Ether has fallen sharply, slipping to 56th place among global assets by market capitalization after losing 14.5% of its value over the past week. Its market cap now stands just above $300 billion, pushing the second-largest cryptocurrency well outside the top 50 assets.

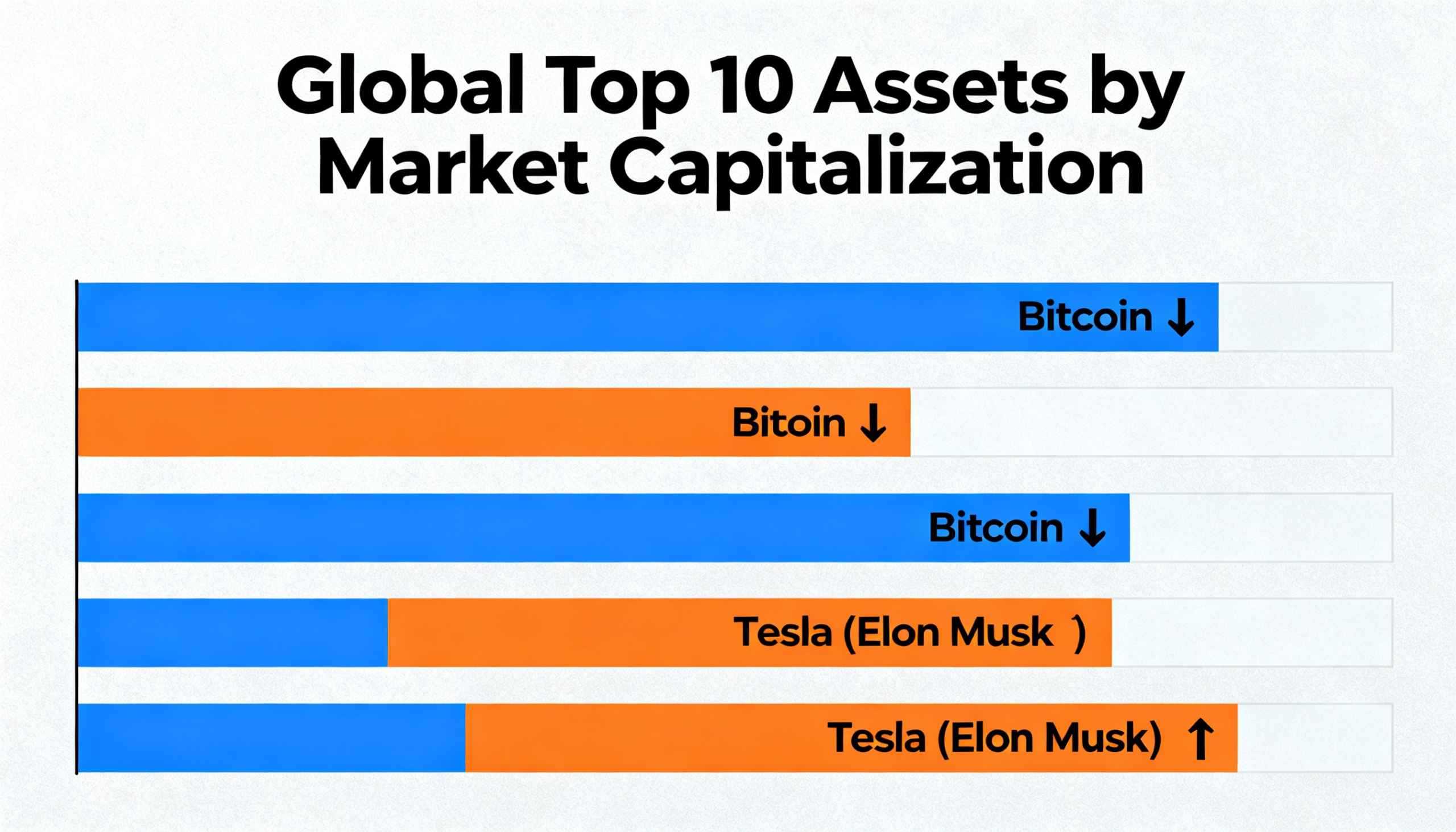

Bitcoin has also suffered, with its market capitalization dropping to roughly $1.57 trillion, placing it 13th globally — behind Saudi Aramco and Tesla. The decline comes after bitcoin’s price fell from about $90,000 to $78,500, a weekly loss exceeding 11%.

The selloff has coincided with a challenging macro environment, including rising geopolitical tensions, a sharp reversal in the precious metals rally, the nomination of a more hawkish Federal Reserve chair, and a partial U.S. government shutdown. These factors helped fuel a stronger U.S. dollar, weighing on risk assets across the board.

Bitcoin’s exit from the global top 10 by market capitalization marks a significant shift. In recent years, elevated prices kept BTC firmly among the top ranks. On Oct. 7, when bitcoin hit a new all-time high, it ranked seventh by market value, and earlier last year it briefly entered the top five, surpassing tech giants such as Google and Amazon. At its October peak, bitcoin traded above $126,000, approaching a $2.5 trillion valuation.

The U.S. dollar’s rally was triggered in part by President Donald Trump’s nomination of former Federal Reserve governor Kevin Warsh, known for advocating higher real interest rates and a smaller Fed balance sheet. The stronger dollar contributed to a broad retreat in alternative assets, including gold and silver. Gold fell 9% in a single session to just under $4,900, while silver dropped 26.3% to $85.30. Gold remains the world’s largest asset by market capitalization at $34.1 trillion, followed by silver at nearly $4.8 trillion. In equities, NVIDIA leads at $4.6 trillion, followed by Alphabet at $4.08 trillion.

Ether’s decline has pushed it below companies such as Caterpillar, Inditex, Coca-Cola, and Cisco. Just weeks ago, the cryptocurrency ranked within the top 50 assets, and prior to the October 10 market crash, it was near the top 25 — highlighting the severity of its recent downturn.