Bitcoin and major cryptocurrencies fell on Sunday as traders dialed back risk ahead of the Federal Reserve’s upcoming rate decision and a pivotal earnings week for U.S. technology giants.

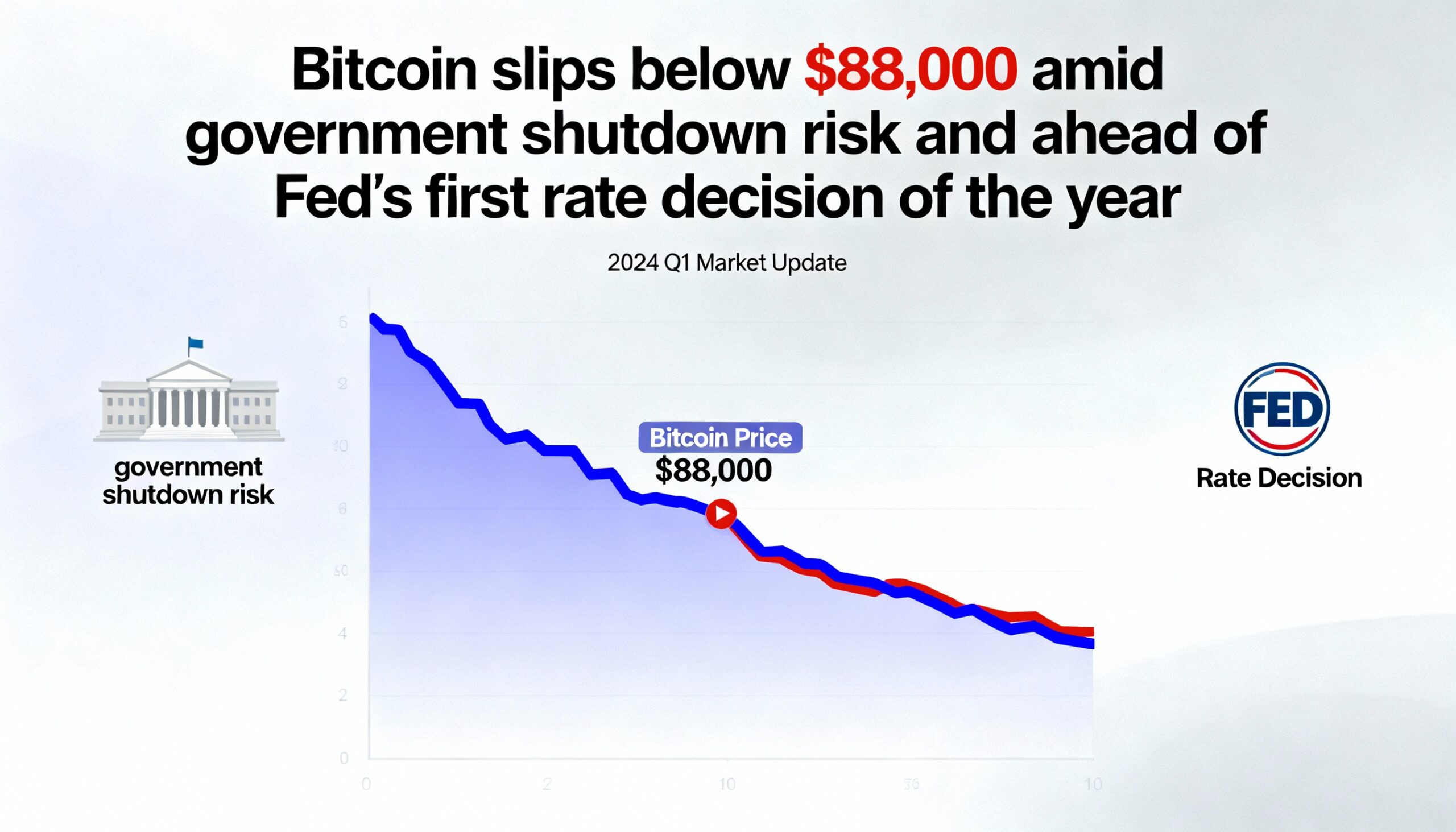

Bitcoin slid below the $88,000 level during thin weekend trading, extending a weeklong pullback across the crypto market. The largest digital asset was trading near $87,800 in U.S. afternoon hours, down about 2% over the past 24 hours, according to CoinDesk data.

Ether dropped toward $2,880, while solana, XRP and cardano each declined between 3% and 5%. Most major tokens remain sharply lower on a weekly basis, reflecting fragile sentiment and cautious positioning.

The downturn triggered $224 million in liquidations of bullish positions over the past 24 hours, led by $68 million in bitcoin futures and $45 million in ether-linked contracts, CoinGlass data showed.

Weekend price action is often driven by positioning adjustments rather than fresh catalysts, especially after bouts of volatility earlier in the week.

Macro and political headwinds

Traders are heading into the new week alert to renewed volatility in the Japanese yen following warnings from Prime Minister Sanae Takaichi against “abnormal” currency moves. Her comments came after a sharp reversal in the yen late Friday, prompting caution across Asian markets even as officials stopped short of confirming intervention, according to Bloomberg.

U.S. political risk added to the uneasy backdrop. Senate Democratic leader Chuck Schumer said Democrats would block a major spending bill unless funding for the Department of Homeland Security is removed, increasing the risk of a partial government shutdown.

While budget standoffs are familiar, they can tighten near-term liquidity and weigh on risk assets when positioning is elevated. Historically, bitcoin has often seen selling pressure ahead of potential shutdowns, followed by rebounds once uncertainty clears.

Polymarket traders are currently assigning a 76% probability to a U.S. government shutdown by the end of the month.

Earnings and the Fed in focus

Attention now turns to a busy week ahead, with earnings due from several megacap technology companies, including Microsoft, Meta Platforms, Tesla and Apple — key members of the so-called “Magnificent Seven.”

Markets will be watching closely for signals on artificial intelligence spending and demand, with management commentary likely to shape broader risk sentiment. Bitcoin, which has increasingly traded like a risk asset, may move alongside equities in response.

The Federal Reserve’s first rate decision of the year will also be closely watched. While policymakers are expected to keep rates unchanged, investors will focus on Chair Jerome Powell’s post-meeting remarks for clues on the future policy path, which could influence bitcoin, the dollar and broader markets.