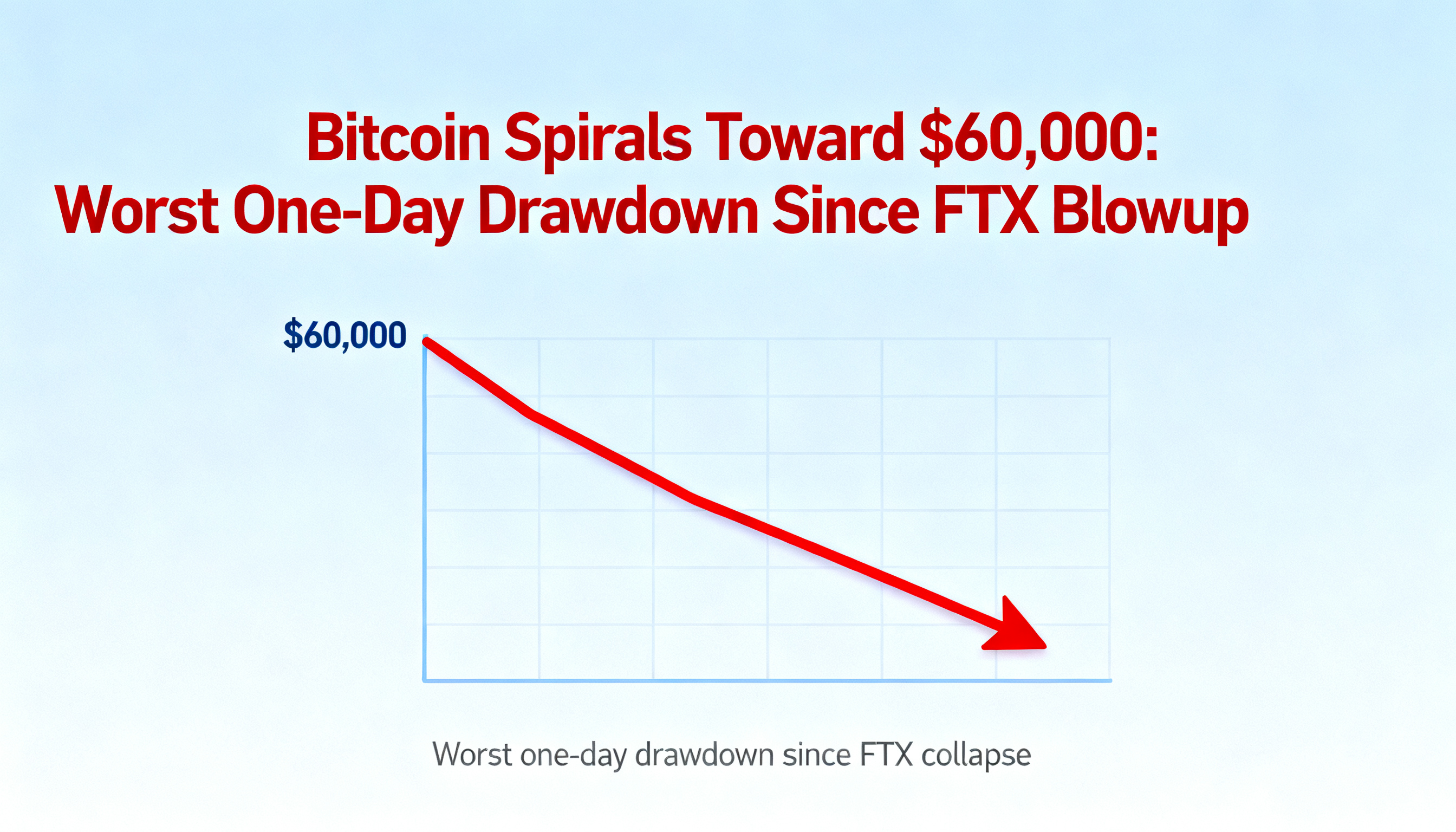

Bitcoin Plunges Toward $60,000 Amid Broad Market Selloff

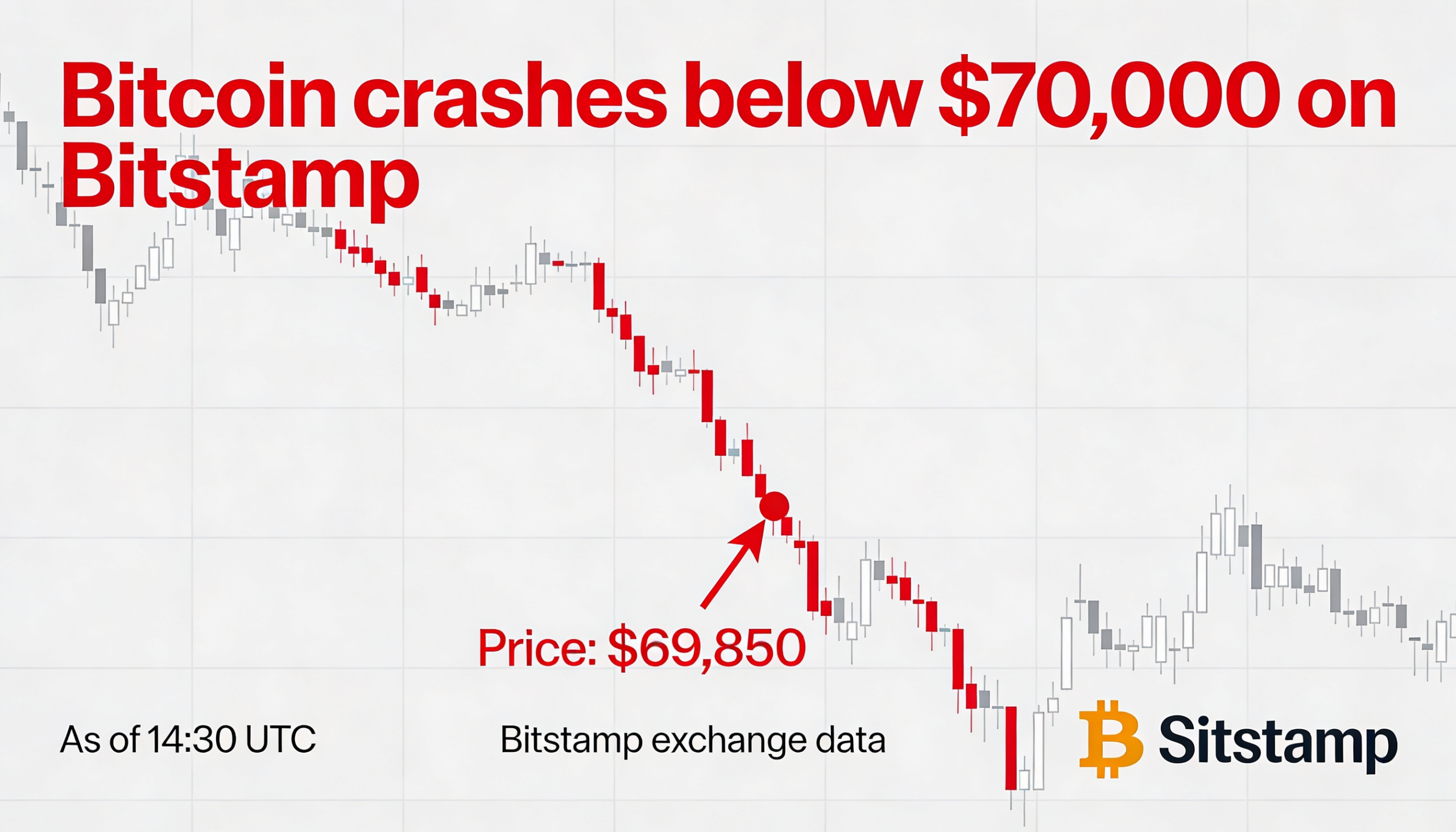

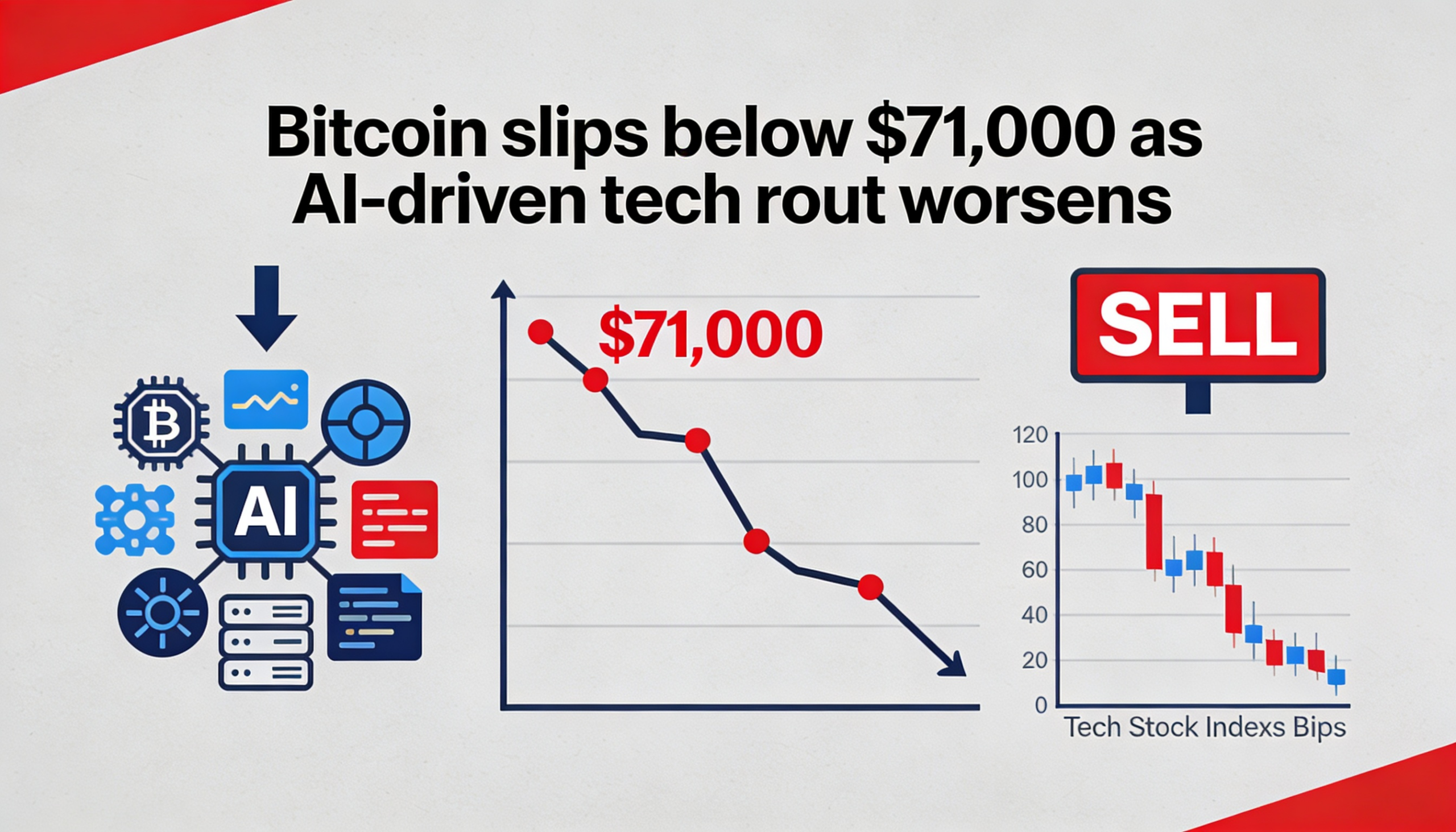

Bitcoin (BTC) dropped sharply to around $63,000 on Thursday, its lowest level since October 2024 and roughly 50% below its record high above $126,000 in early October. The 24-hour decline of over 10% puts BTC on track for its steepest single-day loss since the FTX collapse on Nov. 8, 2022.

Analysts are eyeing the 200-day moving average, near $58,000–$60,000, as a key support level. This range also aligns with bitcoin’s “realized price,” the average cost basis of holders, potentially providing long-term support.

