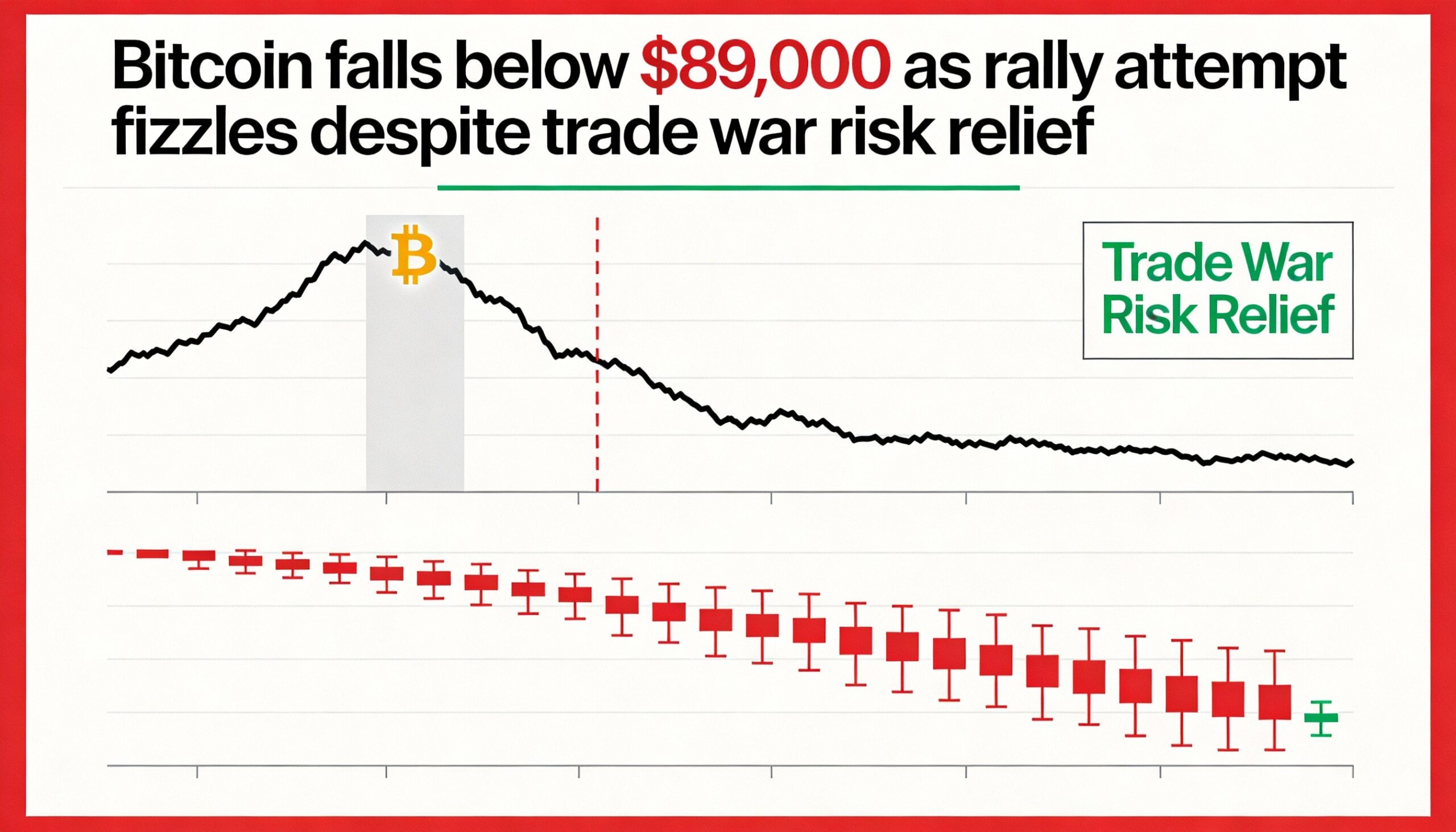

Bitcoin (BTC) at $89,205.79 and other cryptocurrencies were unable to maintain momentum from Wednesday’s Greenland-related relief rally.

After briefly climbing above $90,000 over the past 18 hours, BTC pulled back to around $88,500, down 1.5% over 24 hours. Ether (ETH) fell below $3,000, down 2.5% to $2,955.52.

Most crypto-focused stocks also declined, even as broader equities gained, with the Nasdaq up 0.7%. Shares of Bullish (BLSH), Hut 8 (HUT), Galaxy Digital (GLXY), and XXI (XXI) fell between 2% and 4%.

“The consensus view is that crypto markets remain bearish until roughly September,” said Kaledora Fontana, CEO of Ostium, a platform for trading digitized commodities perpetual swaps. “Rate cuts aren’t expected until after a Fed Chair transition, and it takes time for these changes to filter through to risk-on assets. Meaningful upside is likely only after these effects work through the system.”

Despite bitcoin struggling to hold $90,000 and posting only modest year-to-date gains, some signs of risk appetite remain. This is reflected in the MicroStrategy (MSTR) to BlackRock iShares Bitcoin Trust (IBIT) ratio.

On a day when bitcoin traded lower, the MSTR-to-IBIT ratio stayed slightly positive and is up roughly 5% year-to-date, suggesting continued interest in what MicroStrategy Executive Chairman Michael Saylor calls “amplified bitcoin.” The ratio also appears to have broken a long-term downward trend that had been in place since July.