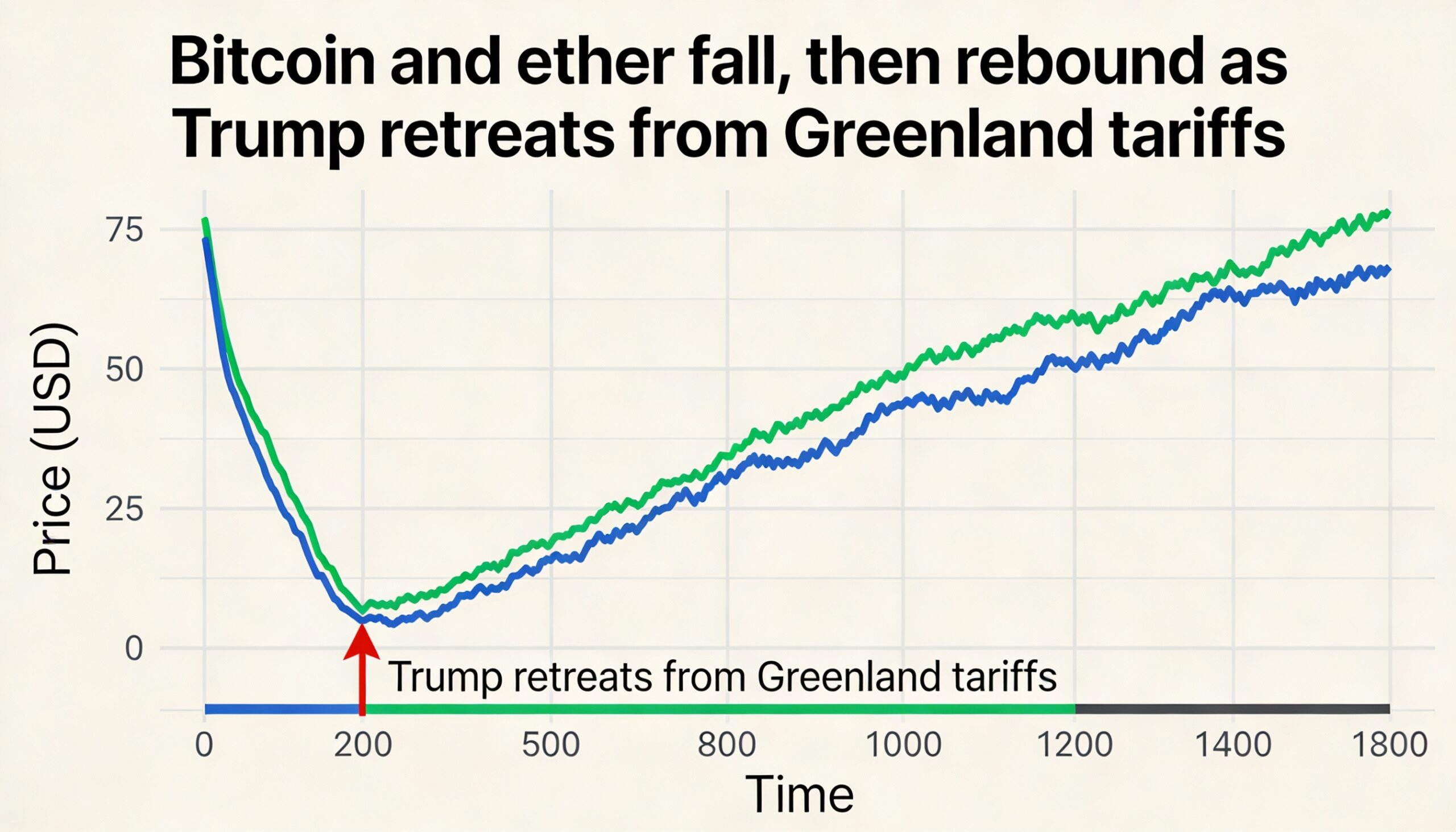

Bitcoin posted a sharp overnight reversal during Asian trading hours, slipping below $88,000 before rebounding toward $90,000, according to CoinDesk market data, after U.S. President Donald Trump softened tariff threats linked to Greenland during remarks at the World Economic Forum in Davos.

The rebound followed a volatile period for crypto markets, which had been under pressure earlier in the week amid a broader global risk-off shift. Sentiment weakened after Trump’s aggressive rhetoric toward Europe, a rise in global bond yields, and renewed volatility across equity markets.

By Thursday morning in Asia, those pressures began to ease, allowing digital assets to stabilize.

Bitcoin briefly dropped to around $87,300 late Wednesday as U.S. markets absorbed Trump’s comments and bond market uncertainty persisted. The mood shifted quickly after Trump said he would refrain from imposing tariffs on European countries opposing U.S. control of Greenland, instead referring to what he described as a “framework of a future deal.”

The change in tone helped steady broader markets. U.S. equity futures turned higher, Japanese government bonds extended gains for a second session, and demand for safe-haven assets cooled after gold reached fresh highs earlier in the week.

Bitcoin moved higher alongside that stabilization, recovering toward $90,000 and erasing most of its overnight decline.

The episode illustrates how tightly crypto markets remain linked to macroeconomic and political developments during periods of heightened uncertainty. Despite bitcoin’s positioning as an alternative asset, it often trades like a high-risk investment when investors seek to reduce exposure. Abrupt shifts in trade policy, bond yields, and global liquidity tend to spill into digital assets, particularly when market positioning is crowded.

Major cryptocurrencies reflected a similar pattern. Ether fell below $3,000 during the selloff before climbing back above $3,020, trimming losses. Solana rebounded to around $130 after earlier declines, while XRP traded back near $1.95. Cardano recovered toward $0.37 after touching weekly lows, and dogecoin regained ground near $0.127. Overall gains were modest, pointing to stabilization rather than a renewed risk-on move.

What stood out was the speed of the reversal. Crypto prices declined rapidly as Trump’s comments reignited concerns over trade conflict and policy uncertainty, then recovered just as quickly once the rhetoric softened. Such whipsaw price action has become increasingly common in a market highly sensitive to macro signals.

Bond markets played a central role in the move. Earlier in the week, a sharp selloff in long-dated Japanese government bonds pushed yields to record levels, tightening global financial conditions and weighing on speculative assets. By Thursday, yields pulled back after officials urged calm, easing pressure across global rates and giving risk assets room to stabilize.

As attention shifts back to Asian and European markets, traders will be watching whether bitcoin can hold above $90,000 or if the relief sparked by Davos headlines fades, allowing volatility to return. Recent sessions have reinforced that global politics and bond market dynamics remain key drivers of crypto price swings.