STRC, the perpetual preferred stock issued by Strategy (MSTR), returned to its $100 par value during Wednesday’s U.S. trading session, its first time back at that level since mid-January, even as bitcoin remains well below recent highs.

Holding at or above par is critical for Strategy because it enables the company to resume at-the-market (ATM) sales of STRC, a capital-raising tool used to fund additional bitcoin purchases. The security last traded at $100 on Jan. 16, when bitcoin was hovering near $97,000. As the cryptocurrency later declined to around $60,000 on Feb. 5, STRC slipped to a low of $93 before staging its recent recovery.

Marketed as a short-duration, yield-focused instrument, STRC currently offers an 11.25% annual dividend paid on a monthly basis. Strategy resets the dividend rate each month in an effort to keep the shares trading close to par, most recently lifting the payout to maintain the 11.25% yield.

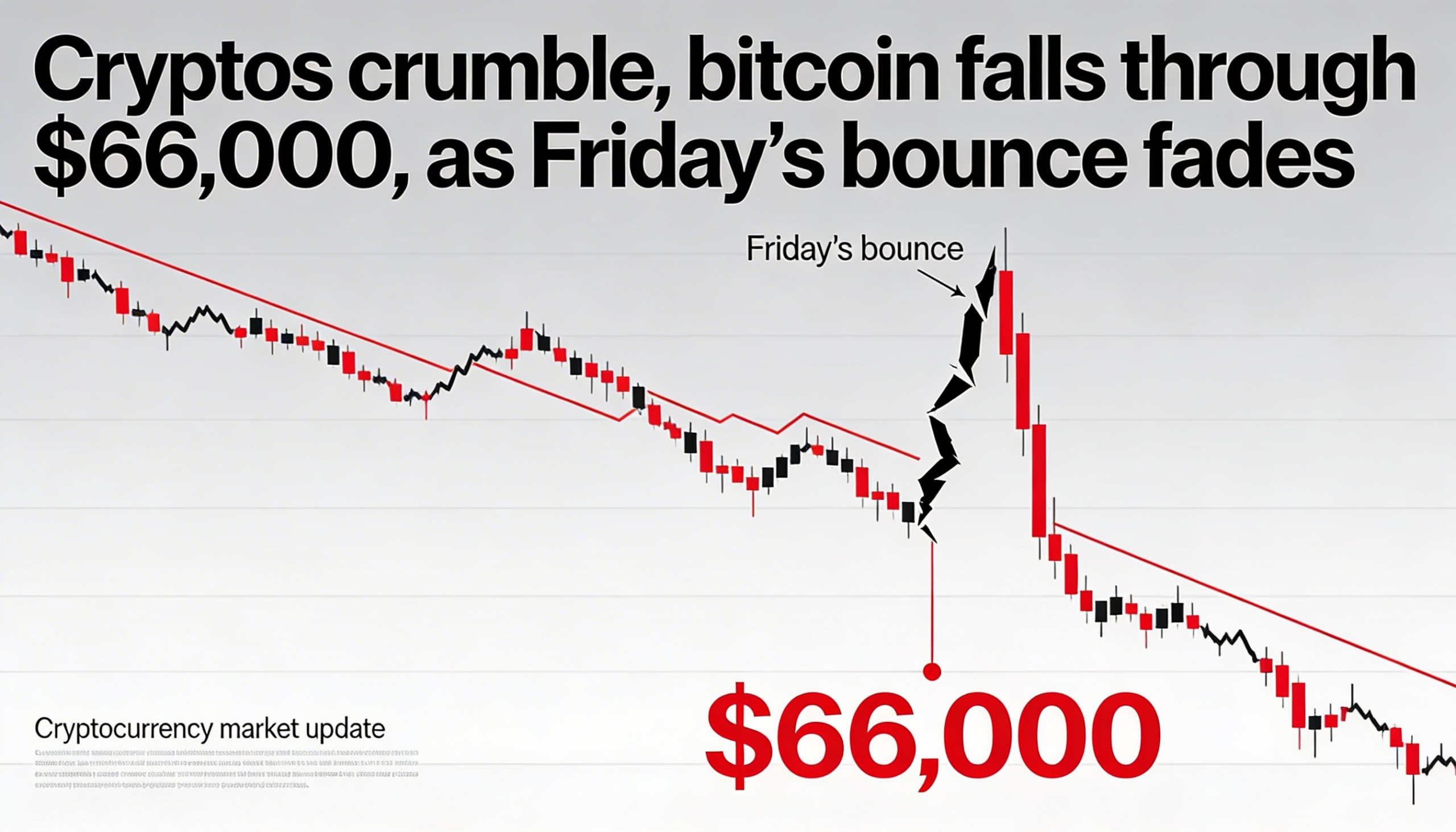

Meanwhile, MSTR common stock fell 5% on Wednesday to close at $126, as bitcoin changed hands near $67,500.