Bitcoin is showing signs of strain as long-term holders accelerate selling to the fastest pace since August, even as some analysts suggest the market may be nearing the end of its current bearish cycle.

The renewed weakness follows a shift in macro conditions after U.S. President Donald Trump unexpectedly nominated former Federal Reserve governor Kevin Warsh as the next chair of the Federal Reserve. The announcement strengthened the U.S. dollar, unwound gains in precious metals, and pushed bitcoin through a closely watched support level.

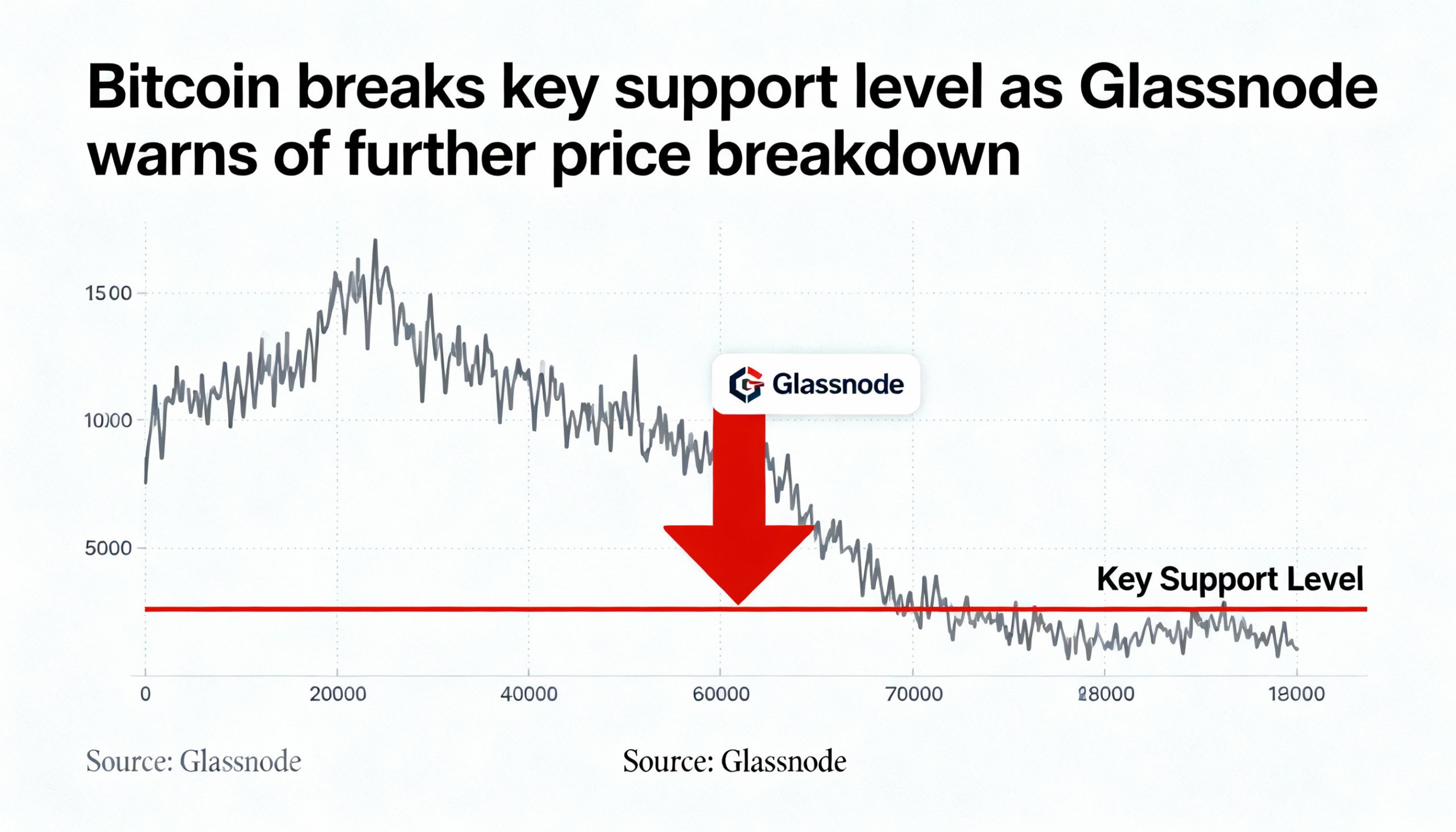

Onchain data from Glassnode indicates that bitcoin had been consolidating just above structural support around $83,400, the lower boundary of its short-term holder cost-basis model. A sustained move below that level raised the risk of a deeper pullback toward $80,700, a zone Glassnode refers to as the “True Market Mean.”

That downside risk is now materializing. Bitcoin has dropped more than 9.2% over the past week and is trading near $81,200. The broader digital-asset market has weakened as well, with the CoinDesk 20 (CD20) index down 12.4% over the same period, dragging the Crypto Fear & Greed Index into “extreme fear.”

Despite the selloff, Glassnode noted that only 19.5% of short-term holder supply remained at a loss while BTC traded above the former support level, well below the roughly 55% threshold typically associated with full capitulation. The data suggests that while pressure is building, the market has not yet reached a point of widespread forced selling.

Derivatives markets reflect a similarly cautious stance. Funding rates remain subdued, pointing to limited speculative appetite, while options markets show growing demand for downside protection. Dealer gamma has flipped negative below $90,000, increasing the risk of sharper volatility if additional support levels fail.

Taken together, the indicators point to a market that is fragile but not yet broken, with liquidity conditions likely to play a decisive role in determining the next move.

At the same time, extreme pessimism across crypto communities may be offering a contrarian signal. According to analytics firm Santiment, sentiment has fallen to levels that have historically preceded price recoveries.

In a recent report, Santiment described the surge in bearish social-media commentary as one of the few constructive indicators in an otherwise downbeat environment. “While network fundamentals are stagnant, crowd sentiment has hit extreme negativity levels,” the firm wrote, adding that such excessive pessimism has often marked local bottoms.

Bitcoin prices have trended lower over recent months as long-term holders step up selling, a move that has coincided with a reversal in the U.S. dollar’s earlier decline. Even so, some industry observers believe the current wave of fear may not last.

Bitwise CIO Matt Hougan recently said on CoinDesk’s Markets Outlook that crypto appears to be in the later stages of forming a bear-market bottom, noting that historically, digital-asset markets have tended to move against prevailing crowd sentiment.