Bitcoin Consolidates Above $90K as New-Year Allocations Offset Cooling Leverage

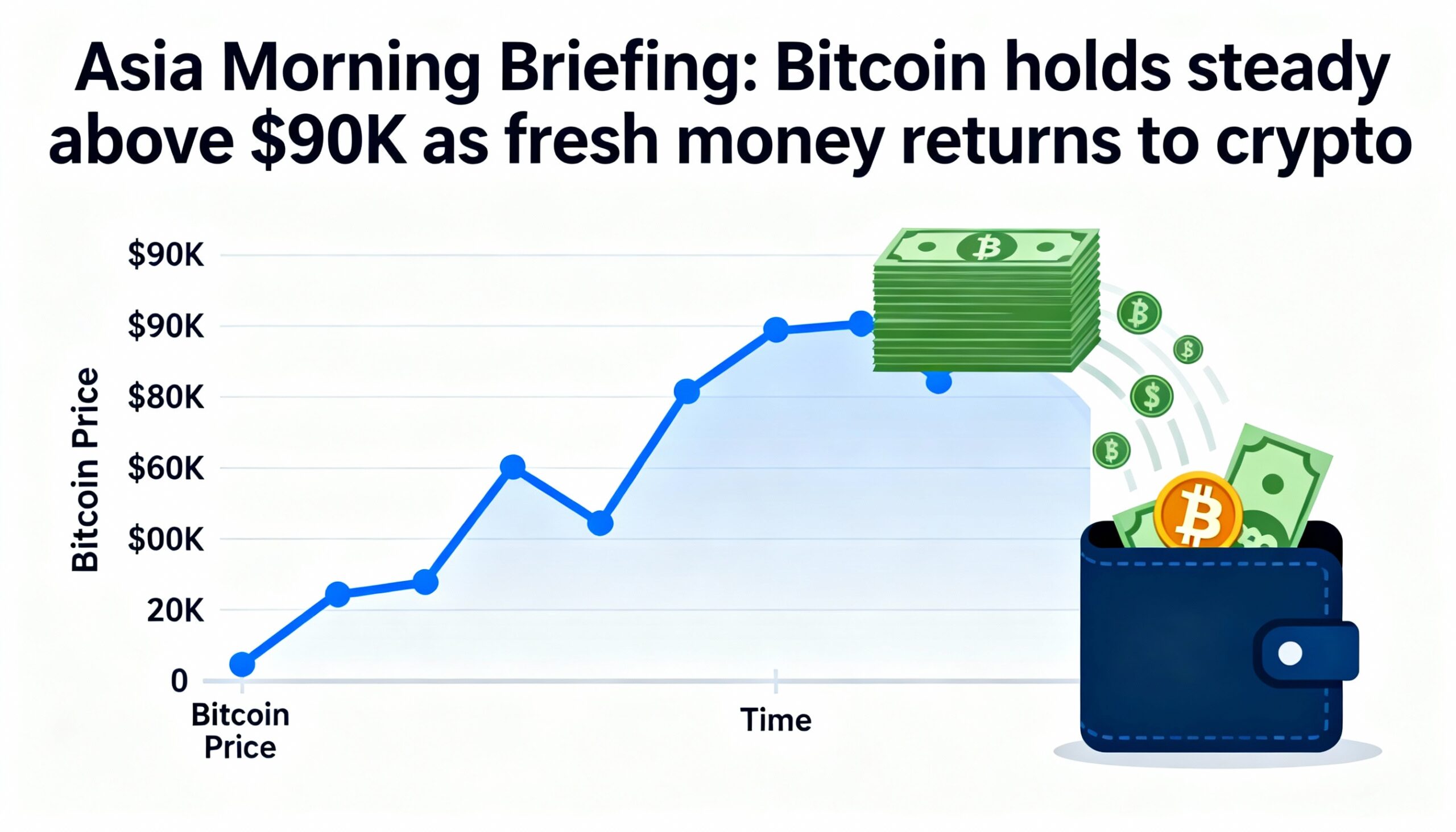

Crypto markets have entered the new year in recalibration mode rather than retreat, with bitcoin consolidating above $90,000 and ether regaining relative strength as institutional positioning resets.

As Hong Kong opened trading on Wednesday, bitcoin dipped slightly on short time frames but remained range-bound after decisively clearing the psychologically important $90,000 level.

“With stocks, gold and other precious metals at all-time highs, we see the market caught between price correcting higher to align with other assets and price moving lower over the next few months to respect the four-year cycle,” said George Mandres, crypto analyst at trading firm XBTO. He added that downside narratives “can quickly become self-fulfilling.”

So far, neither force has taken control. Instead of a sharp correction, bitcoin has moved sideways, signaling consolidation rather than distribution. Mandres said the calendar shift is a key difference from late 2025.

“What’s changed now, beyond price moving above $90,000, is that a new year has begun,” he said. “PNLs reset to zero, and investors need to redeploy capital into attractive risk-reward opportunities.”

Ether presents a slightly different setup. While ETH has outperformed bitcoin over weekly and monthly horizons, futures positioning shows signs of cooling.

Bradley Park, founder of DNTV Research, said CME ether futures open interest provides insight beyond spot price action. Rising open interest has increasingly reflected institutional participation through ETF arbitrage and DAT-style trades, while declines point to position unwinds.

“That unwind now appears well advanced,” Park said, adding that the recent pullback looks more like fading momentum than a structural breakdown, with positioning back near July 2025 levels. Notably, the reset has not triggered heavy spot selling.

A recent Glassnode report echoes the same themes across crypto markets. Options positioning has de-risked sharply, with open interest falling and volatility expectations rising, while U.S. spot bitcoin ETF flows have returned to net inflows. That combination signals renewed institutional demand alongside greater sensitivity to short-term profit-taking.

Overall, market signals point to consolidation and rotation rather than a broad risk-off move. Bitcoin continues to absorb competing macro narratives without breaking trend, while ethereum appears less crowded and better positioned should institutional flows re-accelerate.

Market Movement

- BTC: Bitcoin is trading sideways above $90,000, reflecting consolidation after recent gains rather than renewed selling pressure, as macro support and cycle-driven caution balance out.

- ETH: Ether is hovering near $3,247, edging lower intraday but remaining strongly higher on weekly and monthly views despite cooling futures positioning.

- Gold: After rallying nearly 65% in 2025, banks see gold reaching new records in 2026 amid falling rates, central bank buying and geopolitical risk.

- Nikkei 225: Japan’s Nikkei fell 0.45% on Wednesday as Asia-Pacific markets traded mixed, while Australia’s ASX 200 rose 0.38% after softer-than-expected inflation data.

Elsewhere in Crypto

- DeFi, ethics disputes remain in Senate crypto bill ahead of Jan. 15 vote (CoinDesk)

- Rapper Drake faces RICO lawsuit tied to crypto casino promotion (Decrypt)