Bitcoin traders may need to rethink their macro playbook as the cryptocurrency’s relationship with the Japanese yen has strengthened to record levels.

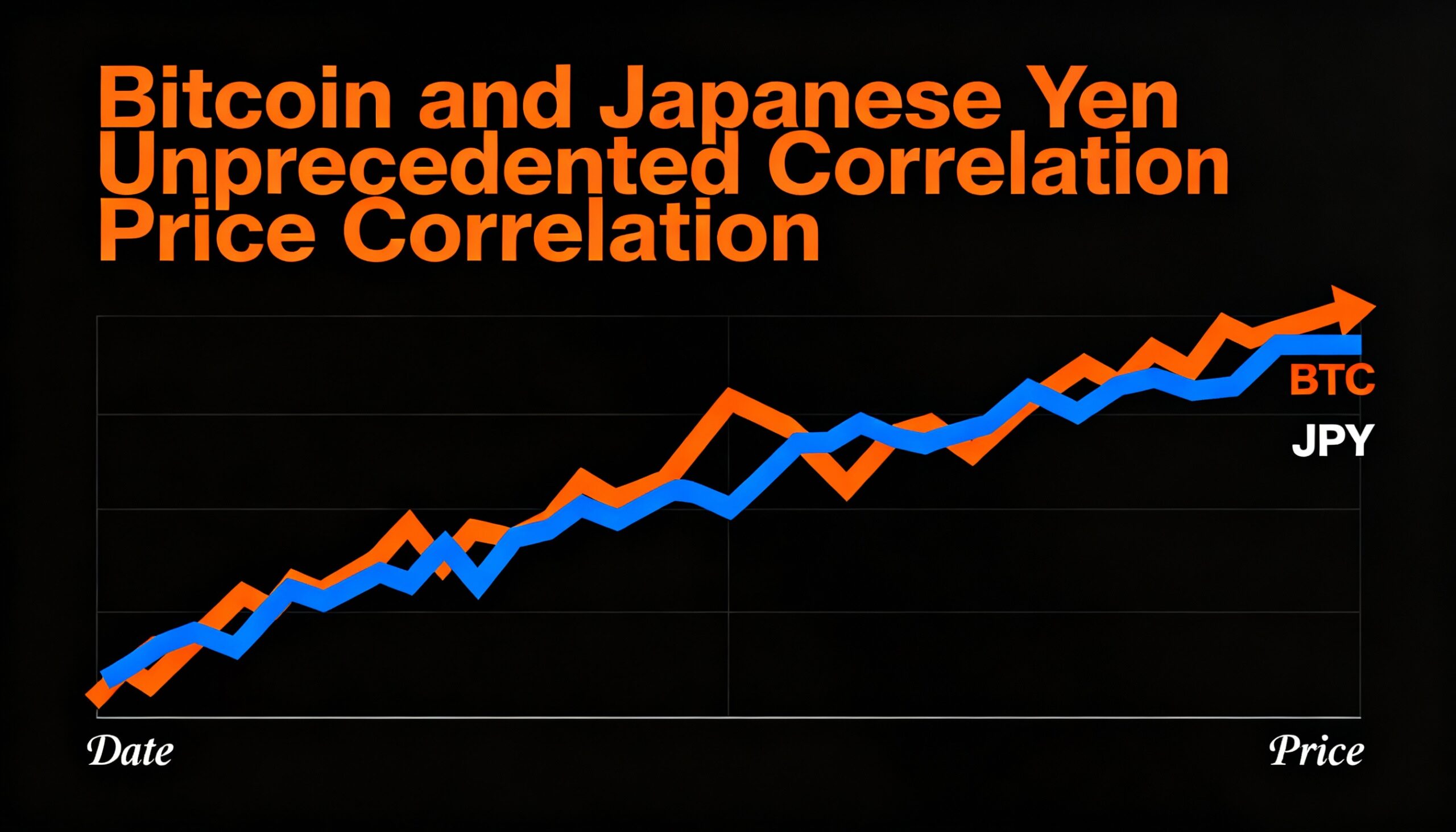

According to TradingView data, the 90-day correlation between bitcoin and Pepperstone’s Japanese yen index has climbed to 0.86, marking the highest reading on record and signaling unusually synchronized price action between the two markets.

That degree of alignment means roughly 73% of bitcoin’s price movements over the past three months can be explained by shifts in the yen. The metric, known as the coefficient of determination, is calculated by squaring the correlation coefficient and provides a simple measure of how closely two assets track one another.

Pepperstone’s JPY Index, or JPYX, is a currency index CFD that measures the yen’s performance against a basket of four major currencies: the euro, U.S. dollar, Australian dollar and New Zealand dollar.

The strength of the correlation suggests bitcoin, long viewed as an asset with limited ties to traditional markets, has recently been trading under the influence of Japanese currency dynamics. Over the past 90 days, BTC has risen and fallen alongside the yen, undermining its reputation as a portfolio diversifier and turning what was once pitched as “digital gold” into a leveraged expression of yen exposure.

Even so, such relationships are rarely permanent. Correlations between cryptocurrencies and traditional assets such as currencies and equities have a history of shifting as market conditions evolve.

Bitcoin peaked in early October before declining over the following two months, a move that coincided with a continuation of the yen’s broader downtrend. Selling pressure in both markets began to ease after mid-December.

The yen has been weakening since April last year as concerns over Japan’s fiscal sustainability pushed government bond yields higher. With a debt-to-GDP ratio near 240%, Japan remains one of the most indebted economies in the world, though much of that debt is held domestically.

That debt burden leaves the Bank of Japan facing difficult trade-offs. Raising interest rates would increase debt-servicing costs and strain public finances, while maintaining low rates risks further depreciation of the yen.

Some analysts argue that Japan’s fiscal stress is already being reflected in currency markets through a sharply weaker yen, and that only a potential U.S. recession may offer Japan temporary relief.