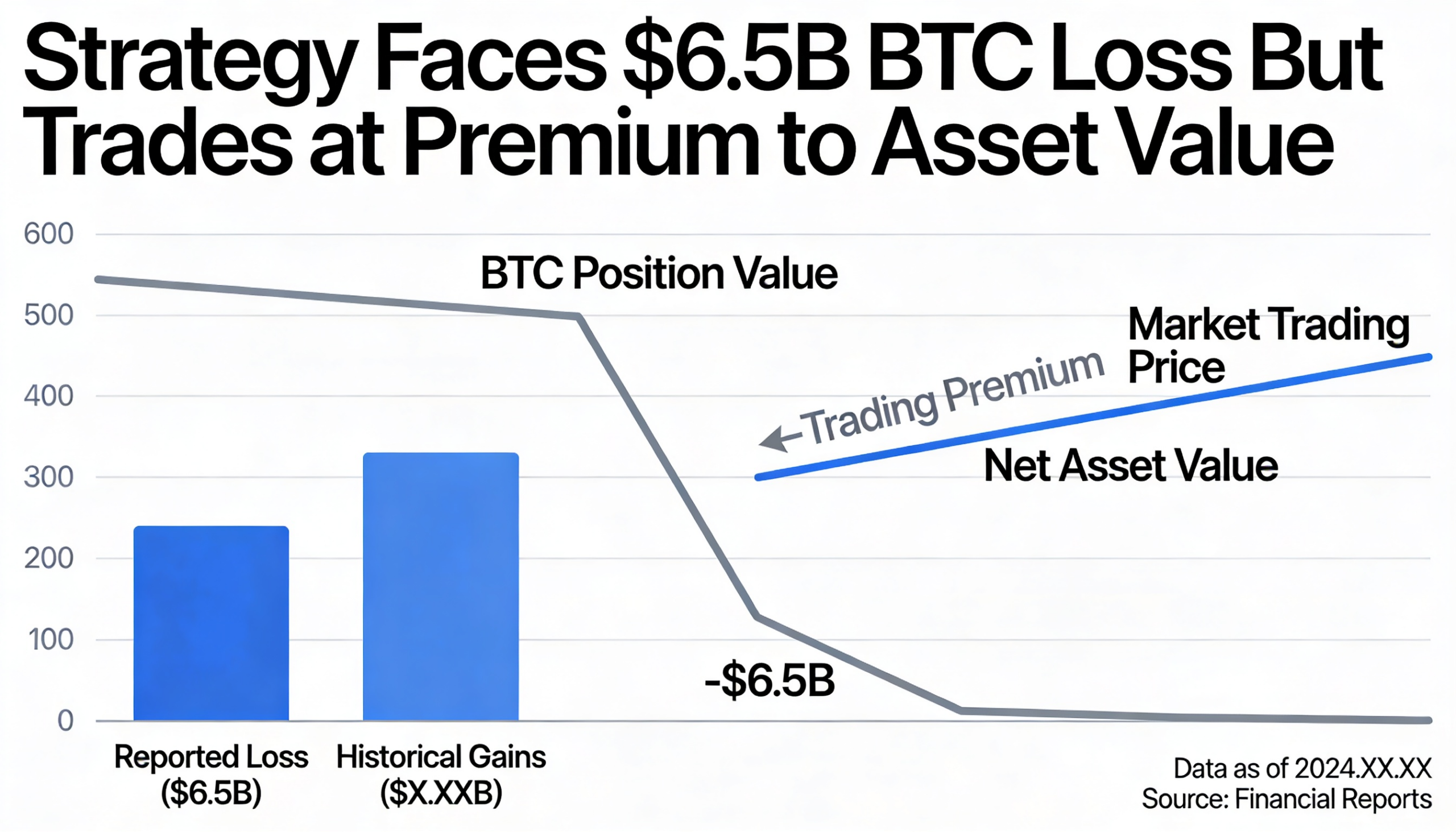

The selloff extended across markets. Silver tumbled 14%, gold fell over 2% to $4,850, and software stocks—including the iShares Expanded Tech-Software ETF (IGV)—declined more than 3%. Major crypto stocks such as Coinbase (COIN), Galaxy Digital (GLXY), MicroStrategy (MSTR), and BitMine (BMNR) also dropped more than 10%.

