Crypto markets showed relative stability on Tuesday after Monday’s tariff-driven volatility, but caution lingered as altcoins continued to underperform bitcoin.

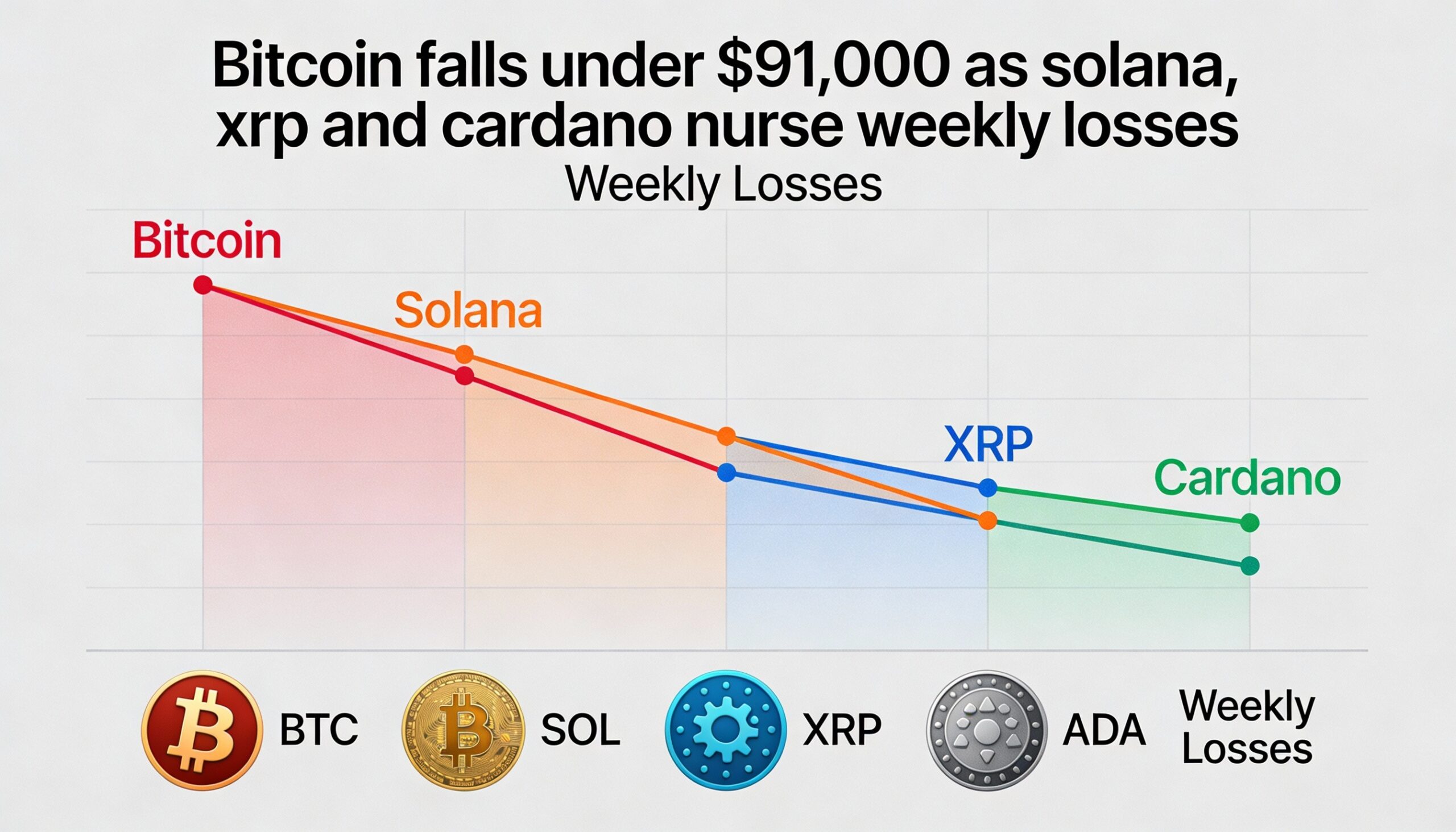

Bitcoin and other major tokens nursed losses through Asian trading, with derivatives traders maintaining defensive positions following Monday’s macro-driven pullback. In early European hours, bitcoin dipped below $90,000, remaining largely unchanged for the day after falling on fresh tariff headlines and a broader risk-off shift toward safe-haven assets.

Ether hovered near $3,200, while Solana, XRP and Cardano were mixed on the session but continued to post steep weekly losses, highlighting how altcoins have borne the brunt of the recent sell-off.

Macro uncertainty remains a key overhang. Renewed U.S.-Europe tariff tensions — sparked by President Donald Trump’s Greenland remarks — have driven investors toward traditional safe havens. Gold and silver advanced, while cryptocurrencies lagged even as some equity markets held steady.

Farzam Ehsani, CEO of exchange VALR, said the weakness reflects crypto-specific fragility rather than a broad risk-off move.

“Capital is rotating into established safe havens, while crypto continues to trade as a high-beta asset,” Ehsani said, adding that bitcoin may struggle to maintain elevated levels without clearer signals on rate cuts or renewed institutional inflows.

Rising U.S. Treasury yields also added pressure, as global bond markets sold off amid fiscal and geopolitical concerns.

For now, traders remain cautious, awaiting a clear catalyst to push markets out of their current low-volatility range.