Crypto Selloff Deepens as Bitcoin, Ether Extend Losses and $1.8B Liquidations Hit

Crypto markets tumbled overnight, with bitcoin and ether extending declines amid a broader risk-off environment. Metals fell sharply, and leveraged traders across derivatives markets faced heavy liquidations.

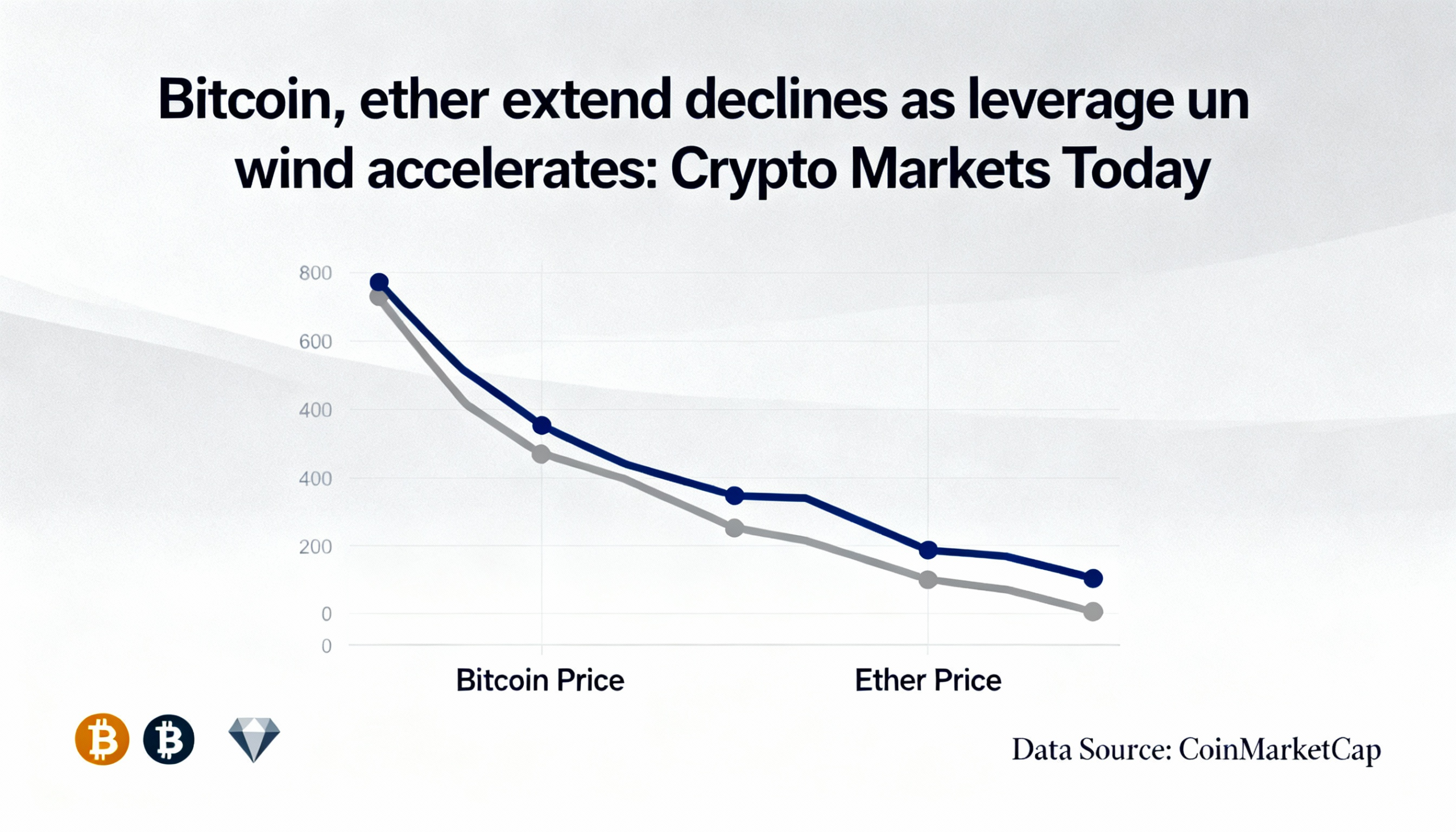

Bitcoin (BTC $76,965) dropped 2.7% since midnight UTC, while ether (ETH $2,310) slid 3.5%, compounding Thursday’s losses. Silver fell 20% from Thursday’s record $121 to $96, and gold dropped 11% from $5,600 to below $5,000.

U.S. equity futures weakened, while the dollar index (DXY) gained 0.57%, driven by speculation that Kevin Warsh could become the next Federal Reserve chair.

The rout pushed bitcoin to its lowest level since November and triggered $1.8 billion in liquidations across crypto markets. The CoinDesk 20 Index (CD20) is down 6.6% year-to-date, while the altcoin-heavy CoinDesk 80 (CD80) has lost 2.28%.

Derivatives and Leverage

The selloff wiped out $1.8 billion in leveraged futures positions over 24 hours. Open interest (OI) fell across most major cryptocurrencies, though DOGE saw a 2% increase, reflecting shorting activity. Perpetual funding rates for BTC, ETH, XRP, and other tokens turned negative, signaling growing demand for downside protection. Bitcoin’s 30-day implied volatility (BVIV) rose to 47% from 40%, while Deribit data showed puts outpricing calls. Traders favored BTC put spreads and ether put butterfly strategies, highlighting cautious sentiment.

Token Highlights

Canton’s CC token was the only top-100 crypto in positive territory, rising 3.35%. Privacy coins Monero (XMR $422.40), Zcash (ZEC $291.00), and Dash (DASH $43.23) fell roughly 5%. Bitcoin dominance dropped to 58.73%, suggesting rotation into speculative altcoins.

RIVER plunged 55% since Monday, including a 25% drop over 24 hours, after an 884% rally earlier this month as traders locked in profits. Tokenized silver on HyperLiquid also saw volatility, with a $47 million long position liquidated as silver prices fell to $96.