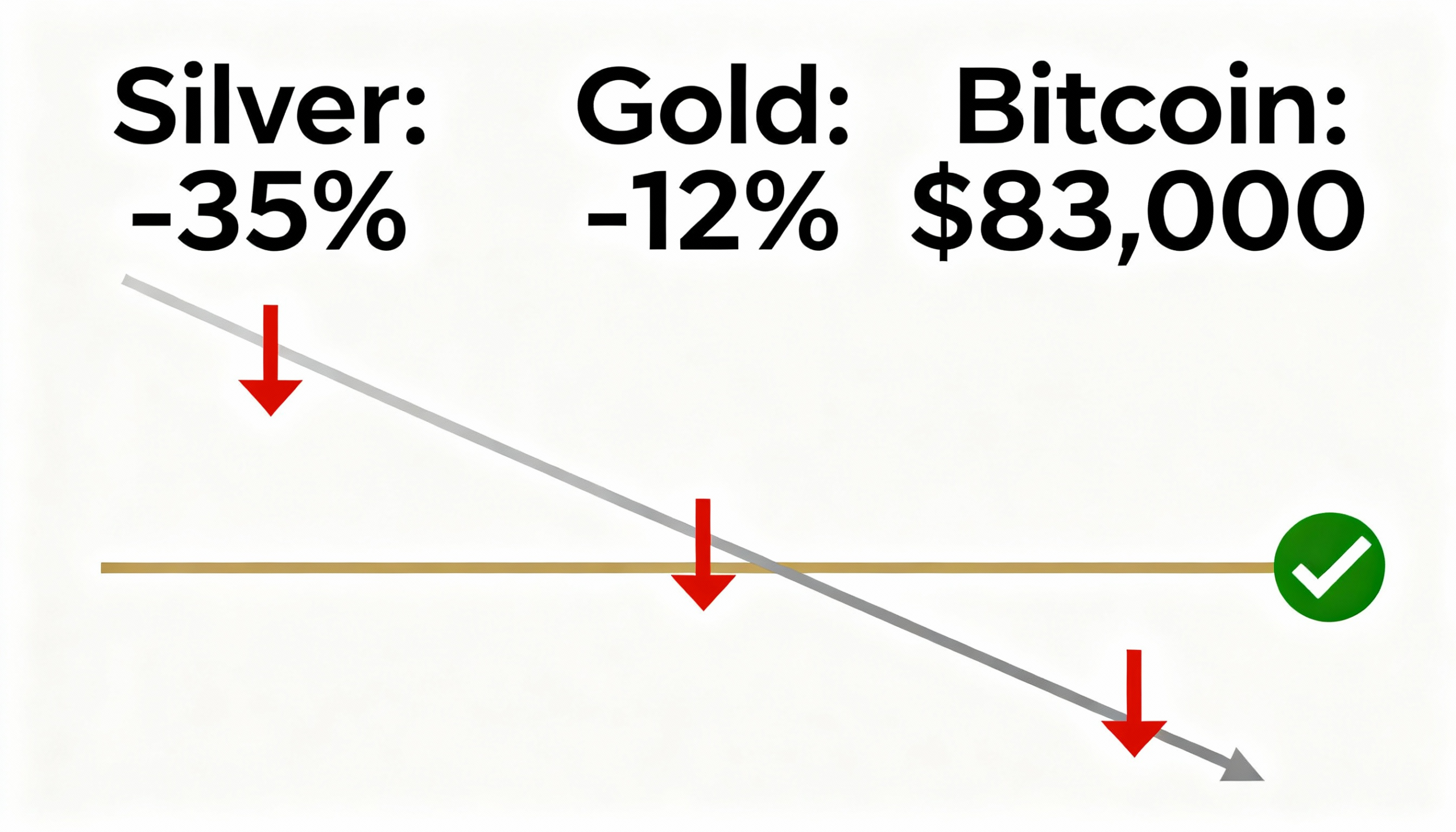

Precious Metals Selloff May Boost Bitcoin as Silver Plunges 35%

Crypto bulls who have long argued that bitcoin’s next major move depends on money leaving overheated precious metals could soon get their answer.

The metals bubble appears to be bursting. Silver, which hit a record $120 per ounce earlier Friday, has collapsed 35% to $75 in U.S. afternoon trading. Gold, which briefly climbed to $5,600 on Thursday, has fallen 12% to $4,718. Silver’s rapid decline wiped out nearly all of its January gains, a level of volatility reminiscent of the Hunt Brothers’ 1980 silver saga.

U.S. equities also weakened, with the Nasdaq down 1.25% and the S&P 500 off 0.9%. Cryptocurrencies, by contrast, have held above Thursday’s panic lows. Bitcoin is trading around $83,000, recovering from an overnight low near $81,000.

Market watchers say President Trump’s nomination of Kevin Warsh as Federal Reserve chair may have triggered broader risk-asset selling, as Warsh is considered a hawkish pick.

Crypto Bulls See Opportunity

Paul Howard, director at trading firm Wincent, noted that parabolic moves in commodities recently drew capital away from crypto markets—a trend that may now reverse. “Cryptocurrency markets have been the victim of capital flowing into the still-popular commodities trade,” he said. Interest in crypto options is rising, with February BTC 105,000 calls among the most actively traded contracts.

Howard added, “The market may be overdue for a commodity-style catch-up.” On Warsh’s nomination, he observed, “What was meant to be a bullish signal coincided with a broader risk sell-off—a knee-jerk reaction as markets recalibrate.”