Crypto Underperforms as Risk-Off Pressure Keeps Prices Near Lows

Cryptocurrency markets lagged broader assets on Thursday, remaining under heavy pressure even as traditional markets recovered from sharp intraday losses.

Early, modest declines accelerated during U.S. trading hours, with the Nasdaq down more than 2% at its lows and gold falling nearly 10% from an overnight record. Both assets later rebounded—the Nasdaq closed down just 0.7% and gold climbed back above $5,400 an ounce—but crypto prices failed to participate in the recovery.

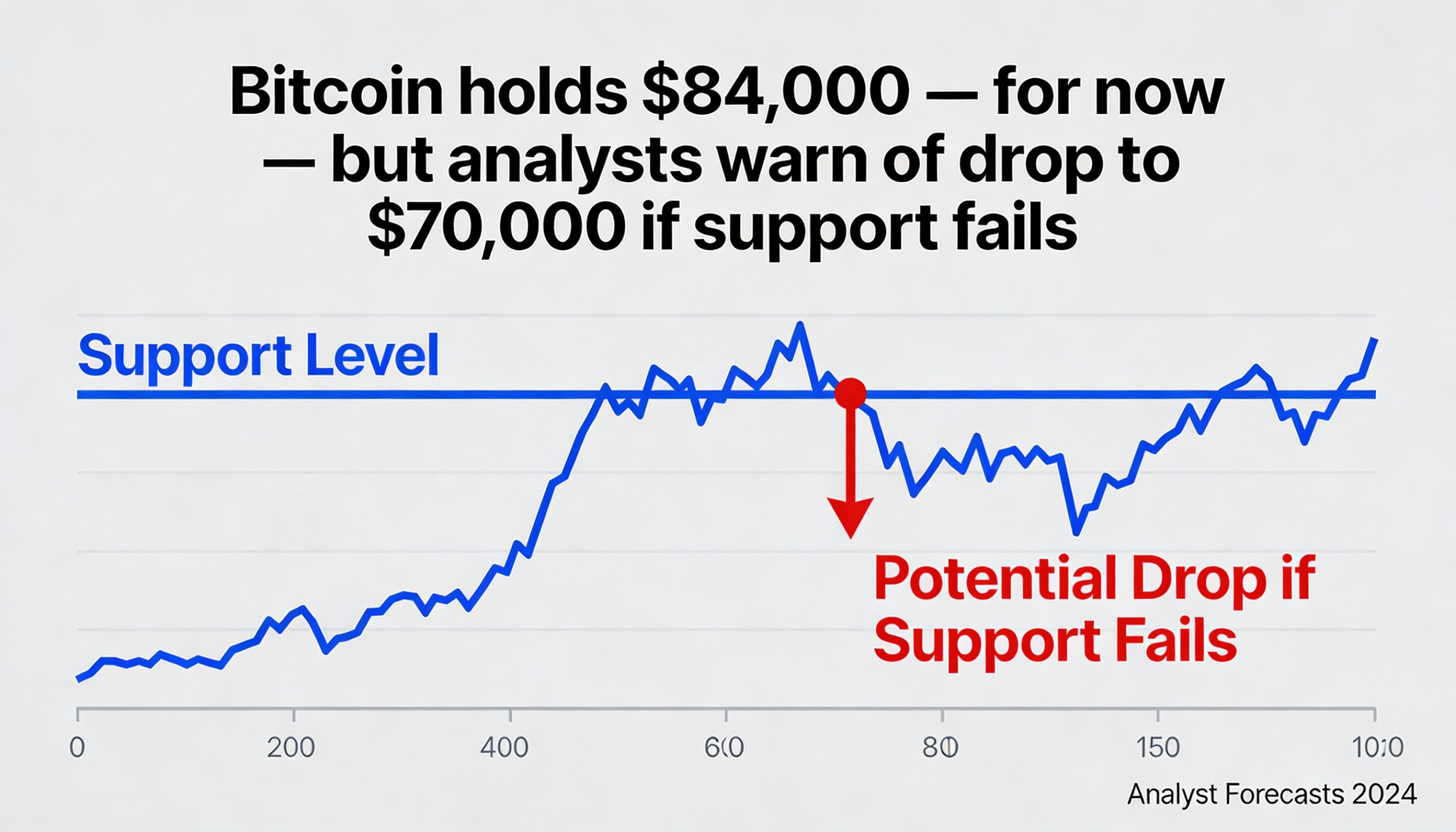

Bitcoin was trading just above $84,000 at press time, down nearly 6% over the past 24 hours and hovering near the lower edge of its two-month range. Analysts warned that a break below that level could trigger a deeper corrective move.

Losses were widespread across digital assets. Ethereum, Solana, XRP, and Dogecoin each declined about 7%, while crypto-linked stocks also sold off. Coinbase (COIN), Circle (CRCL), and bitcoin treasury firm Strategy (MSTR) fell between 5% and 10%.

Matt Mena, crypto research strategist at 21Shares, said Bitcoin’s ability to hold $84,000 is “critical.” A failure of that support could open the way to $80,000—where buyers emerged in November—and potentially the $75,000 lows seen during the April 2025 tariff-driven selloff.

Despite the weakness, Mena described current prices as an attractive entry point, reiterating his expectation that Bitcoin could reach $100,000 by the end of the first quarter and potentially climb to $128,000 if macro conditions improve.

Others urged caution. John Glover, chief investment officer at bitcoin lender Ledn, said the selloff appears to be part of a broader correction from October’s record highs and could ultimately pull Bitcoin toward $71,000, representing a roughly 43% drop from its early-October peak near $126,000.

Glover added that U.S.-driven uncertainty is pushing investors toward alternative safe havens such as gold and the Swiss franc rather than the dollar or Treasuries. While often framed as “digital gold,” Bitcoin continues to trade like a risk asset, moving in tandem with equities, he said.

Still, Glover expects the downturn to be temporary. “I believe this is a transitional phase, and we’ll see a rebound in Bitcoin prices in the coming quarters,” he said.

More bearish voices remain. “Most key technical levels have been broken on the downside, and there’s limited support,” said Russell Thompson, chief investment officer at Hilbert Group, who warned Bitcoin could slide as low as $70,000. “While the Clarity markup is constructive over the long term, the market is firmly in a risk-off mode right now.”