“Thin liquidity is magnifying moves,” said Adrian Fritz, chief investment strategist at 21Shares. “Even small sell-offs can trigger cascading liquidations. There’s no confirmed market bottom yet.”

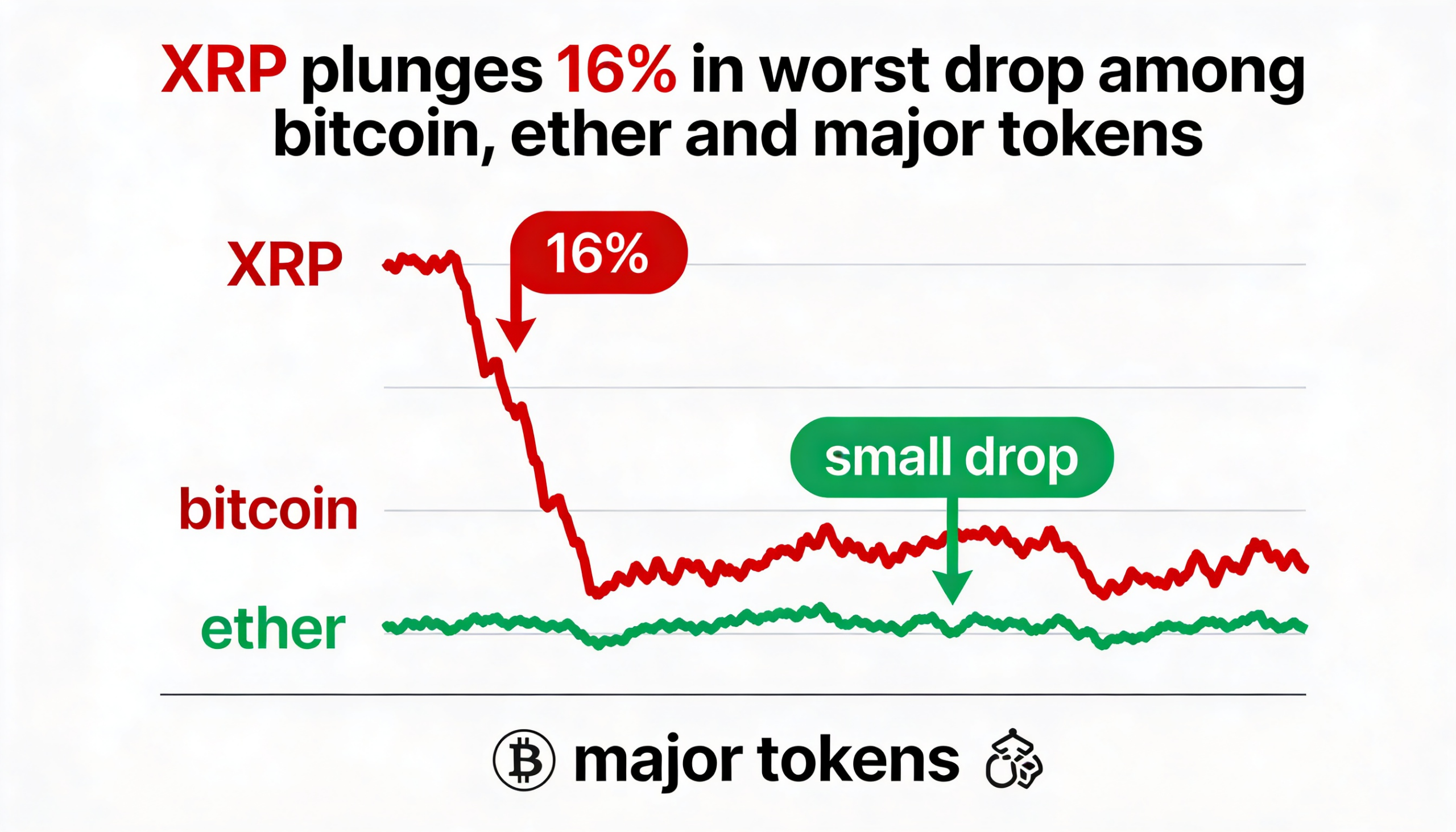

XRP lagged the broader market, plunging 19% over 24 hours, with few technical support levels, making it particularly vulnerable, according to Fritz.