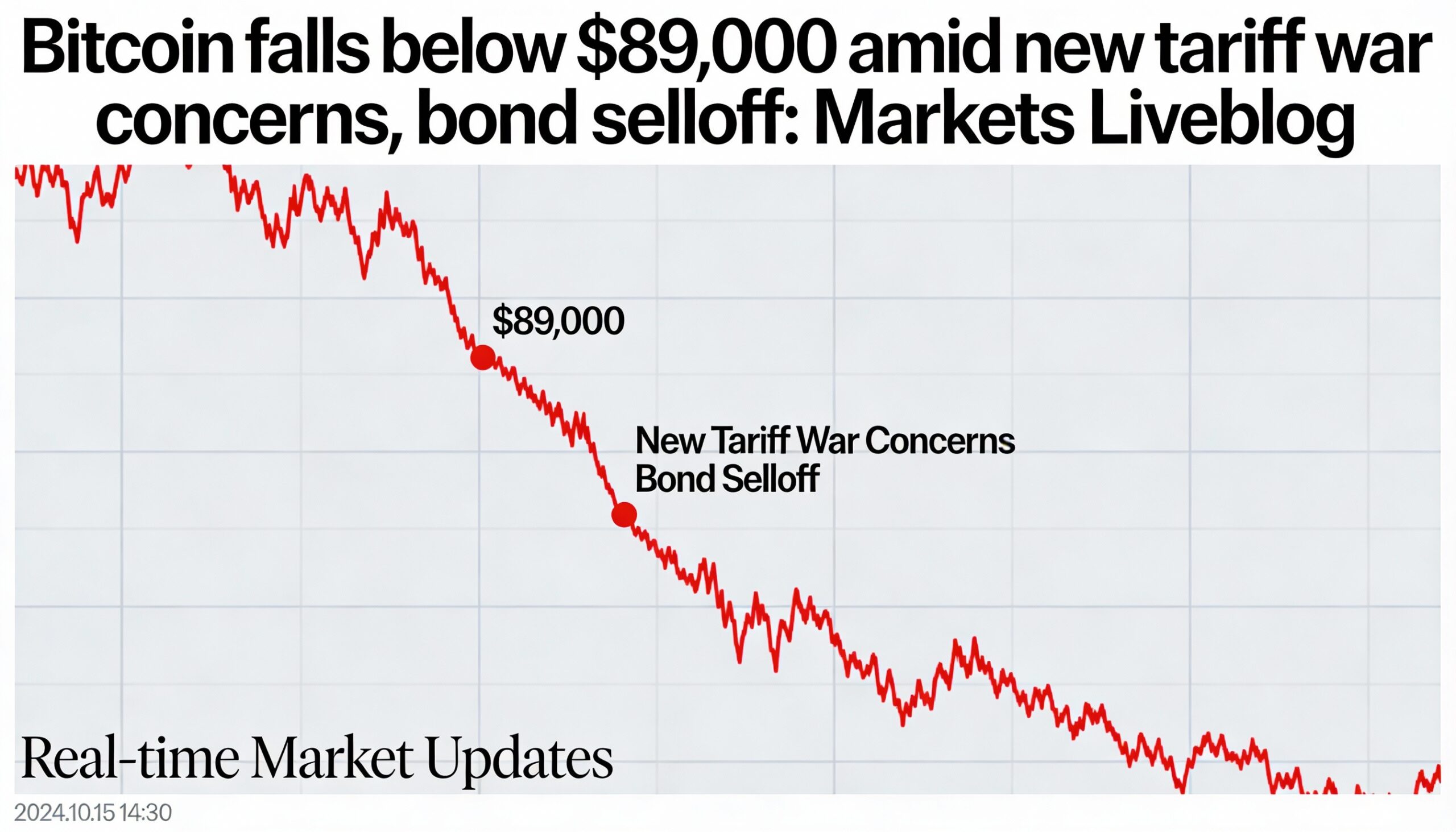

Bitcoin slipped below $90,000 on Tuesday as traders sold risk assets amid turmoil in Japan’s government bond market and renewed U.S. tariff threats against Europe. Ether (ETH) fell below $3,000, down more than 6% in 24 hours, hitting its lowest level since early January.

The decline erased much of Bitcoin’s 2026 gains. BTC dipped to around $88,400, while the CoinDesk 20 Index fell over 5%. Bitcoin’s market dominance climbed to 59.8%, reflecting broad weakness among altcoins.

Veteran trader Peter Brandt suggested BTC could drop to $58,000–$62,000 within two weeks, while options data points to a roughly 30% chance of falling below $80,000 by June.

Crypto equities fell sharply: Strategy (MSTR) lost 7.8%, BitMine Immersion (BMNR) 9.5%, Coinbase (COIN) 5.5%, and Circle (CRCL) 7.5%. Privacy coins Monero (XMR) and Dash (DASH) dropped 11.6% and 8%, while DeFi protocols remained resilient.

Global equities mirrored the risk-off sentiment: S&P 500 down 2%, Nasdaq 100 down nearly 2%, Nikkei down 2.5%, and DAX down 1%. Gold and silver surged 3% and 7% to record highs.

Trading data showed $486 million in long positions liquidated on Tuesday. Bitcoin derivatives’ open interest rose slightly, signaling shorting, while Ether’s open interest fell, indicating spot-market-driven selling.

Some crypto tokens bucked the trend: Canton Network (CC) jumped 18%, ARC rose 30%, and Pumpfun (PUMP) gained 4%, while Bullish (BLSH), CoinDesk’s parent company, climbed over 1%.